[ad_1]

When the world’s most famous electric Car manufacturer finally joins the S&P 500, it will be bitter for investors with around $ 11 trillion in funds tied to the gauge. Their benchmark hugging bets finally get some Elon Musk magic, but they pay seven times the price of last year for the privilege.

Given the luck, how many would have added Tesla Inc. to their exposure to the index in January? Or even in June, when stocks had simply doubled?

Personalization is at the heart of a bubbling investment strategy that has led to two of the biggest asset management deals this year. Known as direct indexing, it blurs the line between stock picking and benchmarking and now commands around $ 300 billion after its popularity has grown in recent years.

The idea is simple: instead of buying stocks in a fund that slavishly owns all the companies in an index, investors buy those stocks directly. Exposure to the index is broadly the same, but investors are no longer attached to it. They can make changes – like adding a skyrocketing automaker long before the S&P 500, for example.

“The Tesla issue of the last few months is probably making it clear for the first time to a lot of people that the S&P is not the 500 biggest companies,” said Elya Schwartzman, founder of ES Investment Consulting LLC. With direct indexing, “you can just build your own index and say, look, I want the 600 largest companies by US market cap,” he added.

Direct indexing is a Twist on separately managed accounts, which have been around for years and are used to build tailor-made portfolios for high net worth individuals. The era of commission-free trading and the growing use of fractional shares means that similar strategies can now be deployed for small investors.

It remains a nascent part of the asset management industry, but the buzz is growing. $ 7 billion from Morgan Stanley The purchase of Eaton Vance Corp. is all about direct indexing – Parametric Portfolio Associates of the latter is the largest provider in the field. BlackRock Inc. this week announced a $ 1 billion buyout of Aperio, creator of tailor-made index strategies.

The ESG effect

As dramatic as Tesla’s example is, the real selling point of direct indexing may turn out to be the ability to remove companies from exposure to a portfolio rather than add them.

In the dynamics of investments that meet environmental, social and governance criteria – which also happens to be one of Tesla’s favorable winds – huge disagreements exist over what qualifies. Direct indexation allows an investor to make adjustments based on their own views, and to eliminate companies that are not. Until stripe.

Read more: Record flows pour into ESG funds as their “ vigilance ” is debated

“Having that extra need for customization is really where we get involved,” said Jeff Brown, director of institutional portfolio management for Parametric. “If I want market exposure, there are quick and easy ways to get it through an ETF, but if I want to customize in any way a shape or shape that doesn’t exist in the space ETF, this is where we can step in to fill it. this gap. “

