[ad_1]

In his testimony today, Jerome Powell, Fed Chairman, reportedly said:

"The relationship between the slowdown in the economy or unemployment and inflation … has disappeared."

Uh, wait a minute. Have you seen the footprints of inflation and UI claims today. Unemployment claims were very high, as was inflation.

Really, when I saw these figures, I was shocked. They are cutting rates and inflation has reached its highest level in a year and a half. Something is wrong.

Let's see the data

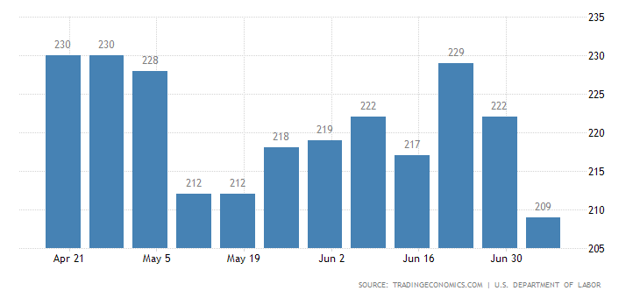

Here are the weekly demands for unemployment.

Lower means stronger; ie d. fewer jobless claims = less less = more jobs.

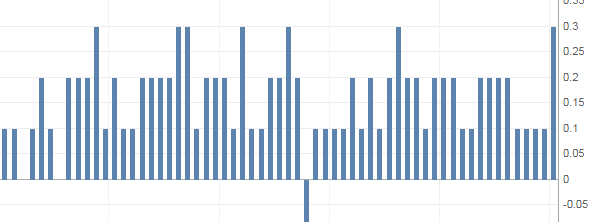

Let's see inflation.

Source

While jobs are strengthening, the core CPI from one month to the next has also reached its highest level in a year and a half and is at its highest level in years.

So it's a bit ironic that the day The Fed Chairman states that there is no more correlation between jobs and inflation. We find that strong jobs are the drivers of inflation.

And a rate reduction?

It's a very strange configuration. If I had to tell you in front of the Fed president, in front of Congress, that the employment and inflation figures would explode, what would you expect from the Fed president?

I would not expect it to sound more dovish.

Something is happening.

And you see bonds and returns react

Above is (NASDAQ: TLT). You see that he is struck by the comments of the Fed. This increases the yields.

Higher inflation leading to higher returns is a market risk.

A Fed rate cut in the face of inflation and stronger jobs is likely to drive up inflation. This may drive up bond and equity prices.

What's the risk?

It's only a month. But a strange one. I have been in this business for a while. Higher inflation and strong jobs are not reasons to lower rates. If anything, these are reasons to raise rates.

If these numbers remain high, the rate cut can now exacerbate the rise in these statistics. Then, the Fed will have to reverse its course and increase its rates, which is a market risk.

Conclusion

The situation is extremely ironic between the Fed's statements: the inflation-unemployment relationship is no longer important. That's exactly the day the data was reported en bloc. It's a day after the Fed talked about rate cutting. Something is wrong.

Normally, I'm talking about technology. I make market calls for subscribers daily. But this news today has pushed me to write publicly about it.

Very ironic today.

Nail Tech Earnings

Enter before the price increase on August 16th.

Daily market calls outperforming Nasdaq

Reuters 5-star performance compared to the entire street.

What our subscribers say:

"It's a home run! "

"Chaim is a rock star."

"paid for himself several times ".

Ready to Nail Tech Gains? Start your free try aujourd & # 39; hui.

Disclosure: I / we have / we have no position in the actions mentioned, and we do not intend to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

Additional disclosure: All investments carry many risks and can lose capital in the short and long term. The information provided is for informational purposes only and may be inaccurate. By reading this, you agree, understand and agree that you assume full responsibility for all of your investment decisions, that you do your own work and that you hold Elazar Advisors, LLC and its innocent related parties. Elazar and its employees do not take individual equity positions to avoid ongoing problems and other potential customer issues.

[ad_2]

Source link