[ad_1]

Asian markets on Monday suggest a muted response to a wave of block trades that wiped out $ 35 billion from leading stocks, eclipsing a record close on Wall Street last week.

U.S. Equity Futures edged down slightly on the open and futures pointed higher in Japan and Australia earlier. Still, the weekend’s revelations of a bidding blitz that rocked stocks, including Baidu Inc. and ViacomCBS Inc., raised questions about who sold and if more are to come. The family office of former Tiger Management trader Bill Hwang was behind unprecedented sales of some US stocks on Friday, according to two people directly familiar with the trades.

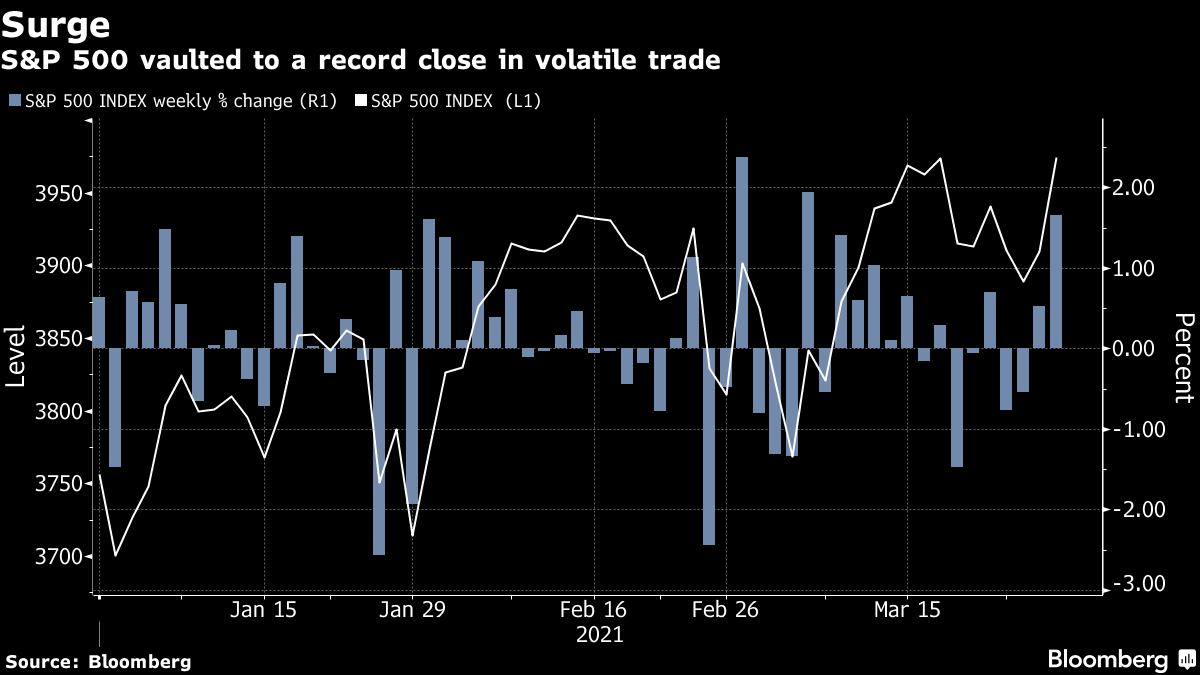

A boost late in the session saw the S&P 500 Index climb the most in three weeks to end at a new all-time high, with energy producers and healthcare companies among the top performers. The benchmark 10-year Treasury bill yields reached 1.68%.

“Equities remain exposed to additional volatility risk due to rising bond yields,” said Diana Mousina, senior economist at AMP Capital Investors Ltd., in a note. “But looking through the inevitable noise in the near term, the combination of improving global growth aided by more stimulants, vaccines, negative real returns and still low interest rates bodes well for assets in the UK. growth in general in 2021. “

The strength of the recovery and inflation risks are central concerns for investors, as US President Biden plans to unveil an infrastructure spending program this week. Labor market data will also take center stage, with Friday’s US unemployment report expected to show the strongest rebound in non-farm payrolls in months. The expansion of vaccinations and an upturn in economic activity have probably encouraged hiring.

Oil has slipped as traders continue to monitor efforts to dislodge a gigantic ship stuck in the Suez Canal, causing the price of oil to fluctuate. Bitcoin was trading around $ 55,000.

Video and footage captured by Bloomberg reporters from the shores of the Suez Canal at Eqypt provide a perspective on the container ship Ever Given as work to relaunch the ship continues.

Some key events to watch out for this week:

- China’s manufacturing PMI is due on Tuesday.

- President Biden is expected to unveil his infrastructure program on Wednesday.

- EIA Crude Inventory Report Wednesday.

- OPEC + is meeting on Thursday to discuss production levels for May.

- China Caixin PMI expected Thursday.

- US Employment Report for March Friday.

- Good Friday begins Easter weekend in countries like the US, UK, France, Germany, Australia, and Canada.

Here are some of the main developments in financial markets:

Stocks

- S&P 500 futures slipped 0.2% at 7:07 am in Tokyo. The S&P 500 Index climbed 1.7% on Friday.

- Nikkei 225 futures rose 1.2% earlier.

- Futures on the Australian S & P / ASX 200 index rose 0.7%.

- Hong Kong Hang Seng Index futures fell 0.1% earlier.

Currencies

- The yen was at 109.68 to the dollar.

- The offshore yuan was at 6.5420 to the dollar.

- The Bloomberg Dollar Spot Index slipped 0.2%.

- The euro was trading at $ 1.1792.

Obligations

- The yield on 10-year Treasuries added four basis points to 1.68% on Friday.

- The yield on Australian 10-year bonds climbed about five basis points to 1.71%.

Basic products

- West Texas Intermediate crude fell 0.7% to $ 60.56 a barrel.

- Gold was at $ 1,731.26 an ounce.

[ad_2]

Source link