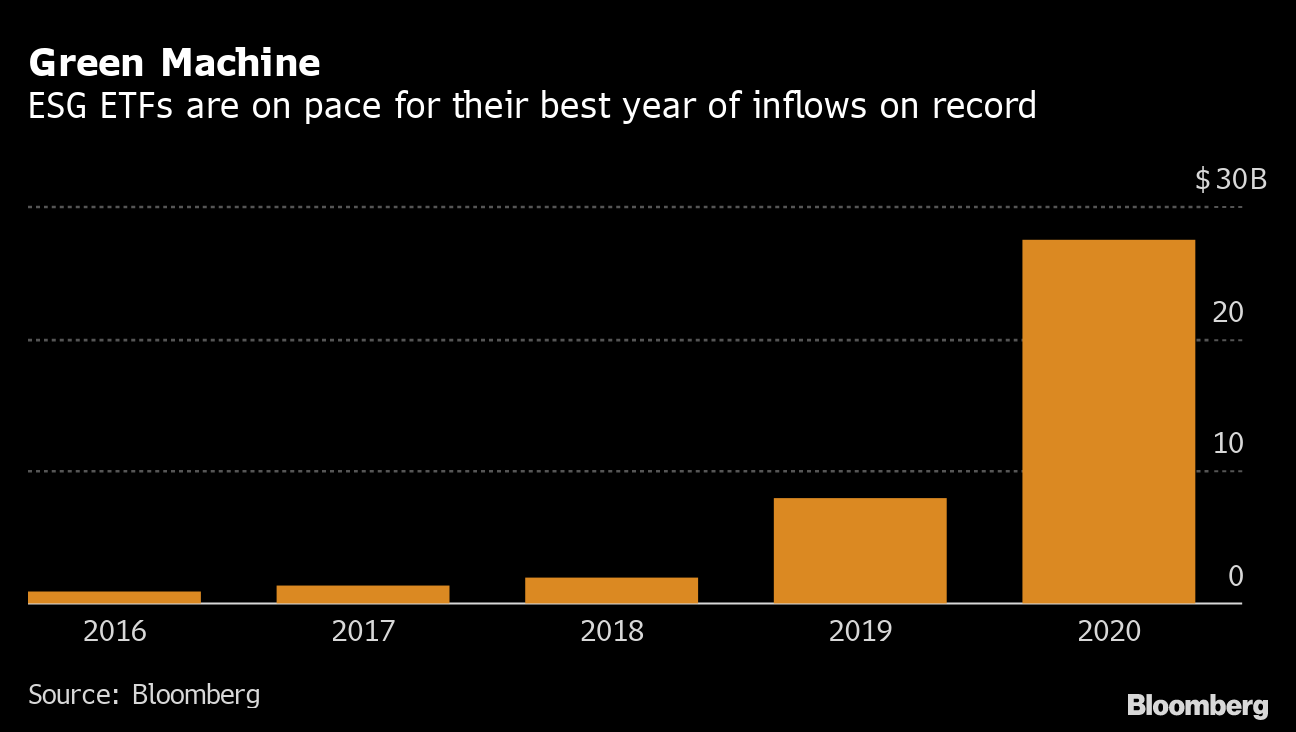

Green machine

ESG ETFs continue their best fundraising year ever

Source: Bloomberg

This kind of flexibility comes at a price, however. As fierce competition between brokers and asset managers drives down trading costs in the industry – thus stimulating direct index products – they still charge around 0.15% to 0.35%.

That’s less than an active mutual fund, but three to five times the price of some exchange traded funds. The fee for the Vanguard Total Stock Market ETF (VTI) is only 0.03%, for example.

“If direct indexing is to experience another growth stage, it will need to spread further into the mass rich market,” said Ben Johnson, global director of ETF research at Morningstar. “It will have to be achievable at a lower entry point.”

Until recently, direct indexing was generally the preserve of high net worth individuals, according to Tom O’Shea, director of managed accounts at Cerulli Associates.

The investment approach offers a huge tax advantage as investors have more losses than they can use to offset gains. ETFs do this as well, but direct indexing allows an investor to use it at an individual stock level, which should add between 1 and 2 percentage points per year to returns.

To get the most out of this, it traditionally required a large number of wholly owned securities, putting it out of the reach of the average investor. But improving technology and fractions of shares offered by brokerage houses such as Charles Schwab Corp. and Robinhood are changing things.

“You can do the same with a smaller wallet,” O’Shea said. “You can have 200 titles, but you don’t have to have that much money.”

A negotiator

A recent Cerulli study found that 67% of asset management firms believe direct indexing presents the most immediate opportunity to manage tax and ESG factors, so it’s no surprise to see some big names make movements in the area.

The world’s largest asset manager, BlackRock, said in its third quarter earnings call that it plans to invest heavily in its separately managed account business. The purchase of Aperio will bring its assets in this field to more than $ 160 billion, the company said.

Along with this and Morgan Stanley’s deal for Eaton Vance, Charles Schwab this year acquired a company called Motif which offers direct indexing. Walt Bettinger II, CEO of Schwab said the strategy will play an important role in the company’s future.

Still, there remains a lot of skepticism about the possibility of a significant acceleration in growth.

Even tailoring to include Tesla’s surge ahead of the S&P 500 can’t beat the sheer profitability of an ETF, according to Morgan Barna, analyst for Bloomberg Intelligence.

VTI, which includes Tesla, has provided only slightly better performance this year than State Street’s SPDR S&P 500 ETF Trust. Meanwhile, despite all the hype, the ESG investing phenomenon is still in its infancy.

This could be one of the reasons why direct indexing entries from industry leader Parametric totaled just $ 15 billion for the past year, while entries to ETF activities from BlackRock – the largest issuer in the world. sector – total $ 126 billion, according to data compiled by Bloomberg. .

“The additional return would have to be much higher than the sum total of your custom picks to make it worth it,” Barna said. “People who felt really heavily bought Tesla directly out of their index exposure ”or bought a larger ETF, where the Car manufacturer was included, she said.

[ad_2]

Source link