[ad_1]

On February 22nd, Kraft Heinz (NASDAQ: KHC) shocked investors with a series of bad news in his earnings report: poor operating results, an accounting irregularity and a massive write-off of the spread. Acquisition, followed by a reduction in the dividend per share. almost 40%. The company's investors reacted by selling their shares, resulting in a fall in the stock price of more than 25% overnight. Although Kraft is neither the first nor the last company to experience a bad quarter, its difficulties are noteworthy for a simple reason. Significant shares of the stock were held by Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) (26.7%) and 3G Capital (29%), a private equity group based in Brazil. The main oracle of Berkshire Hathaway is Warren Buffett, revered by some who follow his words and try to imitate his actions. 3G Capital's capital may not have the reputation of Buffett, but its key players are considered extremely efficient managers, able to significantly reduce costs. In fact, their first joint agreement to bring together Heinz and Kraft, two of the biggest names in the food industry, was considered a master stroke and, given the pedigree of both investors, it was sure to succeed. As promised benefits have not materialized, the investors who followed them in the transaction seem to view their failure as treason.

The story back

You do not need to like ketchup or processed cheese to know that Kraft and Heinz are part of the American culinary history. Heinz, the oldest of the two companies, traces its history in 1869, when Henry Heinz began packing and selling horseradish. After a short period of bankruptcy, he began making 57 varieties of ketchup. After a century of growth and profitability, the company experienced a difficult period in the 1990s. In 2013, Nelson Peltz, the active investor, has targeted himself. Heinz was then bought by Berkshire Hathaway and 3G Capital for $ 23 billion. business. Kraft started as a cheese company in 1903, and in the next century it first developed into other dairy products and expanded its repertoire to include other processed foods. . In 1981, she merged with Dart Industries, battery manufacturer Duracell and Tupperware (NYSE: TUP), prior to its acquisition by Philip Morris in 1988. After a series of convulsions, parts of which were sold and merged with Nabisco, Kraft was created by Philip Morris (renamed Altria (NYSE: MO)) and targeted by Nelson Peltz (yes, the same gentleman) in 2008. During all mergers, divestitures and spin-offs, managers have promised synergies and new At first, the negotiators earned money, but little substance actually changed in the products.

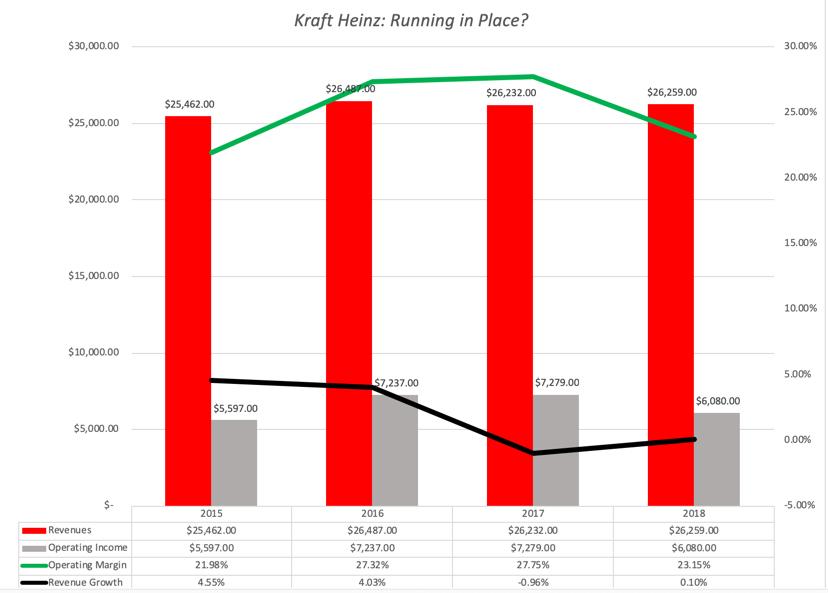

In 2015, the two companies were reunited, Berkshire Hathaway and 3G playing both liaison and funders, such as Kraft Heinz, and the merger was finalized in July 2015. At the time of the transaction, The unbridled enthusiasm of investors and market watchers, and the fact that the new investors gained an indisputable conviction that the new company would become a force in the global food sector was the pedigree of investors. However, in the years following the merger, the company struggled to meet the expectations of revenue growth and cost reduction:

In summary, although much has been promised in terms of revenue growth, expanding its global footprint and increasing margins, reducing costs, at the time of the transaction, the numbers tell a story different. In fact, if investors were surprised by the low growth and declining margins in the last earnings report, they should not have been because the bleeding was long and slow.

The income report

The earnings report that triggered the stock price collapse of Kraft Heinz was released on February 22 and contained bad news on many fronts:

- Fixed Transactions: Revenue for 2018 is unchanged from 2017 revenues, but operating income has dropped (before impairment charges) from $ 6.2 billion in 2017 to $ 5.8 billion in 2018 ; the operating margin increased from 23.5% in 2017 to 22% in 2018.

