[ad_1]

After Square issued weak guidance in the fourth quarter, all eyes were on the payment company to see what kind of growth had actually occurred in the first quarter. The results presented today highlight some of the challenges that the company faces.

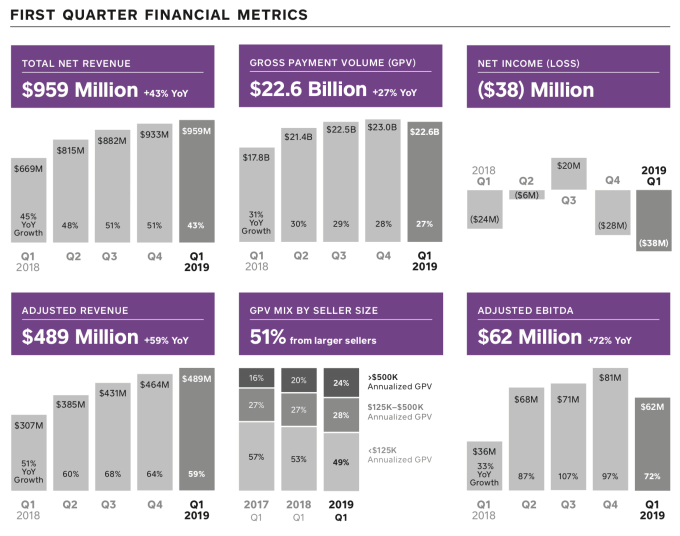

Square Adjusted revenues were $ 489 million, up 59%.% year-over-year, with adjusted earnings per share of $ 0.11. Both figures exceed analysts' estimates. The company expected earnings per share of $ 0.08 and revenues of $ 479.63 million, up 33.3%, respectively% and 56.2% one year ago.

But the numbers also indicated a persistent slowdown: in the last quarter, Square's revenue of $ 464 million was up 64%.%. The group also recorded a growing net loss of $ 38 million compared to $ 28 million the previous quarter and $ 24 million a year ago. (He indicated that his "market price valuation of our investment in Eventbrite" represented $ 14 million of this loss). The gross payment volume of $ 22.6 billion was up 27% last year, but it was down from the previous quarter.

And to add to the challenges, Square's forecast for the next quarter is a continuing decline. Square said it expects total revenues to be between $ 1.09 billion and $ 1.11 billion, with adjusted revenues of $ 545 million, an increase of only $ 435 million.% one year ago. Adjusted earnings per share is expected to be in the range of $ 0.14 to $ 0.16, but with a continuing net loss. The results for the year were slightly adjusted to the company's previous expectations.

Square's shares are currently down 6.4% after hours. It currently has a market capitalization of about $ 31 billion.

Since its IPO in November 2015, the company has experienced strong growth and has generally exceeded expectations. But Square has recorded a net loss for four of the last five quarters, and any kind of slowdown in growth is a challenge to reverse the trend.

Square continued to grow its business, such as Square Cash – its instant money transfer service – and its core payment business (subscription and service revenues). The latter was up 126% to $ 219 million, driven by the growth of the square Cash, Caviar, Square Capital and Instant Deposit app for sellers. Square pointed out that during the first quarter of 2019, Square Capital had facilitated approximately 70,000 loans worth $ 508 million, up 50% from the previous year.

But in the last quarter, the company began to establish itself in one of the new areas of fintech, crypto-currencies, with CEO Jack Dorsey. announcing he hired engineers to work on open source contributions to crypto and bitcoin ecosystems, his first effort being to do so "regardless of his business objectives".

In the last quarter, he has also started to turn more to pure e-commerce and people who do not physically take payments with his dongles. This included the launch of the Square online store to supplement physical transactions and the Square Invoices app, for those who did not take payments in person.

I will be listening to the call of the results and I will update this post with all that is interesting that comes out.

[ad_2]

Source link