[ad_1]

In my last update on Tesla (NASDAQ: TSLA), I predicted that the company would generate a net loss of $ 3.5 billion in 2019 due to the halving of sales of the S and X models (over 60 % of 2018 gross profits) and demand plateau for Model 3 (see report here). I see that the company is struggling to surpass the growth of its sales last year in the first two months of 2019 – which I think should generate negative free cash flow – and future debts of $ 731 million in November, leaving him only $ 1.3 billion in cash by the end of the year.

Many Tesla bulls point to China as the next pillar of Tesla's growth. Adam Jonas, a Morgan Stanley analyst in Tesla, posted a note on May 21 stating that "Tesla may have saturated the BEV sedan retail market outside of China," adding: " to exploit the new demand, it may be necessary Chinese domestic market, among others.

In this report, I try to show how far the Chinese electric vehicle market can represent a potential minefield for Tesla and present my point of view in three parts: (1) Tesla's recent sales trends in China, (2) the extremely competitive landscape Tesla is facing in the Chinese electric vehicle market and (3) at the risk of boycotting US brands by US brands in the face of escalating trade tensions between the two countries.

Section 1: The beginning of the second quarter of Tesla in China is weak

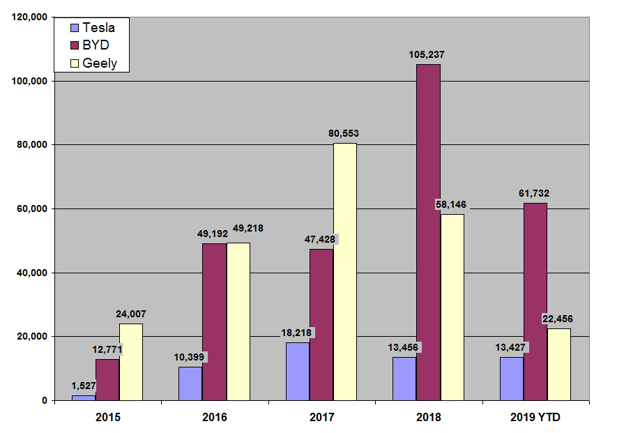

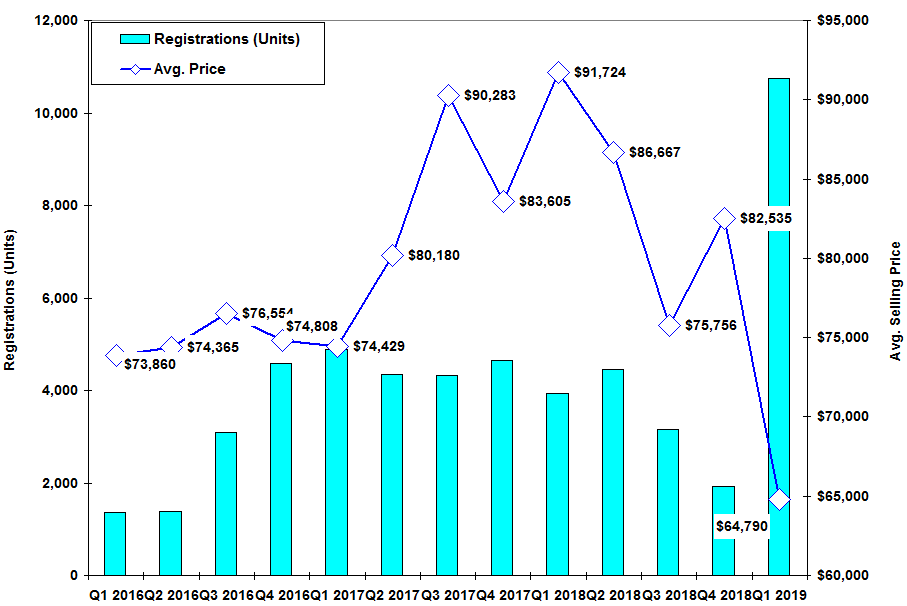

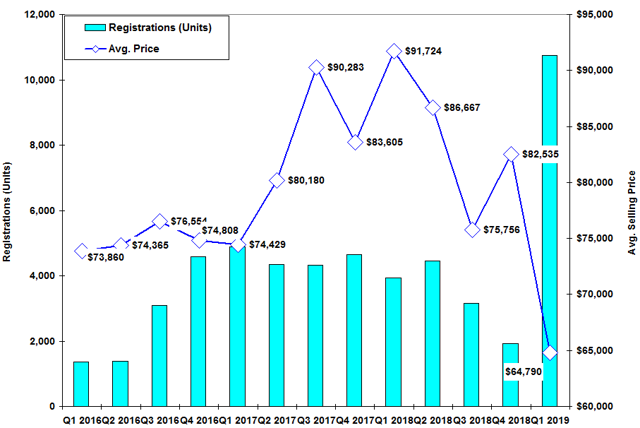

In March, Model 3 finally arrived in China and allowed Tesla's first quarter revenue to rebound + 53% year-on-year, to $ 779 million, despite a very weak base last year. In the first quarter, growth in registrations in China was well above + 174% year-on-year, with the cheaper 3 model accounting for 72% of shipments, resulting in a 29% decrease in the average selling price (see Figure 1). 1). But first-quarter sales in China – according to Chinese industrial research firm JL Warren Capital (blocked on wages) – accounted for a fraction of those recorded in the United States and Europe, with Model 3 recording only 7,748 units (compared with 29,900 in the United States and Europe). 19,555), while the S / X models represented only 2,994 units (-24% yoy), compared with 7,475 in the United States and 3,132 in Europe.