- Accounting Irregularities: Surprisingly, the company also announced that it was the subject of an investigation by the SEC for accounting irregularities in its area of purchases. It incurred a charge of $ 25 million to reflect expected cost adjustments.

- Goodwill Impairment: The Company incurred a charge of $ 15.4 billion in goodwill impairment, primarily in its US Refrigerated and Canadian Retail segments. which proves that they have paid too much for the acquisitions of previous years.

- Dividend Reduction: The company, a perennial payer of significant dividends, has reduced its dividend per share from $ 2.50 to $ 1.60, in order to prepare for what she said is a difficult 2019.

While investors were shocked, the path to this report contained key clues. Revenues have already stabilized in 2017 compared to 2016 and the decline in margins reflects the difficulties faced by 3G to try to reduce costs after the conclusion of the transaction. The only people who care about depreciation charges, an unnecessary and deferred overstatement of acquisitions, are those who use the book value of equity as a proxy for the aggregate value. The dividend cuts may have been a surprise, but more about what they say about the panic that management faces on its future operations, since a company attached to the dividends only cuts them last resort.

Value effects

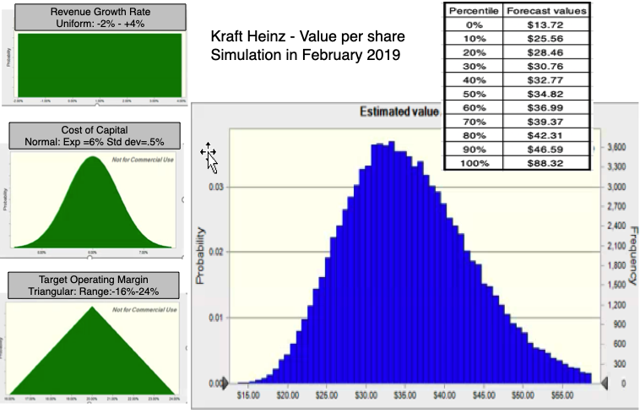

While the bad news in the earnings report is still fresh, let's examine the implications for Kraft Heinz's story and value. Stable incomes and decreasing margins, in my opinion, are part of a long-term trend that will be difficult, if not impossible, to reverse. While Kraft Heinz may have a quarter or two with positive blips, I see more of the same thing in the future. In my evaluation, I haveforecast revenue growth of 1% per annum in perpetuity, lower than the inflation rate, reflecting the headwinds the company faces. This mediocre growth in revenue growth will be accompanied by a corresponding "bad news" on operating margins, where the company will face price pressures in its product markets, leading to a decline (albeit small and gradual) in operating margins over time, from 22% in 2018 (already down from 2017) to 20% over the next five years. The company's cost of capital is currently 6%, which reflects the nature of its products and its use of the debt, but over time, the benefits derived from these will fade, which is close to sector average (US agri-food industry). companies have an average cost of capital of 6.12%), I leave it unchanged. Finally, the mistakes of the last few years will leave at least a positive residue in the form of restructuring charges, which I presume will provide partial tax protection, at least for the next two years.

The good news is that even with an elevated story, Kraft Heinz has a value ($ 34.88) that is close to the stock price ($ 34.23). The bad news is that the potential upside seems limited, as you can see in the results of a simulation that I have done, making it possible to pull the expected growth of products from the distribution, the margin of growth. and the cost of capital, rather than using point estimates.

|

| Results of the simulation |

The discovery of value is in a narrow range, with the first decile at around $ 26 and the ninth at close to $ 47 should not surprise you, because the forks at the entrances are also not very wide. As an investor, here are the actions that would follow this assessment.

- If you owned Kraft Heinz before the earnings report (which I thankfully did not thankfully do), the sale now will produce few results. The damage has already been done and the stock, at its current price, is a fair value investment. I know that 3G sold almost a quarter of its stake in September 2018, which is well seen in the profit report, but any attempt to sell now will not pay them anything. (I have made a mistake in an earlier version of the message and I thank those of you who have reported it.)

- If you do not own Kraft Heinz, the evaluation suggests that the stock is valued fairly, at the current price, but at a lower price, it would be a good investment. I have a purchase limit on the stock at a price of $ 30 (close on the 25thth percentile of the distribution), and if it reaches this price, I will be a shareholder of Kraft Heinz, although I think its future is not promising. If it does not drop as low, there are other fish to catch and I will move on to something else.

