[ad_1]

Fast setting

-

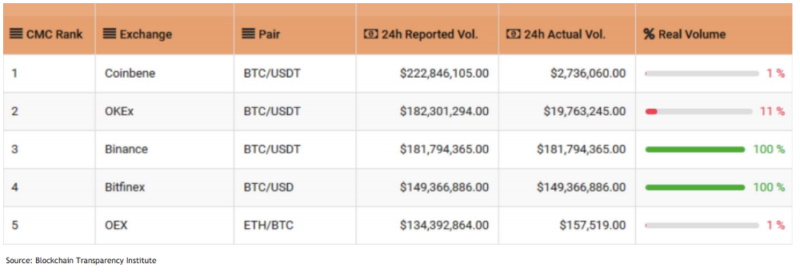

Two of the top five declared cash pairs have less than 1% of their declared actual volume

-

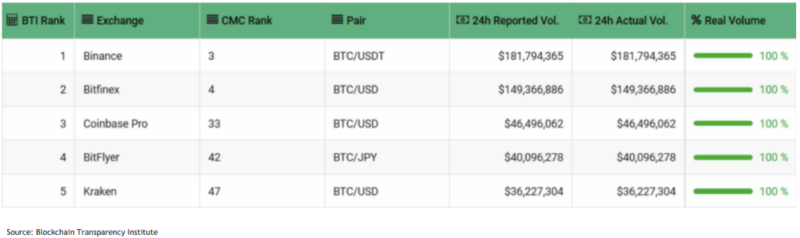

True liquidity is expressed in bitcoin pairs on exchanges that have been operating since 2015 and that trade little API-based trading

CoVenture CoVenture, a business line of CoVenture, has published a study analyzing the "true liquidity" of cryptographic exchanges by exploring location (trade) and trade (liquidity pairs). The main conclusions of the report are as follows: 1) Similar findings from the Blockchain Transparency Institute report revealed that 2 of the 5 most-reported liquidity pairs have less than 1% of their reported volume and 2) the actual liquidity is expressed in pairs of bitcoins on exchanges active since 2015 (Coinbase Pro and Bitfinex) and have few trades driven by APIs.

According to CoVenture Crypto, "for cryptographic markets to mature, smarter regulation needs to be implemented so that more established traditional exchanges can penetrate into space. [As] As more open trading platforms and more derivatives are proposed, we believe that liquidity can 'eliminate' some of the bad players in space and bring 'institutional legitimacy' to markets.

Other highlights to note:

- Incentive to declared and actual juice volumes: Limited regulatory oversight has pushed cryptographic exchanges to explore high-margin companies beyond the reach of traditional financial regulated exchanges (ICO quotes and ancillary trading). These activities are based on a high volume, which results in higher registration fees and higher liquidity, which ultimately creates a feedback loop during which traders seek higher volume trading.

- Total volumes are largely concentrated: The top 10% of trade represents 60% of the total volume of spots, while the top 25 represent more than 90%. Regulated futures (CME and CBOE) represent less than 3% of the total volume of futures contracts.

- All volumes are not equal: Unregulated stock exchanges are known to engage in sensitive trade (buying and selling at the same price without changing ownership). The most likely indicators of trading wash include a high percentage of API-based trading, a large volume of transactions outside working hours, repeated transactions at the same price and no price volatility despite high liquidity.

Three of the top five reported volume pairs have less than 1% of their reported actual volume

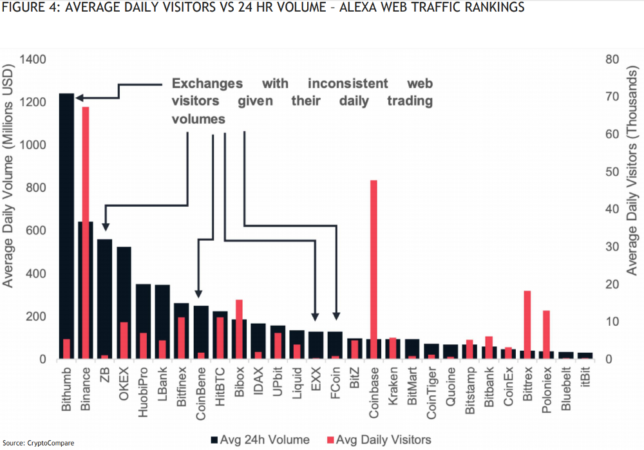

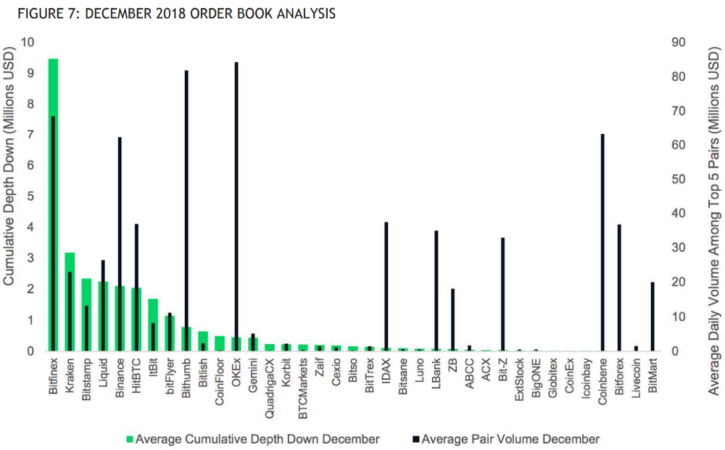

- Ways to test suspect reported volumes: CoVenture Crypto has highlighted two ways to detect suspect reported volumes. One measure is to compare the average daily volume traded to the average number of daily visitors (using the ranking of Alexa web traffic) to determine if there are any inconsistencies in the report compared to peers. Another measure is to compare the depth of the order book, especially the capital required to bring down the price of cryptography in a top 5 cash pair of 10%. An example of disappointing volumes that do not translate into true liquidity is presented with CoinBene metrics that report similar 24-hour volumes as Bitfinex but only require $ 13,600 in capital (vs. $ 9.47 million in Bitfinex ) to lower the price of the most important liquidity pairs. 10 percent!

- Transactional trading models indirectly favor washing trading: Unlike a traditional manufacturer and lessee model, mining transforms costs but reimburses them in the form of original trading chips. Examples include CoinBene and Bit-Z, both of which are in the top 25 in terms of reported volume, but encourage trading robots to benefit from a "zero net" transaction fee environment.

- The odor test for the reported legitimate volumes: There are typically five key indicators of accurately reported volumes: relatively low API transactions, bitcoin as the most liquid trading pair, capacity to offer short capabilities, encrypted and encrypted gateways, and exchanges started before 2014.

[ad_2]

Source link