[ad_1]

summary

In this article I will outline a number of facts that other journalists, and apparently also the SEC, have not taken into account. It is always possible to define a set of events in a positive or negative light, if desired. The SEC has accused a recent tweet from Elon Musk (Tesla CEO (NASDAQ: TSLA)) of being contemptuous. In this article, I will consider this possibility, as well as the contrary view, that Musk has done nothing wrong.

The reader may, with all known facts, make his own decision as to whether or not this last issue should be pursued by the SEC.

SEC action accusing Musk of Outrage

Last summer, Musk tweeted his hope that Tesla could be made public and that he was exploring this option. He said in a tweet that he had "got funding". We could discuss how these words should have been interpreted until the cows come home, but the bottom line is that Musk and Tesla have an agreement with the SEC and have agreed that all tweets likely to change the market would be examined in the future before Musk publishes them. Musk has only posted a tweet that does not move on the market, according to his assessment, and considers his posts as freedom of expression.

Therefore, if Musk published a tweet containing information about market news and did not revise it before publishing it, he would then be guilty of violating the settlement agreement.

That said, Musk is free to publish any tweet of his choice that is NOT news. So anything that is already in the public domain is a reasonably fair game for Musk.

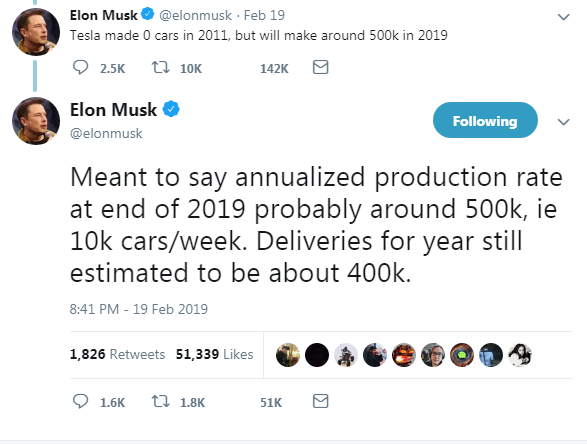

On February 19, Musk tweeted:

(Source: Twitter)

The case of the SEC

As the tweets arrived after the normal working hours, the market did not move. But it does not matter. According to the SEC, what matters is whether Musk had the prior permission to tweet a moving market. According to the SEC's action, he had not obtained prior approval, as evidenced by Tesla's response to the SEC regarding this detail.

According to the SEC, the initial tweet was inaccurate and potentially likely to evolve in the marketplace. As such, it would fall under the terms of the settlement agreement and should have been verified and approved before being mailed. According to the SEC, the tweet was incorrect, as the second tweet proves. The SEC states in the complaint:

Musk's 7:15 tweet for the first time after its publication by Musk, Tesla's "Designated Securities Council" 1 organized a meeting with Musk, who wrote Musk's 11:41 patch tweet together. Id. The first sentence of the tweet of 11:41 recognized that the Musk tweet of 7:15 was not precise: "Wanted to say an annualized rate of production at the end of 1919 probably around 500 000, or 10 000 cars / week" ( underlining added).

The above claims that the first sentence of the second tweet "acknowledged" that the previous tweet was not accurate. This is a way of interpreting words.

The other way is to take the words to the letter. He had meant that the annualized production rate at the end of 2019 would likely be around $ 500,000. He did not mean that there would be 500k model 3 cars built in 2019. However, the second tweet does not indicate that his original tweet was considered by Musk to be inaccurate, as the claims the SEC.

In fact, if we take the trouble to review Tesla's indications, they are accurate. Apparently, Musk only clarified what he intended to say and did not correct an error as claimed by the SEC. In other words, Musk intended to say something different, but what he said is also true.

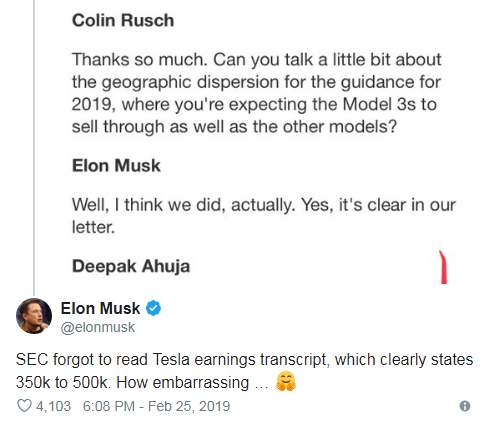

Musk points this out in a subsequent tweet quoting Colin Rusch, where Ahuja and Musk told Rusch that the figures had been leaked in the T4 orientation letter:

(Source: Twitter)

The income letter states:

PERSPECTIVE

Production volumes for Model 3 in Fremont are expected to continue to increase gradually in 2019, reaching a steady rate of 7,000 units per week by the end of the year. We plan to continue producing Model 3 vehicles at peak production rates throughout 2019. By including Gigafactory Shanghai, where we initially target 3,000 model 3 vehicles per week, our goal is to be able to produce 10,000 vehicles. per week in a sustained way. based. Unless unforeseen challenges with Gigafactory Shanghai, we are aiming for an annualized production of Model 3 above 500,000 units between the fourth quarter of 2019 and the second quarter of 2020.

(Source: Tesla Results Letter for the Fourth Quarter, Bold, Emphasis Mine)

On the call for results, Colin Rusch of Oppenheimer asked about the production of Model 3 for 2019. The Musk tweet above indicates that the figures of 350,000 to 500,000 figured in the transcript of the call of the results. Here is the quote from Musk's comments during the call (my transcript of the verbal call):

Yeah, maybe in the order of 350,000 to 500,000 Model 3, something like this, this year. "

(Source: Tesla's 4th quarter 2018 earnings call at 26:50 timestamp)

Therefore, Musk's first tweet only reaffirmed a fact that had been leaked during the call for results. The company could reach a total of 500,000 model 3 cars in 2019. The second tweet proposed a conservative figure of 400,000 units for the year (which also corresponds to the range given in the call for results) , as well as the goal of reaching 500,000 units a year. year rate by the end of the year (again, also in the official release, so nothing new).

So there is nothing in the news tweets and, therefore, the whole argument of the SEC is, in my non-legal judgment, unfounded. The same is true for all the press articles claiming that Musk did something wrong, siding with the SEC and ignoring the fact that the information contained in both tweets was factual and publicly disclosed before the tweets .

But that does not mean that there is nothing hidden behind the statements and figures disclosed as I will explore it afterwards.

Musk probably 500k model 3 cars in 2019

Tesla currently builds around 6,000 model 3 cars a week. The stated goal for Fremont is to reach 7,000 cars a week by the end of 2019 (see outlook above).

If I estimate that Tesla will have an average of 7,000 cars a week from Fremont for the entire year 2019 (probably an overestimate), this year's production would be about 364,000 cars. And if Shanghai reached about 3,000 cars a week by the end of the third quarter (probably another overestimate), it would mean that Tesla could generate about 12 additional weeks * 3,000 cars a week = 36,000 cars.

If these two ambitious goals were met (unlikely), Tesla would build a total of about 364,000 + 36,000 = ~ 400,000 model 3 cars in 2019. Total model 3 output from known factories should therefore be less than 400,000 units during 2019. It seems that there is no known way that Tesla can build 500,000 cars in 2019, based on information known to the public.

That does not mean that Tesla will not build as many cars. It simply means that if Tesla is to build 500,000 cars in 2019, it is necessary for Tesla to have something in her sleeve that she has not yet shared publicly.

(Source: Google Maps and Author Labels This map shows the large industrial area of Lathrop, California, where Tesla owns or leases a number of properties.To find it, you can use Google Maps and enter "Tesla , Lathrop, CA. "This will show structures A and B with tags and the rest of the properties you need to view the different videos and familiarize yourself with the properties using the troopr1023 videos that I refer you to in the discussion below. below).

A and B are Tesla buildings with machining shops, etc., that make parts for Fremont. This is the place where Tesla repaired cars last summer (cars were seen coming in and out of the building, loaded onto cars, then on I-5 South towards Los Angeles). D is the empty lot in the map above, where construction started 6 months ago. The building of the image below is located. F is another property that Tesla probably still rents, where thousands of model 3 cars were parked last summer and where a large number of transport cars remain, as well as striped and numbered parking spaces in the car parks (see picture below).

(Source: troopr1023)

The lots marked E are adjacent properties that Tesla could acquire that are large enough to build an automobile test track similar to that of the Fremont factory. These lots could also be used to park a large number of cars in addition to adjacent properties already under Tesla's control.

However, if you watch the videos, you will have enough space around the perimeter of this property to install a test track for vehicles and enough space to park cars on adjacent properties, so that to become a factory car, it is not necessary to purchase the lots E in the map. To do this, it would probably be necessary for the lane and the alley to have a higher crossing to be able to cross, but it would be a simple addition that has not yet been built because a test track would indicate what this installation will become.

