[ad_1]

Do you want to know the European markets? In your inbox before opening, every day. Register here.

For fund managers worried about US stocks at historic highs during an economic crisis and an election year, Europe could be the antidote.

BlackRock Inc. investors at Manulife Investment Management say the region’s coordinated and swift response to the pandemic is also good reason to be confident, despite the drop in European equities since early June.

The bullish mood over Europe can broadly be seen as a scramble for alternatives in the United States, where equity valuations appear tight and tensions in China are high. The November election is also wreaking havoc on sentiment as President Donald Trump battles the Postal Service and fuels false allegations of widespread electoral fraud.

“If you compare the risks of upcoming events, Europe is a relatively calm economy compared to the US, UK and China,” said Peter Chatwell, head of multi-asset strategy at Mizuho International Plc.

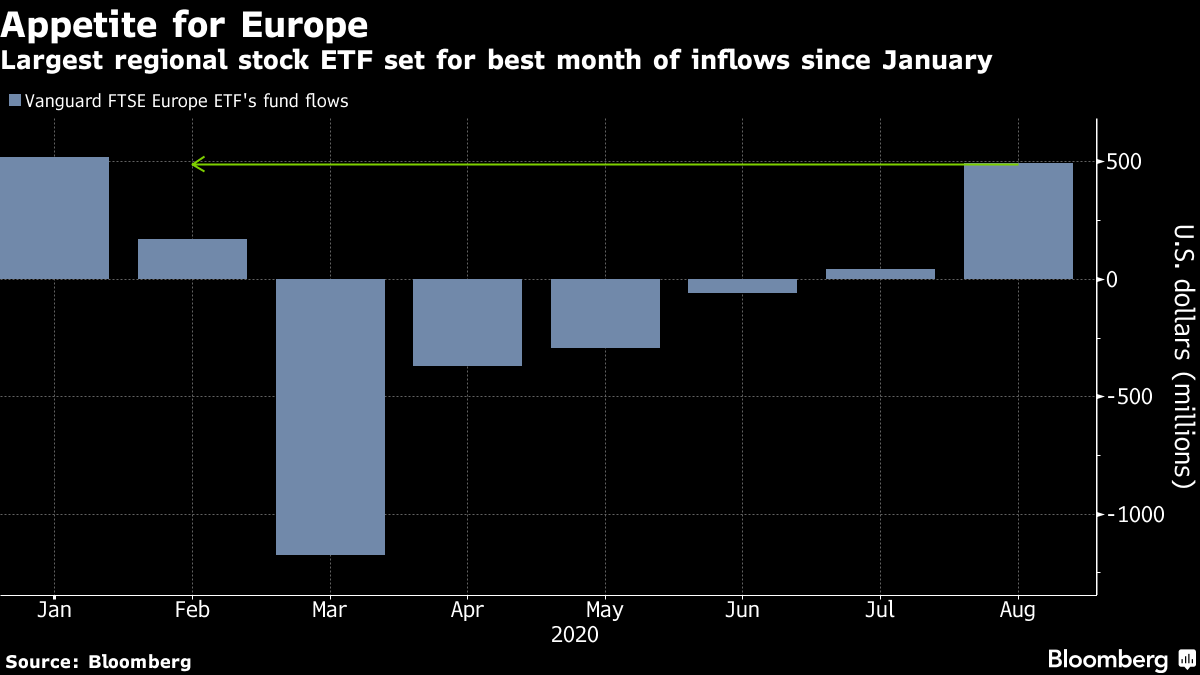

A recent investigation by Bank of America Corp. among fund managers revealed that Europe is now the most favored region and that investors largest overweighting in eurozone equities since 2018. The Vanguard FTSE Europe ETF absorbed nearly $ 500 million in August, putting it on track for the best month since January.

BlackRock Inc. increased its view on overweight European equities in June and cut allocations to the US

“We’ve seen a big rally for US large caps, which is why we’re generally looking for a way to diversify,” said Kiran Ganesh, Managing Director of UBS Global Wealth Management. “There are pockets of Europe that are good.”

