[ad_1]

Warren Buffett once said to be greedy when others are scared. Some analysts favor this approach in CVS Health Corp. (CVS) after the sharp drop in Wednesday's earnings.

With stocks down 9% after disappointing expectations, this may not be a panic among value investors.

"We keep our rating ONE [indicating a buy] on the title, because there is always value here and we will continue to fight as long as we have, "said Jim Cramer's Action Alerts team about his position.

The team added that the dividend yield of 3.15% of the relatively cheap stock compared to comparable stocks should allow some peace. This is particularly the case, as the stock retreated to move closer to its trading level two weeks ago.

"We are going to lower our price target to $ 84, which is a multiple of about 12x from an adjusted earnings per share target now set at $ 7," the team said. "In fact, this figure is above management's expectations, but we are optimistic because it was only a reset of the profit base, which led to better than expected results." in 2019 and 2020, when all the investments / initiatives this year pay. "

The team was not the only CVS observer to consider the opportunity.

"We expect that the stock has now offered a floor with the initial guide," said Ana Gupte, an analyst at Leerink Partners, while maintaining a "Surperform" rating. "[We] can see investors of deep value potentially intervene. "

Gupte has set a price target of $ 100 for those looking for this value, suggesting a significant upside potential.

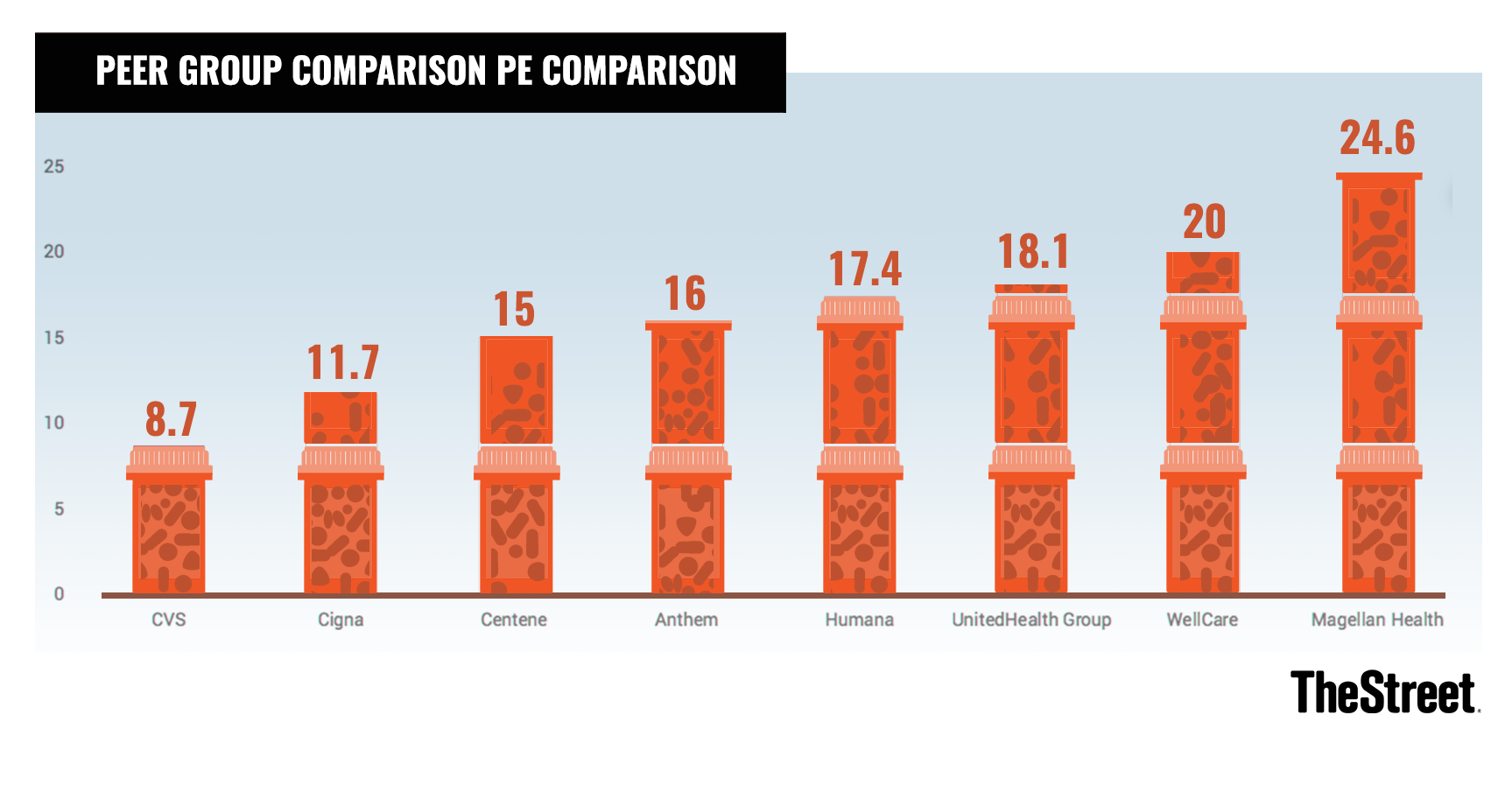

The peer comparison was very good on Wall Street.

"Although the guidelines have been very disappointing, we continue to believe in the long-term vision and strategy," said JP Morgan analyst Lisa Gill on Wednesday morning. "Based on the current location of equities and the midpoint of the guidance range of EPS adjusted for fiscal year 19, the shares are trading at around 9.5 times, which is one of the multiple low of the Rx channel. "

Continued pressure on equities further exacerbated this deal, according to FactSet.

Certainly, some analysts have indicated that they no longer believe in the company from the point of view of execution because it attempts to integrate several major mergers and acquisitions.

"CVS has failed to improve its operations after two years of pressure and continues to struggle with its acquisition of Omnicare LTC, setting 2019 as a weaker year than expected," warned analyst Peter Costa from Wells Fargo. "CVS expects that the pressures on existing companies will have a disproportionate impact in 2019, making it a year of transition beyond the obvious need to integrate the acquisition of # 39; Aetna ".

Due to mistrust, he reduced his price target from $ 104 to $ 68 per share and demoted the title to "Market Perform".

"We think 2019 is a year of transition," he said. "Although we believe that CVS in the long run is well positioned to deal with changes in the pharmacy / mass distribution sector, with the increased use of tight networks, price transparency and other pressures. competitive, its recent acquisition of Aetna could eventually create an integrated health care platform for competitive threats. "

Given the results and market reaction, caution should be exercised.

It will depend on the investment strategy and the level of investor confidence to decide whether they want to be too greedy or not to be vigilant.

(CVS Health is a participation in Jim Cramer's Action Alerts PLUS member club.) Do you want to be alerted before Jim Cramer buys or sells CVS? Learn more now.)

Receive an email alert whenever I write an article about Real Money. Click the "+ Follow" button next to my signature for this article.

[ad_2]

Source link