[ad_1]

CEO of WeWork Adam Neumann

Getty Images

WeWork's parent company, We, made a splash earlier this week with the release of its long-awaited IPO prospectus.

The company's S-1 lays the groundwork for what should be one of the biggest public offerings of the year, second after Uber's IPO in May.

It also contains unusual items that should scare all investors except the bravest, who have a good taste for risk. Here is an overview.

Loss of assembly

WeWork 's business figure for the first half of 2019 may have been more than double that of the previous year, but its losses are accelerating just as quickly. The company said in its IPO file that losses had soared to more than $ 900 million in the first six months of the year, which equates to net losses of 1.9 billion in a full year in 2018.

Massive losses have become an integral part of unicorn IPOs, as evidenced by the debut of Uber and Lyft, two other high-tech companies, among others. However, WeWork continues to face difficult questions about the sustainability of its operations and few of them have received an answer in its S-1.

"You can say that my growth is faster, but you can not say that if for every dollar you get, you lose a dollar," said Kathleen Smith, director of Renaissance Capital.

Similarly, Rohit Kulkarni, a member of MKM Partners, said in a note on Friday that investors "will have to make a huge leap of faith to believe that WeWork would show signs of a sustainable business model," considering the rise costs in its 528 sites. He added that WeWork may soon run out of money.

"With an estimated budget of between $ 1,500 and $ 200 million a month, we think the company has about six months of execution before facing a cash shortage," wrote Kulkarni in a research note.

Expensive rental contracts

WeWork's lease obligations deserve special attention.

The company signs long-term leases with homeowners up to 15 years, which requires it to pay hundreds of millions of dollars in future rent, according to the CB Insights data provider. In the S-1 warehouse, WeWork stated that future lease payments were $ 47.2 billion as at June 30, compared to about $ 34 billion at the end of 2018.

At the same time, WeWork offers members short-term leases to provide flexibility by collecting rent over an average of two years, Smith said.

This is a boon to its members, but it could pose a risk to WeWork's business, as these short-term tenants could get up and leave at any time, leaving the company struggling with long-term rents.

"This mismatch can be life-threatening in a recession," Smith said. "This means that the company must be able to pay the rental costs.If, for any reason, the price, renewals, cancellations and lack of renewal of the market share are not rented, this could be a very big problem. " risk in recession ".

The decline in the company's membership revenues is also causing concern.

WeWork estimates potential opportunities for the potential market at $ 945 billion, applying its average membership earnings to WeWork's potential membership, the report says. However, WeWork also warned that revenue per member would decrease in the future, as it would expand internationally on "discounted markets".

"Investors want to see [average revenue per member] increase, as this can prove this idea of ancillary services, "Smith said.

Services should be a long-term driver of the company's revenues. The CEO, Adam Neumann, previously stated that he considered WeWork as a "global platform" for items such as "space as a service", a game about the world, and a "game". software expression as a service.

If WeWork is already struggling to increase its average revenue per member, it may be difficult to ask members to shell out a few extra dollars for software or other services.

Confusing business structure and unpredictable business in China

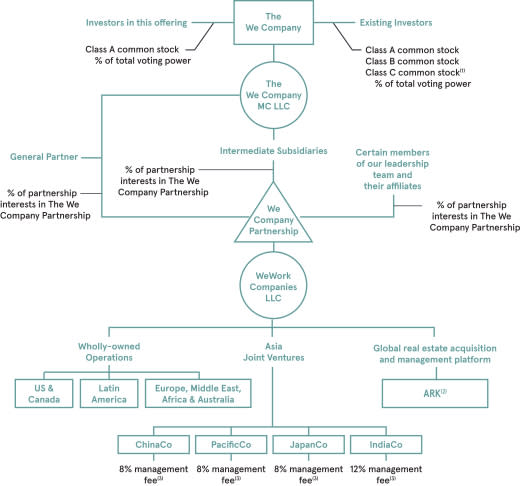

After changing its name to The We Company in April, WeWork adopted a complex corporate structure called the Multi-Compartment Partnership called Up-C.