Figure 1: Tesla sales volumes and average prices in China

Source: JL Warren Capital & Bloomberg for yuan / dollar exchange rates

The second quarter was marked by a very weak start in China, with April deliveries to only 2,685 units. This is particularly striking given that Tesla had 2,005 inventory units at the end of March, which meant pure new sales of only 680 units in April. While listings were still well above 536% compared to April 2018, last year 's volumes were only 422 units. In addition, April's sales of 2,685 in China were well below 11,925 in the United States and 4,401 in Europe.

Tesla tends to focus on most of its shipments in the last month of the quarter, so we expected a decline in April for all regions. While the United States recorded a monthly drop of -18.5% in April, Europe was the worst at -74.8% mom, but China is not far behind with -71% month-on-month.

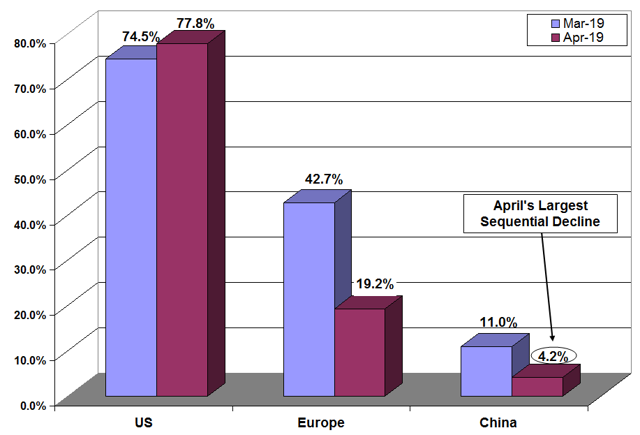

However, with respect to Tesla's share of electric vehicle markets in each of these major regions, Tesla's share in China experienced the largest decline in April among all major regions (see Figure 2). And this is a concern, as the Chinese market for electric vehicles is the largest in the world and China, with Europe this year, is expected to offset the slowing demand for Model 3 in the US , compared to the burst of production observed in the United States. 2H from 2018.

Figure 2: Tesla share in major electric vehicle markets in March and April

Source: InsideEVs TMC, Marklines and JL Warren Capital

Section 2: Competition in the Chinese Electric Vehicle Market Is Intense

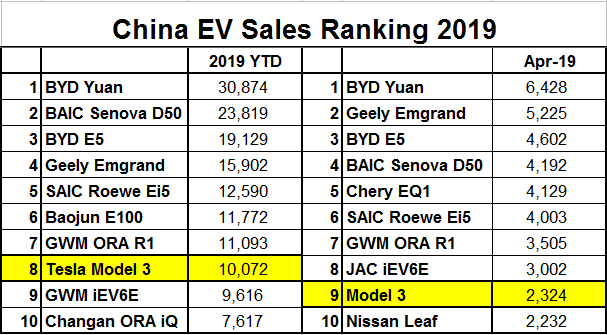

The Chinese passenger car market has seen a 10-month decline in sales, but the electric vehicle market is growing strongly. Sales of passenger cars have dropped -15% since the beginning of the year until April, while electric vehicle sales have increased 84% since the beginning of the year, according to Marklines (blocked pay-block). While Tesla is almost unmatched in the US electric vehicle market, the competition in China for Tesla is gigantic.

