[ad_1]

Soldo, the British fintech offering a multi-user business expense account, has closed a $ 61 million Series B financing.

Battery Ventures and Dawn Capital are leading the ranking, with previous funders Accel and Connect Ventures participating. In addition, a small portion comes from Silicon Valley Bank's debt financing. This brings the total collected by the London-based startup to $ 82 million.

Founded by Carlo Gualandri, who previously contributed to the creation of Italy's first online bank, Soldo offers a multi-user spending account for businesses of all sizes – from SMEs to much larger companies – who need to deploy and manage their spend across their entire organization.

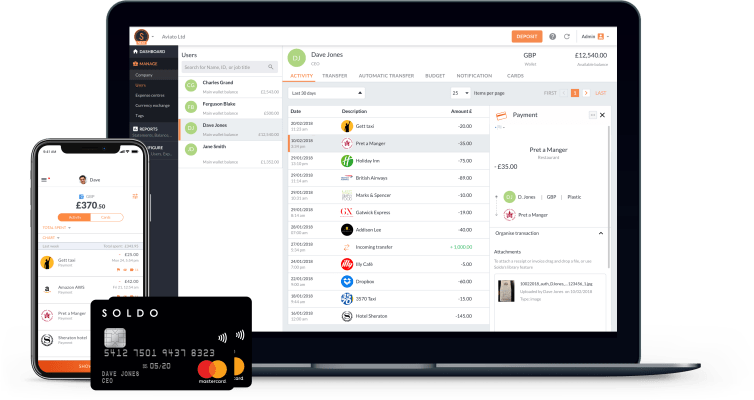

Helps manage department and employee expenses in real time by combining a Soldo account, central dashboard, iOS and Android apps, and virtual wallets or physical "prepaid" MasterCard that can be distributed to employees, services and even external consultants. or entrepreneurs.

In addition, Soldo offers granular expense controls that are at the heart of its technology stack. This makes it possible to define different expenditure criteria for each employee, subcontractor or service of expenditure, with defined authorizations and the follow-up of all the expenses in a centralized way. It also allows users to enter receipt data, while the entire system integrates with the most used accounting packages, such as Xero, Quickbooks, Concur, Expensify, NetSuite, Zucchetti and SAP.

Asked what was the biggest challenge for Soldo in the last 12 months, Gualandri said "educate the market", which he does not see changing at the moment.

"When you do not know that a solution exists, you do not even call it a" problem ", but you consider it a" fact of life, "" he says. "Expense management is a new category that replaces many old and outdated processes. [It] allows businesses to distribute access to money with control, thus allowing organizations to be more flatter and more agile. It will take time for the market to fully realize its transformative power. "

According to Gualandri, the results achieved in the companies that started to adopt Soldo were the most rewarding of the last year. "Thousands of companies, from the largest to the largest, have recognized that we provide innovative and reliable financial services," he said. "No small success in the business world traditionally more conservative".

Soldo is not yet profitable, but Gualandri says it could be in a year or two if that was the goal. However, that would mean choosing "slower, more organic growth" and, given the huge market in Soldo, "it would not be the right choice". The majority of companies in Europe still use "reimbursable expenses, spreadsheets and manual processes to manage the expenditure management cycle", and the competition of Soldo remains largely the status quo (although Pleo's Danish operates in a similar space).

"We are a company with a fixed cost base and a good unitary economy. The breakeven point therefore depends on the amount we invest and the growth of the fixed cost base (because most of our investments are people) and the volume of clients and expenses managed. by our system, "he says. "By deciding to invest in products and sales, we are therefore aiming for a broader income and profit base, but later."

At the same time, Soldo's B-Series will be used to continue its growth in the UK, where it claims a "leadership position", as well as Italy and Ireland. The company also plans to enter new European markets and double its workforce over the next 12 months. Gualandri said Soldo would continue to invest in his product to tackle new "issues" of expense management.

"Travel costs are the most common need, but purchases, purchases of goods and services, subscriptions, mobility expenses, benefits are all areas that can be innovated and are the expression of the concept. management of business expenses, "he said.

At the same time, Soldo has recently obtained an electronic money license from the Irish central bank in addition to the one it holds in the UK so that it can continue its activities in the single European market after Brexit and in case of " non-transaction ". "It's crazy to think that we've been working for a year and a half on an extremely complex project, mostly duplicating something we already had, to prepare our business for something that may not happen. "Gualandri told TechCrunch at the time of the announcement of his new Irish license.

[ad_2]

Source link