(Source: troopr1023 New "Tesla Distribution Center" at Lathrop)

As many readers may know, I suppose Tesla is building the Lathrop structure to house a vehicle assembly plant and the Y model would be built there. Comments in the last earnings call indicated that this idea is incorrect. But that means the plant could build the standard version of Model 3 at $ 35,000.

If so, this plant could solve the puzzle that explains why Musk mentioned the figure of $ 500,000 for the production of model 3 2019. If Tesla could ramp up to model 3 cars at standard range 5k in 2019 before repeating this feat in Shanghai, he could potentially build 4,000 cars a week on average for 2019 over a six-month period. That would give about 100,000 cars and solve the riddle of why Musk mentioned 500,000 cars for 2019.

Tesla will make an important announcement

Musk tweeted (Feb. 27) that Tesla will announce news after the close of trading today, Thursday, Feb. 28. If the announcement is a disclosure of this building as being the US location of the Model 3 standard range, then the price action will likely increase after trading hours and on Friday.

It is logical that Tesla build a new production line for Model 3 in the US before replicating this feat in Shanghai at Gigafactory 3. Tesla can solve the problems here near home and then repeat the installation process of the production line in China.

This, finally, would explain why Musk commented that the standard Model 3 range would begin to be commercialized in mid-2019, that is to say in a few months and before the start of production in China. This would explain how Tesla could build 500,000 model 3 cars in 2019. And that would catch the bear with the upcoming press release with just one trading day before the weekend when everyone will analyze in detail the information published for two days before a potential record. trading day on Monday, March 4th.

If the above scenario is correct, a call after March 8 should yield a sizeable profit. The news and the timing of the news could trigger a brief pressure.

summary

If Tesla announces, Thursday after trading, that the aforementioned facility will be the US Standard Range Model 3 production location, I expect the stock price to rise after trading hours tonight and Friday, as a result of: the disclosure of additional production capacity commissioned in a few months. This commercial frenzy could continue Monday if a short press is triggered.

According to the latest publication, the announcement that model 3 of the standard range can be built profitably will cancel the final thesis of 25 million shares in the portfolio, with an average trading of around 6 millions of shares. This means that the Friday and Monday negotiations will be insufficient to allow the bears to move out of their positions given the new information and the share price could jump upwards, finally rising to the level of $ 400 per share. .

I expected this to happen in many past events and I always made a mistake each time. I can be wrong here and the news may be something else, including something as commonplace as Tesla has paid the $ 900 million debt. But this last configuration is the best ever achieved if Lathrop will host the production of the Model 3 standard range.

Musk had publicly revealed that the production of Model 3 in 2019 could reach 500,000 cars when calling the results. Nothing in these tweets concerned news or the market, as evidenced by the fact that the market did not move until the SEC filed its action (which moved the market).

Therefore, tweets used by the SEC to build a "contempt" action against Musk and Tesla are, from my non-legal point of view, fakes. Worse still, the SEC's actions have turned the market upside down so that short-term markets want the market to evolve. This makes the SEC appear as a branch of short-term bears.

Who is watching the SEC when is the SEC taking the wrong market shares?

According to what is publicly known from the production of Fremont Model 3 and Shanghai, it seems highly unlikely that Tesla can produce up to 500,000 model 3 cars in 2019. The only logical way to accomplish this feat would be that the installation of Lathrop (or Gigafactory 1) will be a factory to build the model variant Model 35,000 dollars of model 3. If so, then it will become a another manufacturing site that is not yet taken into account in Tesla's production capacity.

Given the recent action of the SEC, it would be logical for Tesla to now unveil this production facility to make the action of the theoretical SEC. That would explain how Tesla could reasonably reach 500,000 model 3 cars this year, as well as how and where Tesla plans to build the low-cost, model 3 standard range. Where the standard range version would be built was a mystery and nobody never did. asked during the teleconference, presumably assuming Fremont.

Publishing this information on a Thursday after trading hours is the perfect time to attempt to trigger a short compression. And it is clear that Musk would like to remove these shorts from his stock, as if removing geese from a ship.

However, until it is revealed, it is a speculation based on circumstantial evidence that I have collected. These are not commercial advice and I am not a commercial consultant.

Disclosure: I / we have / we have no position in the actions mentioned, and we do not intend to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link