[ad_1]

Bitcoin could be subject to an immediate bearish correction, but it would eventually rebound to $ 6,500, according to Peter Brandt.

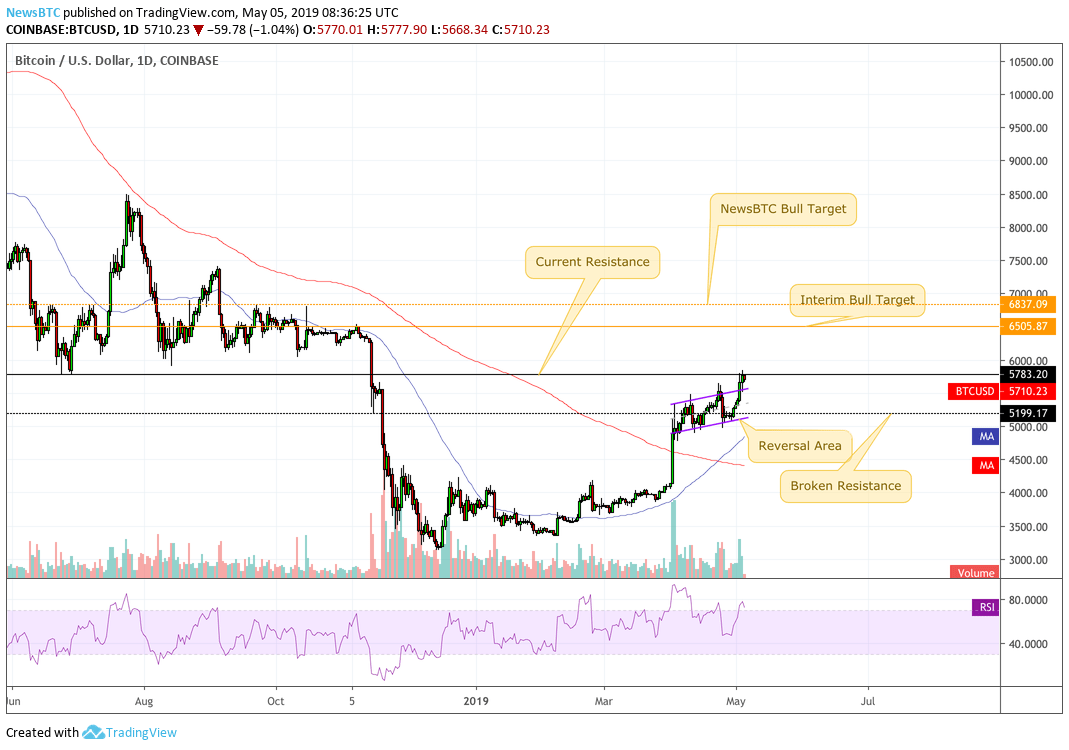

The veteran trader m said On Saturday, the price of bitcoin reached its critical resistance level of $ 5,745, as shown in the chart below. There was a high probability that the asset would undergo a reversal, which vaguely means that traders were not convinced to buy bitcoin at its highest rate. Therefore, those who bought the asset at a price close to $ 5,000 might want to get out of their position with a nice profit of $ 745 per bitcoin, plus or minus.

Bitcoin price targets $ 6,500 upward in the short term | Source: Peter Brandt

However, this does not mean that the current uptrend of Bitcoin could end. Brandt said the asset could reach $ 6,500, traders buying it near the lows of the session. He stated:

"There is a chance that we have reached our price target with a key resistance. A correction could occur before another move to 6500, then a larger correction. "

Just a notice – there is a chance $ BTC is leading here, having achieved its key resistance price target. A correction could occur before another move to 6500, then a larger correction. pic.twitter.com/woetnihqB5

– Peter Brandt (@PeterLBrandt) May 4, 2019

Break down the Bitcoin prediction

Two key elements underlie Brandt's $ 6,500 Bitcoin price forecast. NewsBTC has simplified them as shown in the table below. We also added our bullish target to continue the discussion.

Peter Brandt's Bitcoin Prediction (simplified version) | Source: TradingView.com

Current resistance

Bitcoin has confirmed a break above its bull flag formation (orchid) and is now testing $ 5,783 as its short-term resistance level. Brandt highlighted the region for its historical significance. Note that the black horizontal line in the graph above acts as a critical support level for the downward action of bitcoin. In July 2018, the asset briefly released $ 5,783 to initiate an uptrend that would eventually settle to $ 8,500. And now, the level is once again the goal of Bitcoin price – this time on the rise.

If the asset breaks above it, accompanied by an increase in volume, its probability of reaching $ 6,000 will become greater. The psychological resistance, if broken, could still push the price towards $ 6,500, at least according to Peter Brandt.

Inversion zone

An inversion domain is only a risk assessment tool, if we correctly interpret Brandt's predictions. Indeed, the daily relative strength index of bitcoin is oversold (it is now greater than 70). This means that the asset could be subject to a natural downside correction at any time. If this is the case, the price could fall towards a substantial support area defined by the lower trend line of the bearish flag (orchid) and a support level from the bearish action of November 15, 2018 (in black dashed line, $ 5196-5,199).

The support zone could experience significant accumulation, leading to a rebound to $ 5,783, short-term resistance. This operation will bring the market back to the disruption scenario described in the "Current Resistance" section above.

Beyond $ 6,500

Brandt's target of $ 6,500 for Bitcoin comes after the importance of this level during the trading session from October to November. Nevertheless, it is also important to keep an eye on the $ 6,837, another bullish bull target for the medium term. The dashed saffron horizontal line has been tested a total of fifteen times in the last twelve months as resistance. It has held up well eleven times, making it a much stronger pullout than $ 6,500.

It's food for thought at the end.

[ad_2]

Source link