[ad_1]

The last 2 quarters of 2020 have been frustrating for NVIDIA (NASDAQ: NVDA) investors, as the stock continued to fluctuate. However, in 2021 it increased by more than 50%, setting new highs and quickly reversing declines.

Given that the market rewards strong long-term financials, we wonder if this is the case in this case. In particular, we’ll be paying special attention to NVIDIA’s Return on Equity (ROE) today.

The gun detentions deal belongs to the regulators

Nvidia faces a delay with Chinese regulators over the US $ 40 billion acquisition of chip designer Arm Holdings. Given recent regulatory crackdowns, this is not surprising, although the market remains bullish. Citi puts the probability of the deal at 30%, down from just 10% in April.

Meanwhile, China is not the only problem. The UK’s regulatory agency, the Competition and Markets Authority (CMA), has raised concerns about the deal on national security issues. The UK is likely to take a closer look at the deal.

Regardless of the market capitalization above US $ 500 billion, a deal of US $ 40 billion remains important. The title remains phaseless and is on the verge of reaching a new all-time high.

What is ROE?

The return on equity or ROE of a shareholder is an essential factor to take into account because it indicates to him the efficiency with which his capital is reinvested. In simpler terms, it measures a company’s profitability with respect to equity.

See our latest review for NVIDIA.

How is the ROE calculated?

the the return on equity formula is:

Return on equity = Net income (from continuing operations) ÷ Equity

So, based on the above formula, the ROE for NVIDIA is:

28% = US $ 5.3 billion ÷ US $ 19 billion (based on the last twelve months to May 2021).

The “return” is the income the business has earned over the past year. This therefore means that for every $ 1 invested by its shareholder, the company generates a profit of $ 0.28.

What is the relationship between ROE and profit growth?

So far we’ve learned that ROE is a measure of a company’s profitability. Based on the portion of its profits that the company chooses to reinvest or “keep”, we can assess a company’s future ability to generate profits. Assuming everything else remains the same, the higher the ROE and profit retention, the higher the growth rate of the business compared to businesses that don’t necessarily have these characteristics.

NVIDIA profit growth and 28% ROE

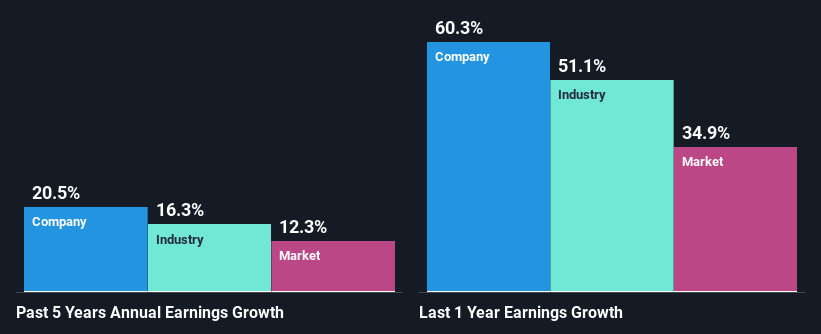

First of all, we love that NVIDIA has an impressive ROE. Second, even compared to the industry average of 14%, the company’s ROE is quite remarkable. As a result, NVIDIA’s exceptional 21% net profit growth over the past five years is no surprise.

We then compared NVIDIA’s net income growth with the industry, and we’re happy to see that the company’s growth figure is higher than that of the industry, which has a 16% growth rate over the same period.

Profit growth is an important factor in the valuation of stocks. Investors then need to consider whether the expected earnings growth, or lack thereof, is already built into the stock price. By doing this, they will have an idea if the stock is heading for clear blue waters or if swampy waters are waiting for them. If you’re wondering about NVIDIA’s valuation, check out this gauge of its price-to-earnings ratio, relative to its industry.

Is NVIDIA Using Profits Efficiently?

NVIDIA’s three-year median payout ratio to shareholders is 11%, which is relatively low. This implies that the company keeps 89% of its profits. This suggests that management is reinvesting most of the profits to grow the business, as evidenced by the growth seen by the business.

Additionally, NVIDIA has paid dividends for nine years, which means it is very serious about sharing its profits with its shareholders. After studying the latest consensus data from analysts, we found that the company’s future payout ratio is expected to drop to 3.9% over the next three years. Either way, the ROE is unlikely to change much despite the expected lower payout ratio.

Summary

Overall, we think NVIDIA’s performance is pretty good. Specifically, we like the fact that the company reinvests a considerable portion of its profits at a high rate of return. This, of course, has enabled the company to record substantial growth in profits. However, the company’s earnings growth is expected to slow, as the current analyst predicts. To learn more about the latest analyst forecast for the business, check out this visualization of the analyst forecast for the business.

Promoted

If you decide to trade NVIDIA, use the cheapest platform * which is ranked # 1 overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, currencies, bonds and funds in 135 markets, all from one integrated account.

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no positions in any of the companies mentioned. This article is general in nature. It does not constitute a recommendation to buy or sell shares and does not take into account your goals or your financial situation. Our aim is to bring you long-term, targeted analysis based on fundamental data. Note that our analysis may not take into account the latest announcements from price sensitive companies or qualitative material.

*Interactive Brokers Ranked Least Expensive Broker By StockBrokers.com Online Annual Review 2020

Do you have any feedback on this item? Are you worried about the content? Contact us directly. You can also send an email to [email protected]

[ad_2]

Source link