[ad_1]

It should come as no surprise that Tesla (NASDAQ: TSLA) is back in the news, although this seems to be for all the wrong reasons. From the advent of Musk on Twitter with the SEC, from discussions about electric turf blowers to worries about the spiral of debt, the company has once again managed to break through in its own way, and this time Here, she has paid the market price, as her stock price test has never seen in a few years. I would be lying if I said that I do not find the company fascinating and that, as has been my case for six years, it is time to update Tesla's assessment.

Looking back: My Tesla posts in 2018

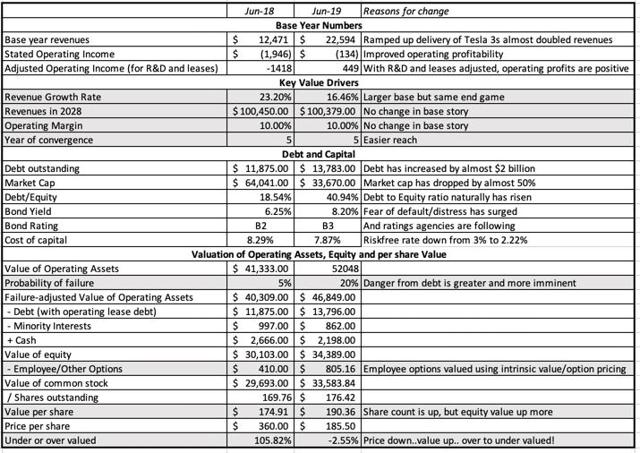

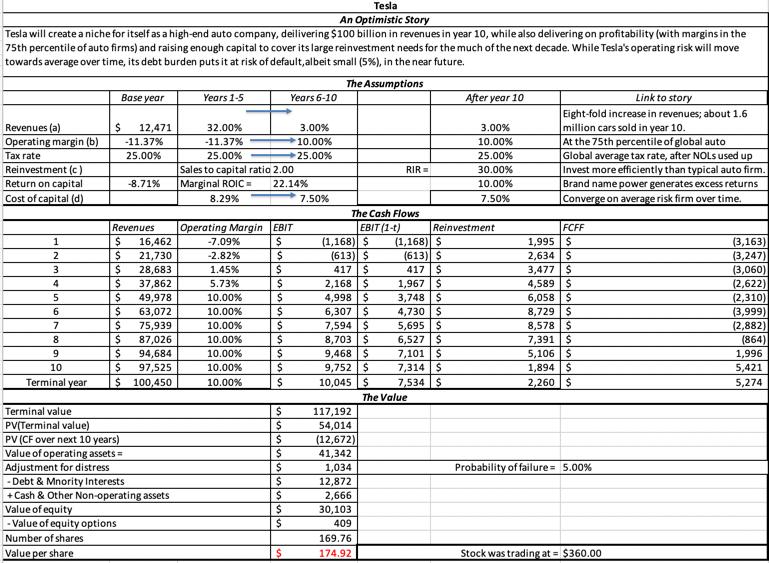

In my last evaluation of Tesla, established in June 2018, I had considered possible, plausible and probable valuations for society. In my story, which I've admitted to being optimistic, I've laid out the path to follow to enable the company to generate $ 100 billion in revenue in 2028, while boosting margins for $ 20 billion. Pre-tax operating at 10% by 2023. The value I got for the stock was 170-180 USD per share, depending on the treatment of the package of very generous options ( 20.2 million options) granted to Musk, and appears in the image below:

In this article, I also indicated possible, possibly plausible, scenarios in which Tesla's equity value could be greater than $ 400 / share, but argued that it would require the equivalent of a royal flush for the company achieves this, a combination of multiplied by ten turnover, an operating margin of 12% and reinvested more as a technology than a automaker. Since the stock was trading at almost $ 360 at the time of the valuation, I concluded that it was significantly overvalued. True to his habit, Elon Musk broke in August 2018 with his now infamous tweet about the funding obtained for a $ 420 stock buyback, causing a rise in the price of the stock, before the It is questioned about the level of funding guarantee and whether the price of $ 420 was in itself a fiction. In my article on the subject, I argued that if you were a private equity investor wishing to take a private company, Tesla would be a poor target, given the need to keep its capital growing, its heavy debt and the presence of Elon Musk. as CEO. In the months that followed, Musk and Tesla paid a high price for the prying tweet, as the first member of the SEC group acted on the so-called manipulation of the stock price and the latter had to fight in the fog. to be heard.

