[ad_1]

Last week was definitely not good for Tesla shareholders (TSLA). The electric vehicle manufacturer has announced very low revenues and a loss of $ 700 million for the first quarter, much worse than estimates already sharply reduced. As questions about the company's financial future swirl, I am here today to review some of the key things I will be watching throughout the second quarter.

How are the sales of the second quarter?

After the first quarter's numbers were well below expectations, Tesla's management led to a much better second quarter. We should start having estimates in the next few days on the April results, but there are still major hurdles to overcome. For example, the data suggests that the Netherlands (here and here) saw about 60 S / X units delivered this year, but there are still about 1,000 units in stock. After this country was one of the two largest in Europe last year, the cuts in subsidies really hurt, as did the United States. Norway's S / X sales at the last audit also decreased by about 80% compared to the same period of the previous year.

Management has guided one of the record deliveries for this quarter. However, it is hard to imagine that the S / X model will come close to the 25,000 units recorded in the fourth quarter of all shipments. So, Model 3 will have to endure the day, and remember that InsideEvs has estimated more than 61,000 units of Model 3 in the US in the fourth quarter, but a fraction of that figure at the beginning of the year. ;year. Until now, only one ship left for Europe this quarter versus three at this stage of the first quarter. It is therefore preferable to have more vehicles, as management claims. One may also wonder if sales are going so well, why did Tesla announce another major referral program giving a significant amount of boost credits for next month or so?

What is the impact of the lease?

Model 3 leasing is now available in the United States. However, the total amount of payments associated with the fact that you must return the vehicle after the three-year period may mean that consumers choose to purchase the vehicle or require a refund of the deposit. In the last two quarters, less than 10% of vehicles were eligible for lease accounting based on quarterly reports, but this could certainly change now.

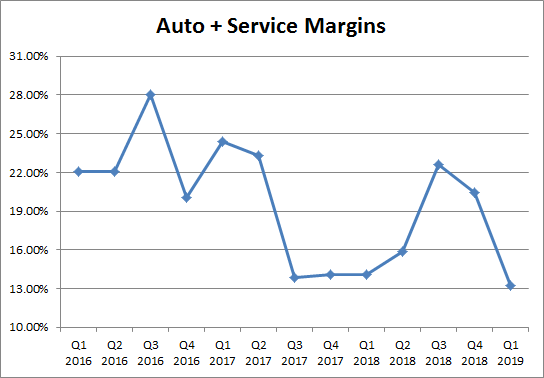

Of course, Tesla does not initially generate as much rental revenue as a regular sale, but rental margins were about double those of auto sales for most periods. The company needs things to improve after the heavy loss of the first quarter, especially as total car margins (including services / others) have reached their highest level. low for several years, as shown in the graph below.

(Source: Tesla investor letters, see here)

It will be interesting to see how margins will be in Q2 given a number of competing factors. More leases mean higher margins for this segment, and more production should lead to more efficiency. However, many price declines and a different sales mix to the extent that standard battery versions have hit Europe and Asia will hurt, especially if high margin credit sales are low . With the major update of the recently announced S / X model, stock units are likely to be discounted, creating an additional margin wind. It will also be interesting to see the impact on the leasing balance sheet of Model 3, and the company is already suffering from a huge working capital deficit.

The issue of the margin also took an interesting turn Monday morning, when the filing of the 10-Q file of the company was made public. Tesla has sold about 200 million additional regulatory credits not mentioned in the report on the results. This means that the margins of the auto sector would have been much lower without these sales and that the overall loss of Tesla would have been about $ 900 million.

Is a capital increase coming soon?

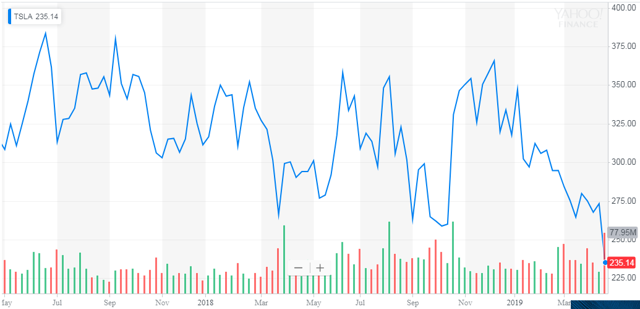

Tesla's management last week seemed more willing to raise capital, which begs the question why they have not done so yet. Did they just think that the company was doing well enough to avoid raising money, or was there something / someone (such as the SEC) that prevented them from doing so? Tesla 2025 bonds currently report more than 8%, suggesting that an increase in direct coupon debt is unlikely at this time. Unfortunately, the stock has also fallen to its lowest point in a few years, as can be seen below.

(Source: Yahoo! Finance)

Investors have been diligently patient in recent years and stock-based compensation has exceeded $ 200 million in the first quarter. Even if Tesla only needed to collect about a billion dollars now, it would have been much better to do it at $ 350 than at current levels. The fact that Tesla's 10-Q also showed that the term loan that was due last year had been pushed back to the June 2019 deadline (its third decline in a few months) shows that Tesla is missing. liquidity. With many recent investors under the water, especially those who have bought after the tweet "secure financing", how many will just take their losses and go ahead? In addition, Elon Musk having borrowed heavily against his position, each lower dollar increases the chances of a margin call.

Do regulators have a say?

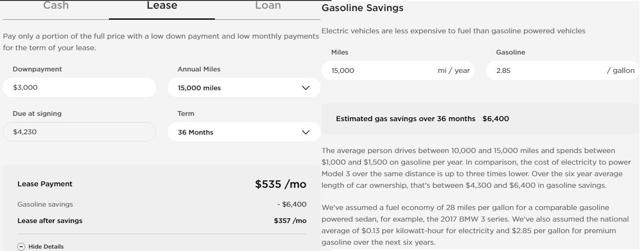

Elon Musk recently reached an agreement with the SEC, but Tesla could still have problems with regulators. For a company that continues to claim that it is so technologically advanced, it seems to have many problems with its website. Unfortunately, some of them may be on the verge of consumer fraud, the last suspicious item regarding the leasing of model 3. Take a look at the images below from the website of the company regarding gas savings on a model lease 3.

(Source: Tesla Model 3 page, seen here)

Tesla mentions gasoline savings of $ 6,400 over a 6 year period, but this is not possible with a 3 year lease. Announcing this saving of about $ 200 a year is completely wrong, according to the figures provided. A total of 45,000 miles using their 28 miles per gallon and $ 2.85 the price of gasoline does not even reach $ 4,600 in gasoline charges. This is even before considering the cost of electricity, especially given the number of price increases from overfeeding in recent years. If some of these sales practices hold the attention of regulators, Tesla could be in trouble. With balance sheet questions, you do not want to start accumulating large fines.

Last thoughts:

Tesla 's dreadful quarterly report has not only brought down the stock, but has increased skepticism about this management team. Second-quarter sales are expected to be much better, but S / X model sales in Europe continue to struggle in key markets. Will model 3 leasing in the United States and cheaper versions in Europe and China be enough to achieve the goals? A capital increase would certainly help the balance sheet and eliminate some short-term risks, but this process would have been much better if stocks and bonds traded much higher.

Disclosure: I / we have / we have no position in the actions mentioned, and we do not intend to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

Additional disclosure: Additional Information from the Author: Investors are always reminded that before making an investment, you must exercise your own due diligence for any name directly or indirectly mentioned in this article. Investors should also consider seeking the advice of a broker or financial advisor before making any investment decisions. Any element of this article should be considered as general information and not as a formal investment recommendation.

[ad_2]

Source link