[ad_1]

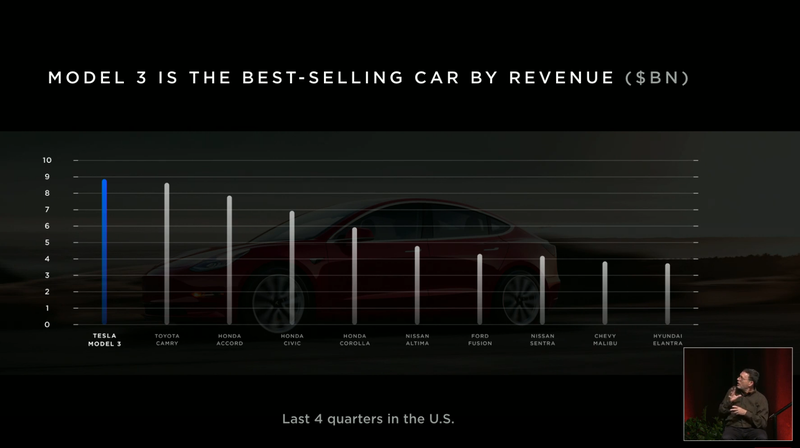

At Tuesday's annual shareholder meeting, Elon Musk, President and CEO of Tesla, assured everyone that the company's cars did not pose a demand problem, and that the Tesla Model 3 was in fact the most popular car. more sold, in terms of revenue, against heavyweight competitors such as Toyota Camry, Honda. Accord, and whatever the hell of a "Honda Corolla". But what does it really mean?

After discussing the fact that the Tesla Model 3 continues to surpass that of its high-end compact sedans such as the BMW 3 Series, Audi A4 and Mercedes-Benz C Class, Elon Musk went on to claim that the Model 3 was the car the most sold in terms of income. all high-volume sedans sold in the United States

You can watch this time around 28:30 in the video uploaded to Tesla's YouTube channel. Here is a screen capture of the comparison chart between the Model 3 and the other livestream sedans:

The typos In addition, one wonders why Tesla chose to compare the Model 3 to other high volume sedans only in terms of turnover. As for the industry figures, the bestseller by turnover is a kind of bullshit, because it is only an indicator of the money that comes in, and does not take into account the sum necessary to build, market and deliver the car. other expenses.

Also, as Musk said on stage, cars like the Camry, Accord, Civic and Corolla are selling the Model 3 in volume, but their cost is lower because they are not part of the luxury sedan segment. Model 3. Even more interesting, Musk said the Model 3 was both better sold and better sold than all its true competitors – the Series 3, the C-Class and the Audi A4 – combined.

It's impressive and it's certainly the kind of thing you would say at a general meeting, to a public ready for good news. But Tesla is still behind the measurement system used by almost everyone else in the industry to gauge the health of a business: profit.

Toyota, for example, had a $ 22 billion operating profit for the fiscal year ending in March. Honda's operating profit over the same period was less than $ 7 billion. BMW gained about $ 10 billion in 2018, while Daimler cashed $ 12.5 billion and Volkswagen $ 15.8 billion during that period.

In the meantime, Tesla announced in January that it lost a billion dollars in 2018, which resulted in another huge loss in the first three months of 2019, wondering if the weakening of demand was starting to become a problem for society.

Nicole Carriere, a spokeswoman for Edmunds.com, told Jalopnik that Tesla was calculating bestseller statistics by turnover using some Edmunds data, but that it was not used internally. .

"… it's not something our analysts use, or even calculate, as a way of assessing the health of a builder's business (profitability is a key factor that n & # 39; 39, is not included in this figure), "said Carriere after we sought expert opinion.

Tesla declined to comment on the case, but pointed Jalopnik on comments made by chief financial officer Zachary Kirkhorn during the first-quarter earnings conference call when she reported a loss of $ 702 million. dollars in the first three months of 2019.

Yes, it's Zach. I mean, what we saw on February 28 when we launched the Standard range, the variation of the Standard Plus range is that there is pent-up demand for the products marketed very soon after its announcement. And then, as time went on and the order rates stabilized, it starts: the average PSA actually increases every week since the order rate has stabilized. And just under $ 50,000 ASP represents the most recent data, and we think they are starting to stabilize there. We will also see developments in EMEA and China, but what we are seeing in North America is that more than 50% of our orders are long-term variants and that ASPs are sufficiently profitable.

In this context, ASP represents the average selling price. Thus, a model 3 with a stable average selling price of just under $ 50,000 seems appropriate, given that performance starts at $ 59,900 before options.

But all these numbers will be useless if Tesla can never make a profit reliably, and it is up to them to prove to everyone that there is really no problem of demand. We will have more guidance on this when Tesla will release its second quarter numbers later this summer.

[ad_2]

Source link