[ad_1]

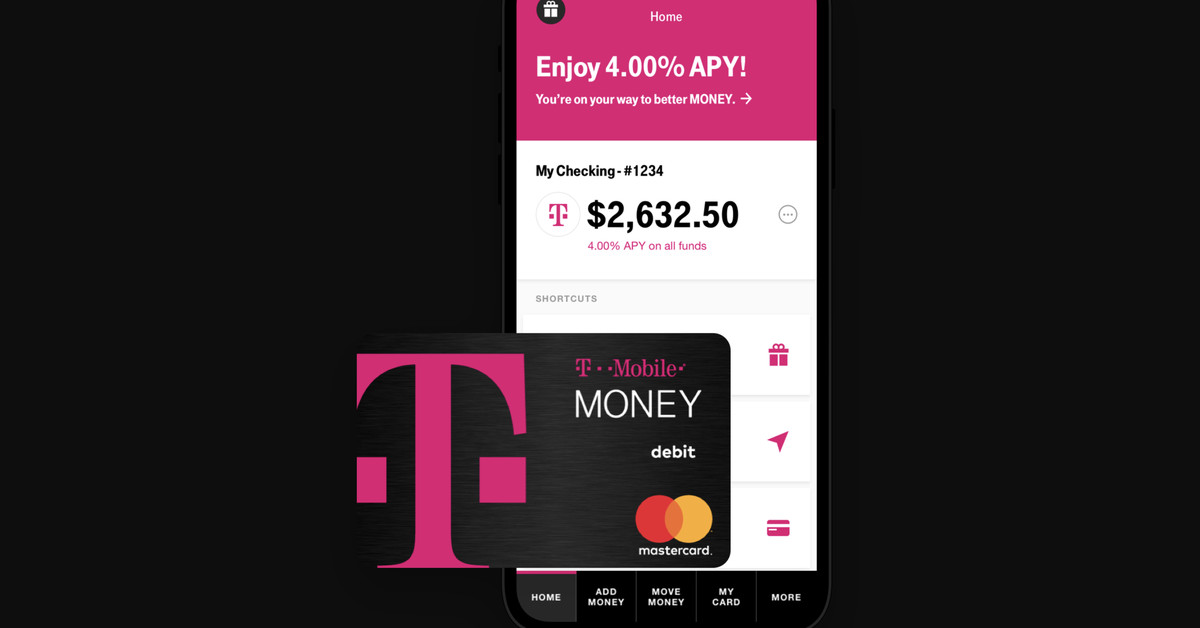

T-Mobile is now a bank, apparently. The cellular service provider is launching a new company called T-Mobile Money, a current account service for T-Mobile customers.

Let's be clear: T-Mobile does not operate its own bank. It's more of a face operated by T-Mobile for a digital bank called BankMobile, which is part of Customers Bank. It's a bit like an MNVO, but instead of a start-up using the existing cell service of a large operator to offer its own service, its T-Mobile using the existing banking infrastructure.

T-Mobile Money is still a real checking account with FDIC insurance for balances of up to $ 250,000, a debit card powered by Mastercard and the possibility of a credit card. send paper checks directly from a smartphone application. You can also add a T-Mobile Money card to Apple Pay, Samsung Pay, or Google Pay.

To sweeten the deal, T-Mobile offers up to 4% annual percentage yield (APY) on balances of up to $ 3,000 on a T-Mobile Money check account that deposits at least $ 200 USD per month. (If you exceed this figure of $ 3,000, you will be lowered to an APY rate of 1%.)

There are also other benefits, such as a $ 50 overdraft protection feature that covers your account for free when you switch (assuming you pay it back within 30 days). There are no account fees, no maintenance fees, no minimum balance and no charges at 55,000 ATMs on the Allpoint network.

Source link