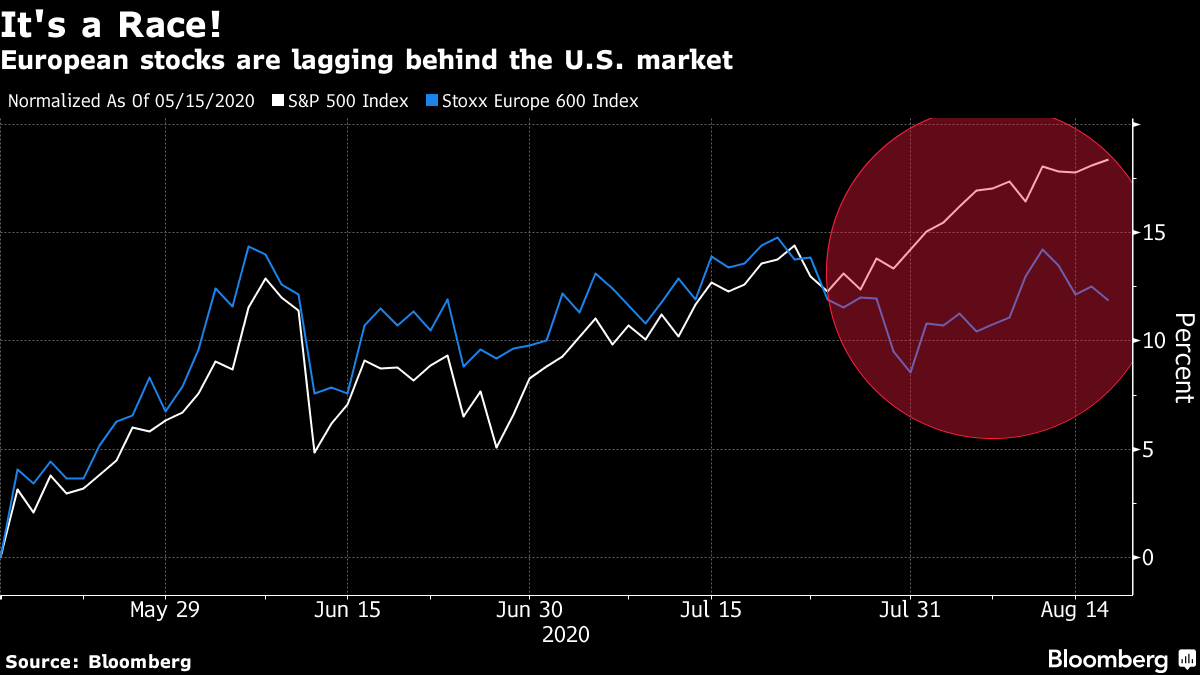

All this optimism has not yet shown in the prices. Stocks in Asia and the United States almost hit record highs, but the Europe Stoxx 600 index is still around 15% of pre-pandemic highs.

Even though there is a lot of enthusiasm for Europe, that doesn’t necessarily mean investors will be right. Predictions of a catch-up rally have failed several times over the years, and an increase in virus cases and travel restrictions threaten an already fragile economic recovery.

Still, investors say the market is cheap and the data shows European stocks are about to rebound faster. According to Bloomberg estimates, profits the growth of the Stoxx 600 companies will be 36% in 2021, compared to 24% for S&P 500.

Some strategists also cite the euro as a possible bullish catalyst, saying the rally could stabilize and ease the pressure on exporters’ profits. Rabobank says it will be difficult for the currency to break above $ 1.20 given the risk of further lockdowns in Europe and gloomy economic data. The bank expects the euro to soften to $ 1.16 this year from $ 1.18, according to Jane Foley, head of currency strategy.

“There is a perception that Europe as a whole has handled the Covid crisis better, and the feeling that US asset prices are tight in the lead Until an uncertain election cycle, ”said Nathan Thooft, Head of Global Asset Allocation at Manulife Investment Management.

[ad_2]

Source link