[ad_1]

Stocks end the week on a cautious note as investors assess their valuations after a record rise in stocks this month and the pandemic lingering in parts of Europe and US oil retreated in the middle growing tensions between OPEC + members.

The Stoxx Europe 600 index has fluctuated, with Electricite de France SA increasing 7.7% following reports that France and the EU are close to reach agreement on nuclear regulation. Banco de Sabadell SA has plunged after ending negotiations with Banco Bilbao Vizcaya Argentaria SA. Futures on the S&P 500 edged up. Shares slipped in Australia but rose in China and Japan.

Treasuries rose and the dollar slipped, heading for a second weekly decline. Market volumes could be below average on Friday with reduced trading hours for US stocks and bonds.

Global equities are on track for the best month on record, rising 13%, pushing valuations near their highs in about 20 years. However, the feeling remains fragile because the virus count continues to rise in Europe and United States The task of vaccinating the world’s population is filled with logistical challenges, as the virus gains traction and economic recovery falters.

“Vaccine optimism continues to build momentum in December that could face a slowing economy and liquidity challenges,” said Ben Emons, managing director of global macroeconomic strategy at Medley Global Advisors. “Yet the hope of a complete reopening of the global economy remains firmly established.”

Political clarity has also boosted risky assets this month, as President-elect Joe Biden continues his transition to power. President Donald Trump has said he will relinquish power if the Electoral College confirms Biden’s victory, but he has signaled that he may never officially concede defeat and ignore the Democratic nomination.

In China, data shows industrial company profits surged at the fastest pace in a single month in nearly nine years in October, further sign of the country’s economic recovery.

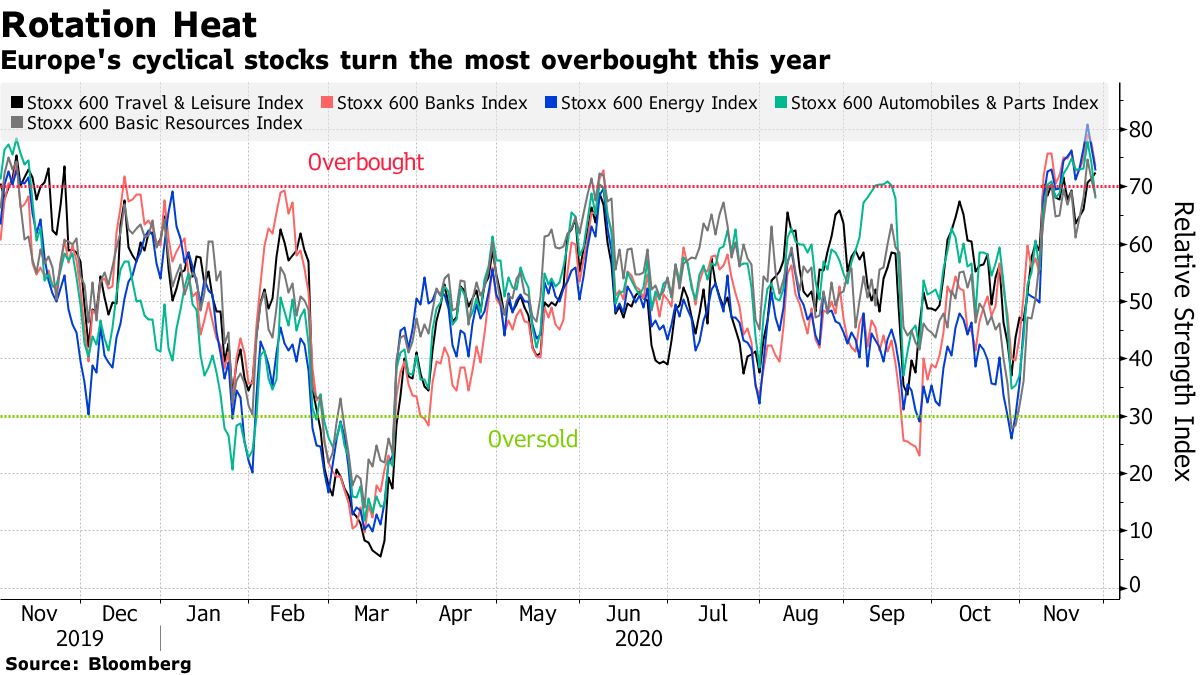

State Street’s Rebecca Chesworth advises equity investors to focus on cyclical recovery, not just value rotation.

Markets: European Open. (Source: Bloomberg)

Here are some key upcoming events:

- The US stock market closes at 1 p.m. Friday.

- The week ends with Black Friday, the traditional start of the holiday shopping season in the United States.

Here are the main market movements:

Stocks

- The Stoxx Europe 600 index rose 0.1% at 9:10 am in London.

- S&P 500 futures were up 0.3%.

- The MSCI Asia Pacific index rose 0.3%.

- The MSCI Emerging Markets index rose 0.1%.

Currencies

- The Bloomberg Dollar Spot Index fell 0.2%.

- The euro rose 0.1% to $ 1.1928.

- The British pound gained 0.1% to $ 1.3370.

- The yen was at 103.99 per dollar, up 0.3%.

Obligations

- The yield on 10-year treasury bills fell two basis points to 0.86%.

- Germany’s 10-year yield increased by one basis point to -0.58%.

Basic products

- West Texas Intermediate crude fell 1.4% to $ 45.08 per barrel.

- Gold fell 0.4% to $ 1,809.41 an ounce.

– With the help of Adam Haigh

[ad_2]

Source link