[ad_1]

Find out what clicks on FoxBusiness.com.

Heavily leveraged China Evergrande stock trading (3333.HK) was suspended on Monday, days after some bondholders said the real estate developer at the center of China’s financial system nervousness missed a key second bond interest payment.

Shares of its Evergrande Property Services Group unit (6666.HK) were also suspended, the Hong Kong Stock Exchange reported. The exchange did not say why trading in the companies’ shares was halted, and it was not clear who initiated the suspension.

Evergrande did not immediately respond to a request for comment.

COSTS OF COVID-19 IN HPITAUX MAY VARY TEN THOUSANDS OF DOLLARS, ACCORDING TO WSJ ANALYSIS

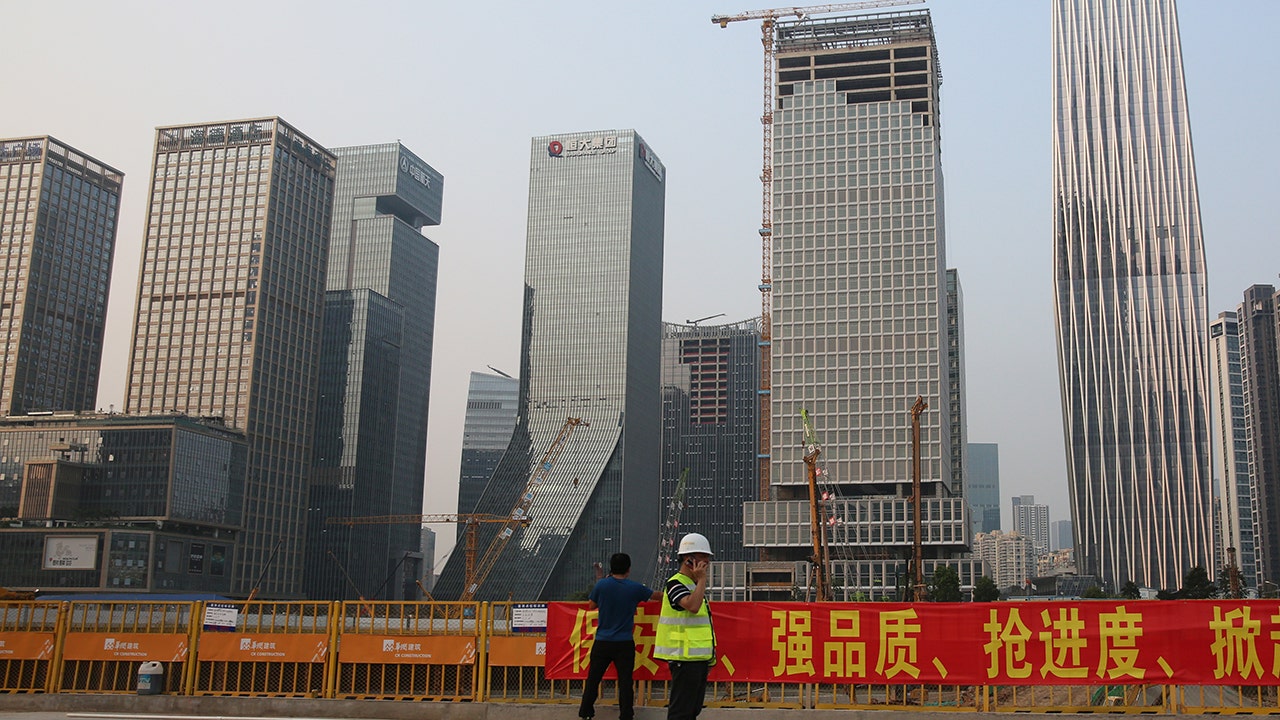

A photo taken on Sept. 29, 2021 shows the head office of Chinese developer Evergrande Group (C) in Shenzhen, Guangdong province, China. The group is in financial crisis. (The Yomiuri Shimbun)

With liabilities amounting to hundreds of billions of dollars, or 2% of China’s gross domestic product, Evergrande has raised concerns that its woes will spill over into the financial system and reverberate around the world. Initial concerns eased somewhat after China’s central bank pledged to protect the interests of homebuyers. Read more

Monday’s suspension of stock trading sent shivers down the broader financial markets, which remain nervous in the face of contagion, pushing the offshore yuan down a bit and weighing on the benchmark Hang Seng and in particular on financials. and other developers. Guangzhou R&F Properties Co Ltd (2777.HK) fell 7%, Sunac China Holdings (1918.HK) and country garden (2007.HK) each fell 4%.

Evergrande shares have plunged 80% so far this year, while its real estate services unit has fallen 43% as the group scrambles to raise funds to pay its many lenders and suppliers.

Stock in its electric vehicle unit, China Evergrande New Energy Vehicle Group (0708.HK), fell as much as 8% early Monday before cutting losses.

The cash-strapped group said on September 30 that its Wealth Management Unit had repaid 10% of Wealth Management Products (WMPs), which are largely owned by onshore retail investors, which were to be paid to the same date.

Once the best-selling real estate developer in China and now set to undergo one of the largest restructurings ever in the country, Evergrande has prioritized domestic creditors over offshore bondholders.

EXXON SEES GREEN GOLD IN ALGAE-BASED FUELS. THE SCEPTICS SEE GREENWASHING.

The two offshore payments, which bondholders say were not received by their due date, come as the company, which has nearly $ 20 billion in offshore debt, faces deadlines for bond coupon payments in dollars totaling $ 162.38 million next month.

Beijing is pushing public companies and state-backed real estate developers to buy some of Evergrande’s assets, polling them directly or indirectly on asset purchases, people with knowledge of the matter told Reuters last week.

Meanwhile, Chinese real estate group Hopson Development (0754.HK) said in a statement on Monday that it had suspended trading in its shares, pending an announcement related to a major acquisition by Hopson of a Hong Kong-listed company and a possible mandatory bid.

It was not clear whether the deal was tied to the Evergrande group and Hopson did not respond to a request for further comment.

CLICK HERE TO LEARN MORE ABOUT FOX BUSINESS

Hopson shares, which have a market value of HK $ 60.4 billion ($ 7.8 billion), have jumped 40% so far this year.

($ 1 = 7.7868 Hong Kong dollars)

Click here to read more about Reuters.

[ad_2]

Source link