[ad_1]

Over the last two years, electric vehicle manufacturer Tesla (TSLA) has set the bar very high for its capital expenditure forecasts at the beginning of the year, only to reduce forecasts again and again. Although management has reported many savings and some expenses in future periods, it is also likely that savings will be made, resulting in many delays for key products and services. The expanding supercharging network is one area in which consumers have suffered a great deal. A recent article showed this key element in a very bright light, which was not entirely correct.

As I detailed in my list of Tesla failures, the problem of compressor growth really began in 2015, when the company electrified only 208 new stations when it guided about 300 bets online that year. The company was expected to grow to 10,000 superchargers by the end of 2017, then to 18,000 by the end of last year. However, it was only 8,400 at the end of 2017 and 12,000 last year. We have almost three quarters of the way this year and Tesla is not even 14,300 stands. There are many places, mainly in Eastern Europe, on the compressor map where the stations were announced as opening at the end of 2016 and are still listed as coming.

Part of the delay is due to the fact that the company's version 3 of Supercharger was not published when Elon Musk promised. This year, the first of these new high speed chargers has been put in place and several locations are coming. Wednesday, ELECTrek published an article explaining how crowdsourcing speeds up, indicating:

Tesla finally seems ready to accelerate the deployment of Supercharger stations with more than 40 new stations entering the permit or construction phase in the last two months.

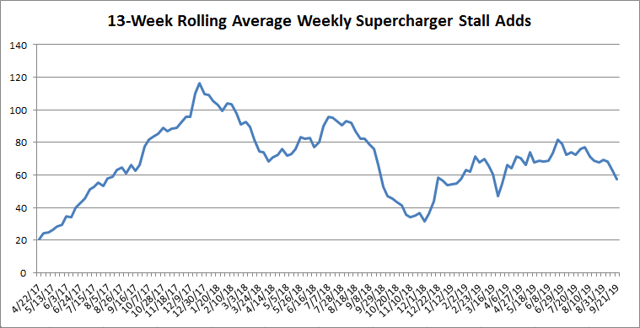

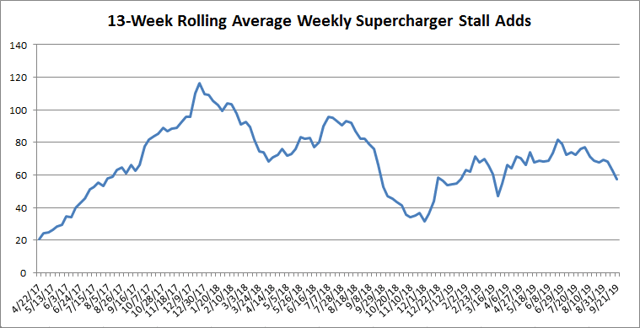

The supercharging stations are one thing, but we have seen with only two stands and others that can hold 40. In fact, nearly a quarter of the stands opened in recent months were urban versions of 72 kW, much more slow than the rest of Tesla's network. The problem with ELECTrek The statement on accelerating deployment is that it's really not true if you look at stall growth, as shown in the graph below.

(Source: supercharge.info, seen here)

For the weekly period ending September 21st, Tesla has opened an average of about 58 stalls per week over the last 13 weeks (748 stalls in total). In terms of stall growth, it is the slowest pace since the end of March. It is certainly not an acceleration. In fact, the first 12 weeks of the third quarter (data week ending Saturday 9/21) saw a total growth of 638 booths, down substantially from 918 in Q2.

Tesla has now upgraded the peak load rates of some of its older superchargers. Buyers will therefore claim that there is no need to open as many new locations. This may be true up to a point, but when you say that the growth of the stations is accelerating and that stall growth is falling, you do not look very good, d. as much as Tesla is trying to dramatically increase deliveries with Model 3 this year. On Wednesday, only 10 new stands were added during this weekly period, compared to 110 new stands added during the last week of the second quarter. Without a big weekend, the 13-week average will drop again, to a point never seen since an era that included harsh winters when construction naturally slows down.

I'm raising the issue of reducing the growth of the booster stalls as a way to question whether Tesla will reduce its capital expenditure forecast again. As of 2018, management has announced investments of about $ 3.5 billion for the year, but the forecasts have been cut several times and Tesla has finally spent only 2, $ 24 billion. factory. This year's initial forecast included capital investments of $ 2.5 billion, but the forecast at the end of the second quarter was between $ 1.5 billion and $ 2 billion. The company has only spent $ 530 million in the first half, which means that it will require a massive acceleration in the second half, unless the forecasts are lowered again. The capex forecast having been reduced in recent years, we found that the company was failing in areas such as the maintenance of vehicles where repairs were very long and the shortages of parts persistent.

When you do not spend on capital investments, it also reduces future capacity. This is why products such as semi-trailers, roadsters and solar roofs have been delayed. This also raises the question of the financial situation of the company, because when you do not have the necessary money, you need a lot of money. Over the years, many capital increases have taken place, those that Musk has declared would never be necessary. By reducing capital expenditures to what some might call rudimentary bones, cash flow figures look good, but at what price?

Thursday, we also had the usual Electrek leak towards the end of the quarter regarding possible deliveries for the period. Supposedly, Tesla is selling around 100,000 units, which is about what I've predicted for the period. The key issues are margins and revenues, given the lower sales mix on Model 3. The most important point is the trend of net orders tending toward 110,000 for the third quarter. Given that this seems to include Model Y, Model 3 built in Shanghai, and new S / X / 3 orders from four countries, Tesla opened the order backlog this quarter, which is not a huge amount of net orders. potential deliveries.

At the end of the third quarter, do we expect another reduction in planned capital expenditures for Tesla? While Electrek reports that the deployment of booster stations is accelerating, the number of booths added is at its lowest level in six months. Although this is partly due to the upgrade of the old charging speeds of the over-charging and the release of version 3, the drop in the growth of the drop-out makes me wonder how much was spent in capital expenditure during this period. Since we have seen how many capex reductions in previous years have resulted in many delays, future projects will be further hampered if Tesla hurts the pennies again. In addition, leakage on deliveries and net orders did not inspire much confidence.

Disclosure: I / we have / we have no position in the actions mentioned, and we do not intend to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

Additional disclosure: Investors are always reminded that before investing, you must do your own due diligence for any name directly or indirectly mentioned in this article. Investors should also consider seeking the advice of a broker or financial advisor before making any investment decisions. Any element of this article should be considered as general information and not as a formal investment recommendation.

[ad_2]

Source link