Catch the news

If you wonder what can happen in a year, you obviously do not follow Tesla, as the company is an attraction pole for news events. Borrow a movie title to classify what happened to the company over the past year, I would divide the news into good, bad and what I can only call gobsmacking, where you hit the head and say " what was that? "

1. the good

The market's momentum has clearly shifted against Tesla and all the news concerning the company seems to distort the "bad" one. It is interesting to note that good things have happened in society over the last year:

- Increased revenue: In the drama of production targets and logistical shortcomings, it's easy to lose sight of the fact that the Tesla 3 has allowed the company to almost double its revenue over the last year, while also winning Easily race to the best sell an electric car in the world.

- Improved Profitability: While Musk's rumors about Tesla's positive earnings may have been premature, the company is on the road to profitability, reducing operational losses and capitalizing on R & D. D, or even operational profitability.

In short, the operating base on which I will build my Tesla valuation in June 2019 will be stronger than the one I used in 2018.

2. the bad

With Tesla, the good news is always associated with bad news, some of which is due to macroeconomic events, but most of them are the result of self-inflicted injuries:

- Debt and distress: when Tesla decided to ease the burden of its debt by borrowing $ 5 billion in 2017, I argued that there was no good reason for that Tesla borrows money because the companies in loss of money do not benefit from any tax advantage and the debt jeopardizes the growth potential. . Tesla has since added to this debt, using the false logic that she had to borrow money to finance her growth; A much better option would have been to raise equity, notwithstanding the dilution. In June 2019, this debt, now close to $ 14 billion, reveals its dark side, while falling bond prices and rating downgrades threaten to jeopardize Tesla's growth.

- Late reinvestment: Growth requires reinvestment, especially for car manufacturers, where assembly lines and a logistics infrastructure must be in place for cars to be delivered to customers. It is both frustrating and confusing that Tesla, a company loyal to its customers and ready to wait, did not want to make the investments needed to meet the demand. Instead, the company seems to be going from one production crisis to another (remember the tents that needed to be set up to reach the goal of 5,000 cars / week) while its CEO complicates yet things by saying that the company does not only represent a positive profit but a positive cash flow. For now, the Fremont factory remains Tesla's main production site and, while a factory in China is expected to be put into production by the end of 2019, the US-China trade war and the Tesla's own story about operating delays lead to skepticism.

It should also be noted that a significant portion of Tesla's time was spent extracting another untrained error, his acquisition of SolarCity in 2016, with cost reductions and layoffs inconsistent with a company claiming strong growth.

3. The gobsmacking

A Tesla investor should earn a special bonus for having to endure so unusual reporting on the company that it would be considered fiction by other companies. Just to give a sample, here are the other items that have added to the smoke around the stock:

- Supervision of the SEC: If there has been a recurring narrative over the past year, it relates to the aftermath of the "assured financing" tweet from Elon Musk, which led to an investigation of the SEC and a threat of sanctions to society. Although the company has reached a settlement with the SEC, this regulation requires Musk to be restrained in its future market disclosures (particularly in the form of tweets), and withholding is not a strong point. of Musk.

- Autonomous Cars: In April 2019, Musk unveiled a plan to deploy autonomous taxis. Tesla owners are now allowed to add the network, with the promise that Tesla's driving technology was well ahead of the competition. There is an interesting debate about autonomous cars and how they will change the carpool business, but it is almost certain that this will not happen smoothly or soon.

- The rest: As it was Tesla, there were weekly distractions while Musk would scramble the waters talking about electric leaf blowers and insurance products.

Tesla evaluation updated

For the most part of its existence, Tesla has been a stock of history. This remains true, but as society ages and acquires substance, it can be said that history is increasingly limited. In this section, I will first update my Tesla story and evaluation, then review the uncertainty surrounding the assessment and end with a comment on an "evaluation" by ARK Invest, the One of the largest institutional cheerleaders of Tesla.

1. The story: Tesla, a business teenager?

In collecting all that has happened at Tesla over the past year, I find myself telling the same story that I told a year ago about Tesla, that a company would find a revenue potential of $ 100 billion by 2028, with strong operating margins, remains intact, with a noticeable change. The over-indebtedness of society, already worrying a year ago, has become a clear and present danger to society. Indeed, at the operational level, the company is in better shape than it was a year ago, but with a financial leverage, it faces a risk of truncation more important (a probability of failure 20%). The value per share obtained with the two integrated effects is about $ 190 / share:

If there is a change to my story, it would be this. While I often watched Musk jeopardize Tesla's story and its value with its distractions, I remembered teens around the world, endowed with immense potential and intelligence, who risked all for momentary and often vain rushes of meaning. In fact, I'm tempted to add a teenage phase as part of my corporate life cycle and put Tesla in, a corporate teenager with tremendous potential, which, on many occasions, puts everyone in danger of distraction.