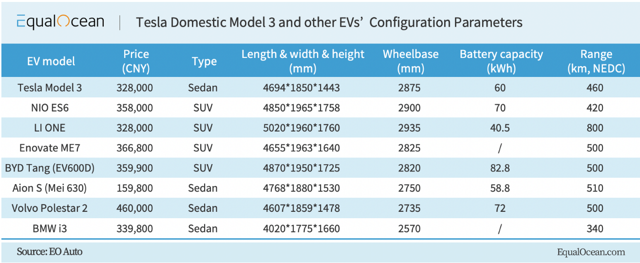

Local manufacturers such as BYD (OTCPK: BYDDF) and Geely (OTCPK: GELYY) are the two dominant players. The new BYD Yuan SUV won first place in 2019 with 30,874 units, which is three times more than Tesla's Model 3 at just 10,072 units. Geely's Emgrand sedan, with 15,902 units sold in April, has sales almost 60% higher than those of Model 3 (see Figures 3 and 4).

Figure 3: Tesla sales in China BYD & Geely's EV Sales (Vehicle Units)

Source: Marklines and JL Warren Capital

Although Tesla is a coveted brand in China, its prices are more than double those of top-selling models, such as the Yuan Yuan, because of 15% import duties and 17% tax on added value. That's why, a 3 SR + model in China starts at $ 54,575 (377,000 yuan), or 37% more than its price of $ 39,900 in the United States. BYD Yuan, the best-selling vehicle in China this year, has a range of about 336 km (210 miles), for a price of only $ 20,252 (139,900 yuan, more details here), less half of the Model 3 SR + price in China.

Figure 4: Top selling electric vehicle brands in China

Source: Marklines and JL Warren Capital

China's model 3 price announcement made with skepticism: On May 31, Tesla announced the price of its 3 SR + "Made in China" model of 328,000 yuan, or $ 47,475. Here are some key points of the ad:

- The Chinese model of 3 SR + model at $ 47,475 represents 19% more than the same model sold in the United States for $ 39,900, although Musk claimed that the "unit cost of production" in Shanghai would be less than 50 % to Fremont's (penultimate quarter). paragraph in this article) – something that I consider implausible, since labor costs are generally 50% cheaper in China, according to the factory engineers in China with whom I spoke.

- This seems positive for the profits of Model 3 manufactured in China and, according to my estimates, would generate a gross margin of 35.4% compared to Model 3 manufactured by Fremont at 14.6%.

- Charging more than the US version in China may be perceived as an aggressive price policy by Chinese consumers, despite China's much lower production costs. Apparently, there was a lot of negative discussion on the Internet about the high price of the locally manufactured model 3, given that the national autopilot version would cost only $ 3,000 less than the imported model 3, which gives free autopilot (second to the last paragraph here).

- In my opinion, Tesla will ultimately have no choice but to lower the price. While Tesla received 180,000 orders in the United States within 24 hours after the opening of Model 3 orders in 2016, no such news has been announced in China since the announcement of the awards last Friday. . CEO of China's electric vehicle manufacturer Xpeng said the price should drop by $ 10,000 (here). Given the low-end interior of the SR +, I think he is right – even if he is a rival of Tesla – given all the choices Chinese consumers have in the local electric vehicle market. .

- The Chinese will align their hours on the bargains and the Model 3 SR + made in China is not a good deal compared to the electric vehicles of their local competitors, as shown in Figure 5. It should be noted the next SUV of NIO's luxury ES6 (NIO), featuring many modern features (see the fun features of voice activation in this short clip and the specifications here). Like the United States, SUVs are much more popular in China than sedans, and the price of the NIO ES6 is only 9% higher than Tesla's model 3 made in China.

Figure 5: Model 3 made in China Chinese rivals in the same price range

Section 3: The heavy risks for Tesla of a US-Chinese trade war

The risk of China mobilizing its people in the face of a total trade war with the United States is a serious cloud that threatens Tesla's Gigafactory 3 (GF3) project in China. When the Chinese Communist Party (CCP) wants to express dissatisfaction with a country by which it feels aggrieved, it mobilizes its citizens very effectively. On June 4, China's Global Times – the CCP's English-language spokesperson – singled out Tesla for its article on Tesla's "maybe illegal" tax practices in China (here).

This comes 15 days after the editor of the Global Times, Hu Xijin, publicly announced that he was abandoning his iPhone for a Huawei phone (see this YouTube video) and barely 2 days after the Chinese authorities opened a survey on FedEx China (here). On June 5, the Chinese authorities fined Ford (F) $ 23.6 million for "monopoly" (here). Having covered the automotive industry for more than two decades, I've seen it before, and it's a slow-motion chaos. Here are two recent examples that remain etched in memory of the fate of China's anger: Japan and Korea.

