[ad_1]

As we enter the last part of May, there is no stock that worries me more for long holders than Tesla (TSLA). The stock price represents more than 50% of its record, but it was not a stock split at the rate of 2 to 1 because the company seems to be carrying even worse than I thought at the beginning. Less than six weeks into the quarter, there appears to be another large-scale attempt to move vehicles at any cost.

(Source: Yahoo Finance)

Tesla forecasts between 90,000 and 100,000 deliveries in the second quarter, which would put almost the entire range at a quarterly record higher in the fourth quarter of 2018, just under 91,000 vehicles. According to estimates from InsideEvs and TMC Europe, the month of April was less than about 5,000 vehicles in the United States and Europe in the month of April. ;October. Part of this gap will be filled by China, but these sites estimate that about 23.4% of quarter shipments from these regions occurred during the first month of the fourth quarter. In November and December, many sales were recorded, particularly in the United States, making comparisons very difficult for May and June.

The year 2019 has already been marked by many hurdles, given the reduction of US electric vehicle tax credit and the progressive reduction of benefits for the Netherlands. Tesla is also starting to face a little fiercer competition – for example, until May 21st in Norway, the number of registered S / X models is 141, against 324 for the Jaguar i-Pace and 283 for the Audi e-Tron. For the quarter to date, listings in Norway S / X have fallen by more than 76% and the Netherlands are far worse. Even though Model 3 sales offset the unit gap next month, you're still talking about a vehicle being sold at half the price or even lower margins.

It was late April that Tesla announced changes to the Model S / X. Less than a month later, the company had already reduced its prices on these vehicles. I've already talked about the impact this would have on the already important stock of the company. What bothers me most is the following statement provided by the company, detailed in the ELECTrek article above on Tuesday's price cuts:

A spokesman for Tesla sent us the following statement about the price change:

"Like other automakers, we periodically adjust prices and available options. These price changes represent a reduction of approximately 2% to 3% in the prices of the X and S models. Last week, we raised US Model 3 prices by 1%. In all reasonable respects, these small changes are not worthy of interest. "

Now, this statement shows you that Tesla is primarily a car company, not a technology company, as some of its supporters claim. But the last part about not being newsworthy caught my attention. Indeed, as you will see in the images below, the CEO, Elon Musk, had already tweeted several times about a $ 1,000 price change compared to the cost of the autonomous driving feature. It would be a small price change, and the CEO has announced directly to more than 26 million followers on Twitter. You can not say that price changes are not relevant when the head of your company talks about them on Twitter several times.

(Source: Elon Musk Twitter page)

However, it was not the only important news of Tesla on Tuesday. according to ELECTrek, the company has also brought unlimited free overeating for those who buy S / X stock units. Not only are these vehicles greatly reduced, thanks to the new versions, but this is an additional benefit that could represent hundreds or even thousands of dollars over the life of the vehicle, depending on its use.

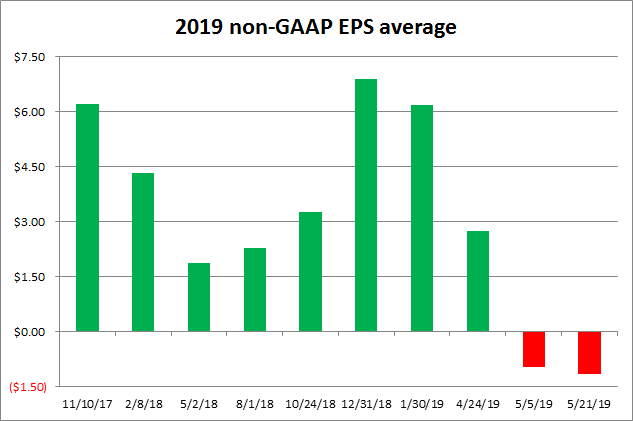

Both movements will have potentially significant margin implications for Tesla in Q2 and beyond. The price cuts obviously have the effect of reducing revenues and gross margins, and they are also impacted by the strong dollar that I mentioned in my previous article. It also means that inventory needs to be revalued to a lower amount, which means a larger write-down than expected of new and used inventory. As we see below, Tesla's estimates for the year are already at their lowest level and I could easily see them fall further.

(Source: Yahoo Finance analyst estimates)

If Tesla lowers its prices and offers big benefits, it probably means that the demand is not where it should be. Management has already added pressure by making risky projections and reiterating the call for the capital increase. If the company runs out of delivery, there will likely be a lot of disgruntled investors, especially if the stocks and bonds remain well below the prices at which they were sold recently. There are already many ongoing lawsuits over the SolarCity contract, secure tweet financing, and Model 3 projections, so the last thing Tesla needs now is another set of legal issues to deal with.

As margins are likely to be reduced, it is even more difficult for Tesla to be sustainably profitable in the future. This is where the name should have appeared several times already on the basis of previous statements by management. The fall in the title shows that investors are starting to give up Tesla's story and that another failure in the second quarter could push even more investors to run for the exits.

Disclosure: I / we have / we have no position in the actions mentioned, and do not plan to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

Additional disclosure: Investors are always reminded that before investing, you must do your own due diligence for any name directly or indirectly mentioned in this article. Investors should also consider seeking the advice of a broker or financial advisor before making any investment decisions. Any element of this article should be considered as general information and not as a formal investment recommendation.

[ad_2]

Source link