In order to give an idea of why the value per share is today higher, even with a much greater risk of failure, I have compared the figures that I have used in my evaluation from June 2018 to June 2019:

It should be noted that while my final revenue figure ($ 100 billion by 2028) and operating margins (10% over 5 years) has not changed, base numbers make it easier to achieve two goals. The increase in default risk (from 5% in 2018 to 20% in 2019) is at least partially offset by a lower risk-free rate and a cost of capital. In reality, the value per share is close enough for me to say that there has been little change, but that the price per share has fallen by almost 50%, which makes the stock overvalued by significantly to almost valued now.

2. Dealing with uncertainty

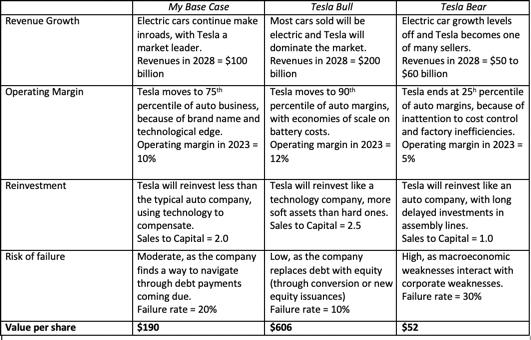

As with all Tesla assessments I have done in the last six years, this is accompanied by warnings and uncertainties. The table below presents the divergent views of bulls and bears on society:

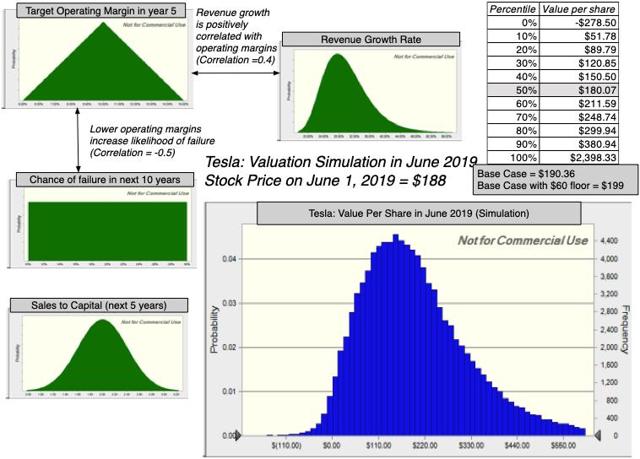

As you can see, I'm borrowing both sides of this debate and I'm sure the Tesla bulls will be disappointed at not having higher revenues for the company and Tesla's bears will not challenge my reinvestment assumptions and expectations that the company will eventually generate strong margins. Using a technique that I find useful, in the face of diverging points of view, to deal with uncertainties, I calculated the Tesla values in a simulation, with the following results:

In summary, the median value of the 100 000 simulations is 180 USD / share, the 10th percentile generating a value of 52 USD / share and the 90th of 380 USD / share. In this simulation, I assumed that Tesla would remain a standalone company and that the value of its equity could drop to zero if the value of the operating assets suffered a shock, given the burden of debt. It seems however that Tesla could become an acquisition target for a car company or a technology company (see this rumor that Apple (NASDAQ: AAPL) would be interested in 2014). Although some problems need to be addressed (like Panasonic's in the battery factories), there are usually two obstacles in this direction. The first is that Tesla has been an expensive target, especially when its market capitalization has exceeded $ 50 billion. This will become less of a hindrance, as stock prices fall, and with a market capitalization of less than $ 15 billion, it could be much more affordable. The other is a bigger problem and more insoluble. Tesla has a poison pill that few companies will want to absorb, and it is likely that the relationship will have to be broken or at least significantly weakened for the acquisition to occur. I remain skeptical about the chances of an acquisition, precisely because I do not see Musk go quietly into the night, but adding a floor of acquisition of value $ 15 billion for equity (approximately $ 60 per share) increases the simulated value of the security by approximately $ 10 / share.

3. Tesla ARK Price

It's not my role to be a referee of other people's assessments, and I usually avoid commenting on them unless they belong to the public domain. , as was the case with Tesla / Solar City's fairness opinions, or soliciting public comment. I will make an exception with the "evaluation" ARK of Tesla by the ARK, in part because they are part of the biggest boosters of the action and partly because of the fact. they put their model in place for the public comments, for which I congratulate them. In summary, here are the ARK numbers:

- It's a price, not an estimate: I know it sounds a bit chaotic, but what the KRG has produced is a term price for Tesla, not an estimate. An intrinsic valuation requires a forecast of cash flows over time, after taxes and reinvestment, and then discounting these flows at a rate reflecting the risk of the investment. Pricing usually involves choosing a measure (sales figure, profit, EBITDA), choosing a forecast year for the measure, and applying a multiple based on the position of other peer group companies. The base model of ARK provides for revenue, profits and other indicators in 2023, and applies a multiple of estimated EBITDAR & D in 2023, making it a forecast price.