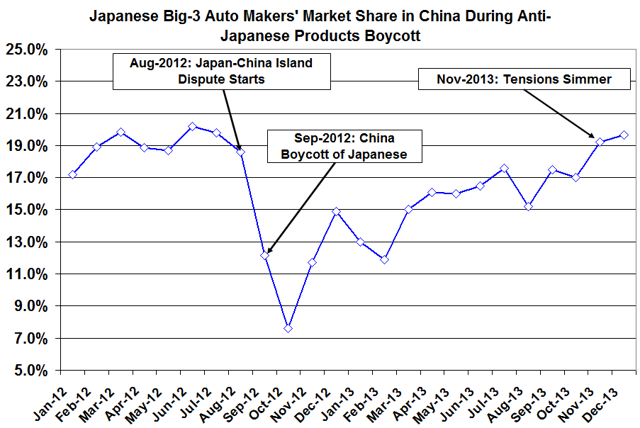

Anti-Japanese BoycottIn August 2012, the governor of Tokyo bought 3 plots of the Senkaku Islands (called the Diaoyu Islands in China) from a Japanese private landowner, who sent the CCP leaders in "war" mode. The state-run media campaigned relentlessly against Japan, advocated a boycott of Japanese products, and in September not only Toyota (TM) and Honda (HMC) dealerships were burned (see details here), but citizens Chinese driving Japanese cars have been attacked (see image here).

Japanese car sales fell (see Figure 5). In the end, China created an "air exclusion zone" over the islands and the United States and Japan took no corrective action, which caused a mimicry of tensions . However, in the one-year period following the outbreak of the conflict in August 2012, vehicle sales of the three major Japanese automakers in China fell by -17% year-on-year and their market share experienced difficulties If Tesla suffered the same thing, it would do it with the heavy startup costs of the Shanghai Gigafactory, which weigh on its weak revenue base in China, which accounted for only 17% of global revenues in the first quarter.

Figure 5: Sinks from the market share of the Japanese automakers of the Big-3 car manufacturers

Anti-Korean Boycott: In February 2017, China launched a boycott against Korean products because of the presence of Korea, allowing the US military to install its THAAD missile defense system on Korean soil to protect itself against a possible nuclear attack by North Korea. China believed that THAAD had advanced radar systems that could be used to monitor Chinese military operations and protested vigorously. This time, with the 2012 anti-Japanese boycott, the CCP has adopted a more sophisticated strategy, launching more than 40 acts of retaliation (details here) against Korea. This included not only the ban on buying Korean cars and cosmetics, but also the cancellation of K-pop concerts and tour packages from China to Korea.

During this process, the boycott of Korean products resulted in a -36% drop in car sales in China in 2017 and a decrease in market share (see Figure 6). While the anti-Korea boycott came to an end in November 2017, after South Korea decided to stop some joint military exercises with the United States, Hyundai and the Korean retailer Lotte Group still suffer. a brand image tarnished to this day.

Figure 6: Hyundai Group's market share suffers from boycott of China

US-Chinese trade war could seriously hurt TeslaIf Tesla were to be harassed by the Chinese Communist Party, like the Japanese and Korean automakers, it would not only be negative for its growth, but also damaging to its fragile balance sheet, because of the costs associated with the Shanghai Gigafactory. And given President Trump's warlike stance on China and China's refusal to yield, it could only be a matter of time before China mobilizes its citizens in a true boycott of American brands.

China has not yet declared a complete boycott of US products, but the way things are happening is quite reminiscent of the rise of the aggressive Chinese boycott of Japanese and Korean products in 2012 and 2017, respectively. Here are the main risks that Tesla faces in the current conditions:

- China could stop the construction of the Shanghai GF3.

- China could force local lenders to raise $ 520 million for GF3 construction to repay their loans.

- China could impose tariffs on parts and components imported from the United States, which would increase Tesla's production costs, Model 3 manufactured in China containing a significant amount of components and modules from the United States .

- China could launch a boycott of all US brands, which would leave Tesla quiet and the huge start-up costs would weigh heavily on its Shanghai Gigafactory, while demand for its Model 3 was low.

China is currently the world's fastest growing electric vehicle market and the most logical country for a company like Tesla. It is probably for this reason that Musk chose to build Tesla's second automobile factory in Shanghai. While many Tesla bulls consider Tesla's project in Shanghai as one of its major growth drivers, the competitive landscape of the electric vehicle market and the political risks in China are largely neglected.

For now, China is one of Tesla's main potential liabilities. Any interruption of the Shanghai Gigafactory project, before or after its completion, would result in depreciation that Tesla could not handle properly, given its extremely fragile balance sheet. Even as trade tensions between the US and China dissipate, Tesla still faces increased competition in the Chinese electric vehicle market – where large discounts are a normal practice – more than any other region in the world. In my opinion, it is highly likely that with a single model of local production, Model 3, Tesla will struggle to make money and greater losses because of its exposure to China .

Disclosure: I am / we are long TSLA. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link