In fact, this has transformed WeWork into a limited liability company, overseen by The We Company and joint ventures in Asia, as well as by other related entities, such as its ARK Capital Advisors fund, which oversees real estate management and global acquisitions. (The acronym stands for Adam, Rebekah and Kids, referring to his wife – who is listed as a co-founder and has significant influence on the company – and their five children.)

This graphic of S-1 shows how complicated it is:

The Up-C structure offers tax benefits to Neumann and other executives because they will be able to pay taxes on all profits at a personal income tax rate, according to the Financial Times. At the same time, public shareholders will be subject to double taxation, since the holding company will be taxed on income and investors will pay another tax on dividends.

In its S-1, WeWork stated that the Up-C structure would give it more flexibility to continue its acquisitions, while separating the debts and obligations of its other activities.

"Such a structure allows us to separate our space offer as a WeWork service from the rest of our existing business and will also allow us to separately hold all future business areas in which we can grow." indicates the deposit.

In an interview with CNBC, Kulkarni said that WeWork's business in Asia was still in its infancy, so its structure allows it to "isolate the losses" associated with it.

In the S-1 publication of the company, WeWork indicated that its contribution margin, which corresponds to income from membership and services after deducting operating expenses from these sites, would have been greater than three percentage points if she had excluded the activity in China.

WeWork faces unique risks with its operations in China. Business in the region is managed by groups it can not control, local laws are different in term of lease term and fall under China's 2017 Cybersecurity Act, which gives the Chinese government a access to company data.

Kulkarni said that he thought WeWork had not provided "enough information on how assets in China and Asia are being held" and that its confusing business structure might present significant risks.

"It's a puzzle that needs to be solved," Kulkarni said.

A board of directors composed exclusively of men

We have disclosed who will be part of its board of directors in its IPO prospectus. Not a single woman will be part of the board of directors of the company, consisting of seven members, which could eventually make it criticized later.

Neumann is chairman of the board of directors and is joined by Bruce Dunlevie, founding partner of Benchmark Capital, Ronald Fish, vice president of WeWork's largest sponsor, SoftBank. Lewis Frankfort, Steven Langman, Mark Schwartz and John Zhao are also directors.

By appointing only male directors, WeWork counteracts the broader trend towards inclusive boards of directors. As of last month, each S & P 500 company had at least one female director. Having a more diversified board is widely seen as a way to improve returns for shareholders.

CEO Adam Neumann's control and potential conflicts of interest

If you bet on WeWork, you bet on Neumann.

It controls the majority of voting rights through the class B and C shares of the company, both categories having 20 votes per share compared to class A shares, which have one vote per action. Neumann's holdings could further increase due to an option pre-IPO allocation of about 42.5 million shares, which will be acquired over the next 10 years.

To make matters worse, WeWork rents and pays the rent for buildings that are partly owned by Neumann. It holds interests in four commercial properties leased to WeWork, an S-1 group country. Between 2016 and June 2019, the company paid $ 20.9 million to the owners who oversee these leases, which includes Neumann.

In addition, when WeWork changed its name to The We Company in April, it acquired We Holdings LLC's "We" trademark, an investment vehicle with Neumann and co-founder Miguel McKelvey. As part of the transaction, We Holdings LLC acquired an additional $ 5.9 billion in We.

This type of transaction is something investors do not generally like, says Smith.

Neumann is so much taken into account by the company that it was included among the risks listed in WeWork's S-1 document. The company noted that Neumann is "critical" for its operations, but that it has "no work contract in effect".

"If Adam does not continue to assume the duties of CEO, this could have a material adverse effect on our business," the report says.

In addition, if Neumann became disabled for life or died, his wife Rebekah, who is responsible for the brand and the impacts of the company, is one of two other people who choose his successor. If two short-listed directors no longer sit on the board, Rebekah can also select the board members who will assist her in the selection process.

WeWork acknowledges in the S-1 that Neumann has "a deep involvement in all aspects of the growth" of the company, adding that he "proved that he could simultaneously wear the visionary hats, d & # 39; 39; operator and innovator, while flourishing as a community and culture.

[ad_2]

Source link