- The Bear ARK is bullish: in the case of ARK Bear, Tesla will sell 1.7 million cars in 2023, at an average price of 50,000 USD / car and will generate a margin of operation 6.1% on these revenues. Each of these assumptions is plausible and the combination is possible, although revenues are multiplied by seven in five years and the average profitability of the sector improves in parallel.

- The weakest link: the weakest link in the model concerns cash flow, because to sell 1.7 million cars, it is necessary to first manufacture them, as well as the production capacity of Tesla, even if It is considered that the Chinese factory is functional and has about the same capacity as the Fremont factory. , brings you about halfway to the goal. It will be magic if you add $ 3.7 billion to net tangible capital assets (as the KRG seems to assume) and $ 1.2 billion in working capital will allow you to increase revenues by 63, $ 5 billion, but it becomes even more difficult, assuming that Tesla pays a $ 14 billion debt (as the KRG seems) over a five-year period. In summary, the downside will require at least $ 25-30 billion in cash flow, even with the KRG's own assumptions, over the next five years and, as the company's operating cash flow is still minimal, own funds will be required. emissions in massive proportions fairly quickly. The ARK authorizes a capital increase of $ 10.6 billion, which seems to me insufficient to fill the gap, but in the absence of a balance sheet or a flow chart cash, I may miss something (and it must be very large).

- Number of shares: even for the capital increase of 10.6 billion USD, ARK reduces the impact on the number of shares assuming a share price of 360 USD / stock (the market capitalization will be 70 billion USD) at the time of the increase. Given that this capital will soon have to be mobilized, there is one element of wishful thinking, that is to say that stock prices will double rapidly and that the capital increase will follow. In addition, if the stock price rises, as assumed by the KRG, the board of directors will have granted a surplus of 20 million options that will become real shares. In short, for the money in the PRC to grow, the number of shares will have to double over the next five years.

- There is a temporal value issue: applying a multiple to EBITDAR & D in 2023 gives a value in 2023 and, to compare it to the current stock, you will have to update it today, according to an adjusted rate for the risk. In fact, if you introduce the probability of failure built into Tesla bonds, there will be an additional discount on the value.

Even if you take the case of the ARK as realistic, as Tesla plans to sell 1.7 million cars in 2023 and release operating margins close to the auto sector, the price per share obtained will be closer to $ 250 / share, with a more realistic price. share the account and time value adjustments, not the $ 560 you see on the ARK spreadsheet. As for the Bull case, I will leave it intact, because it seems to me more fable than valuation, a world where there will be 7.2 autonomous cars on the road in 2023, with Tesla controlling a 70% market share and generating $ 52. billions of dollars in annual cash flow. I'm willing to accept the argument that Tesla has better control over autonomous car technology than its competitors, but I see a company farther away than 2023, less dominated by Tesla and much less profitable than the KRG does. suppose it. . In short, for now, it's more of an option than the conventional operating value, and even if I believed it, I would make more money than selling short on Uber (NYSE: UBER) and Lyft (NASDAQ: LYFT), rather than buying Tesla.

Bottom line

I made my first assessment of Tesla in 2013, below the mark, partly because I saw its potential market as a luxury car (smaller) and partly because I underestimated the capacity of Fremont factory production. Over time, I made up for both mistakes by giving Tesla access to a larger (although still more upscale) market and greater growth, while reinvesting less than the typical car manufacturer. Despite these adjustments, I have consistently delivered valuations well below price, estimating the stock at about half its price just a year ago. This year marks a turning point, because I find that Tesla is undervalued, even if only by a small fraction. Even in the midst of my most negative reviews on Tesla, I confessed that I love society (even if it's not Elon Musk's antics as CEO and financial choices) and that I would be one day owner of the shares. That day may be here, as I was placing in a purchase order of $ 180 / share, knowing full well that if I became a shareholder, this company will test my patience and my reason. (Update: My limit purchase has just been executed. As a shareholder, my risks would be much lower if Musk was banned from tweeting …)

Youtube video

Editor's note: The summary bullets for this article were chosen by the Seeking Alpha editors.

[ad_2]

Source link