However, investors looking at this head must consider two concerns. The first is that when companies say they have discovered accounting irregularities, but they have put their affairs in order, they are often hidden and there are more shocks to come. With Kraft Heinz, the extent of the irregularity is small and, since they have no experience with accounting games, I am willing to give them the benefit of the doubt. The second is that the company has a debt of $ 32 billion and that, if this debt has no toxic side effects today, it is because the company is perceived as having stable cash flow and positive. If the decline in margin that I expect becomes a margin runout, the debt will expose the company to a clear and present risk of default. In simple terms, this will worsen the cases of bad cases incorporated in the simulation and may threaten the existence of society.

The lessons

There are lessons to be learned from Kraft Heinz's explosion, but I will walk carefully, as I may offend some, with remarks that you may consider not only incorrect, but sacrilegious:

- It's human to be wrong: at the risk of raising the obvious, Warren Buffett and the leading 3G operators are human beings, prone not only to make mistakes, like the rest of us, but also to have blind spots to invest that hurt them. In fact, Buffett was frank about his mistakes and costs, as well as those of Berkshire Hathaway's shareholders. He has also been outspoken about his blind spots, including his reluctance to invest in companies he does not understand, a sphere that is only growing with age and economic changes, and excessive reliance on business leaders. invests in. While he is largely an excellent judge of character, his investments in Wells Fargo (NYSE: WFC), Coca-Cola (NYSE: KO) and Kraft Heinz show that he is not perfect. In my opinion, the fault is not Buffett, but the legion of investors, analysts and journalists who treat him as a deity of investment, citing his words as a gospel and a blur for those who dare to question them.

- Stocks are not bonds: in my data feeds, I've looked at how US companies have abandoned dividends to buy them back, by way of cash back. This trend, however, has not been universally welcomed by investors and remains a large subset of investors whose strategies rely on the purchase of large dividend stocks. One of the reasons why stocks such as Kraft Heinz attract cautious investors is that they offer high dividend yields, often well above those you could earn by investing in treasury bonds or even in safe corporate bonds. In fact, the argument invoked by investors is that by buying these shares, they actually get a bond (the dividends replacing the coupons), with a price appreciation. From the Dogs of the Dow to filtering on dividend yields, the underlying principle is that investors can rely more on dividends than on redemptions. While it's true that dividends are more stubborn than buybacks, with many companies retaining them or increasing them over time, these dividend-based strategies become delusional when they treat dividends as mandatory payments. rather than as expected payments. After all, even if companies do not like to reduce dividends, they are not contractually obliged to pay dividends. In fact, when a stock gives a dividend yield that looks too good to be true, it's usually almost always an unsustainable dividend, and it's only a matter of time before the dividend is cut (or even stopped) or that the company enters a financial gap.

- Brand names last a long time, but nothing lasts forever: one of the main goals of traditional investment in value is that, although technology, cost efficiency and new products are all competitive advantages that can generate value, it is the brand name that is the most power remaining. Again, this statement reflects the truth that brands last a long time, often for decades, but that even the benefits of brands change as customers change and companies seek to globalize. The troubles at Kraft Heinz are part of a much larger story, where some of the most recognized and acclaimed brands of the twentieth century, from Coca-Cola to McDonald's (NYSE: MCD), see their magic to fade. By using my life cycle terminology, these companies are aging and no financial engineering or strategic repositioning will rejuvenate them.

- Cost reductions can take you far, but no further: in recent decades, we have significantly reduced the wait time for those who use cost reduction as a way to create value, many acquisitions and restructurings resting almost entirely on his promise. Do not mistake yourself! In companies where costs are inefficient and excessive, cost reduction can generate significant profits, but even with these companies, these gains will be limited over time because there is only too much fat to cut. Worse still, some companies are struggling for a host of reasons that have little to do with cost inefficiency and cost reduction because they are a recipe for disaster. It is true that 3G has done a remarkable job in reducing costs and increasing margins for Mexican Grupo Modelo, the Mexican brewer it acquired through Inbev, but that's because Modelo's problems lent themselves to cost reduction solution. It may have worked for Kraft Heinz at first, but at this point, the company's problems may have little to do with cost inefficiency, but many with a less attractive range of products than before. , as well as cost-cutting is the wrong medicine for all that makes them suffer.

Conclusion

I hope you do not read this as a Warren Buffett success and / or 3G. I admire Buffett's adherence to a fundamental philosophy and his willingness to speak openly about his mistakes, but I think he's poorly served by some of his followers, who insist on putting him on a pedestal and refuse to accept the reality of his philosophy. his limits, and like everyone else, he has an ego and makes mistakes. If you have faith in values-based investing, you should be willing to make sure that faith is put to the test of the mistakes that you and the people you admire are making as part of its pursuit. If your vision of investing is a dogma and you believe that your path is the right one to succeed, I wish you the best, but your righteousness and rigidity will only prepare you for more disappointments like Kraft Heinz.

The data

Editor's note: The summary bullets for this article were chosen by the publishers of Seeking Alpha.

[ad_2]

Source link