[ad_1]

The state of shale production in the United States is an important factor that explains why a bidding war exists between Chevron (NYSE: CVX) and Occidental Petroleum (NYSE: OXY) over Anadarko (NYSE: APC) . Occidental CEO Vicki Hollub said she made offers to Anadarko several weeks before Chevron's announcement, and "focused on Anadarko for several years". For OXY, the $ 38 billion acquisition is a growth plan that aligns with its relative strengths as a major shale player, global operations, and enhanced oil enhanced recovery prospects. American shale assets in the United States of Anadarko would be very complementary.

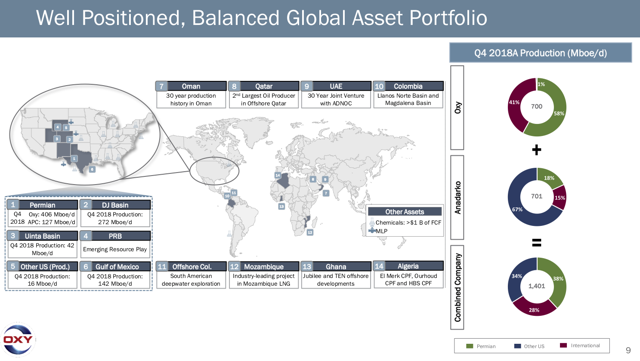

The pro forma company would look like this:

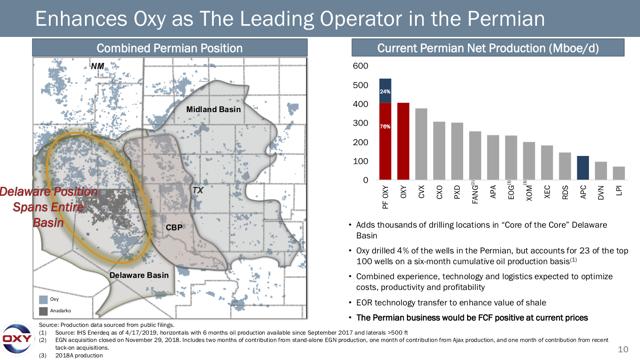

Chevron's bid and Anadarko news dominated mid-April. OXY then reappeared as a bidder with a potentially higher bid, with Anadarko's board reviewing the bid (after also a lot of bad press on the executive pay schedule before the Chevron announcement). From OXY's point of view, the meaning of the agreement revolves around what OXY will do with Anadarko's assets. Hollub notes that "OXY (Permian) oil wells in the Delaware Basin are operating 74% better than those in Anadarko and that OXY spends less on well drilling and (fracking). ), and could apply his expertise to 10,000 wells where he was buying Anadarko ". Hollub and his team estimated the cost savings at $ 2 billion based on synergies and additional annual capital reductions of $ 1.5 billion in the Permian at the merger.

OXY notes:

The combined company is expected to produce approximately 1.4 million barrels of oil equivalent per day, with a relatively even geographic distribution between the Permian, other US regions and the international.

In the Permian, the combined entity's production would be about 533,000 BOE.

An expanded OXY would have the scale needed to continue to be profitable in the largest US production pool, the Permian. It would also be the first DJ pool producer if the acquisition was completed. The potential investment of $ 10 billion by Warren Buffett's Berkshire Hathaway (BRK.A) (BRK.B), if the transaction is completed and completed, is theoretically a development. should mitigate the fluctuations in the price of OXY stock, thus dispelling market concerns.

About the Permian and the oil

Last Thursday at the Texas Energy Council's annual symposium, while attending a presentation on oil prices, a few points to remember about the state of the oil markets. Mark Hagerty, an analyst at BTU Analytics, presented his findings.

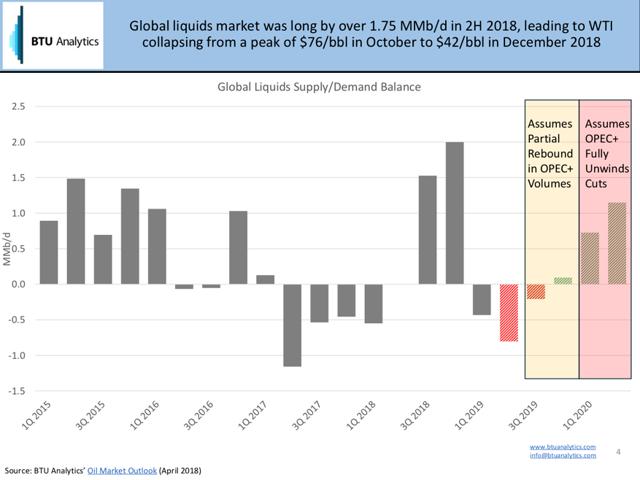

• Prices in the second half of 2019 are likely to remain firm due to tightening supply, but an increase in the volume of approximately 1 million barrels per day in 2020 will result in a positive balance, which will restrain prices. price. The growth of US production alone responds to the growth in oil demand, forcing OPEC to reduce its activities until 2019. However, Iranian barrels have decreased by 1.1 m / b / j in March due to sanctions and will continue to decline.

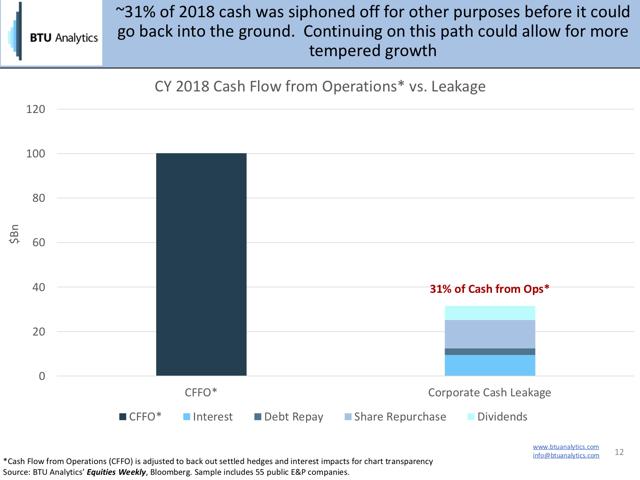

• Capital discipline generally wins the day of E & P public producers. However, the capital discipline limits the growth of US oil production to $ 50 WTI, especially in 2020-2023. OXY reaches the threshold of $ 40, depending on their transcription.

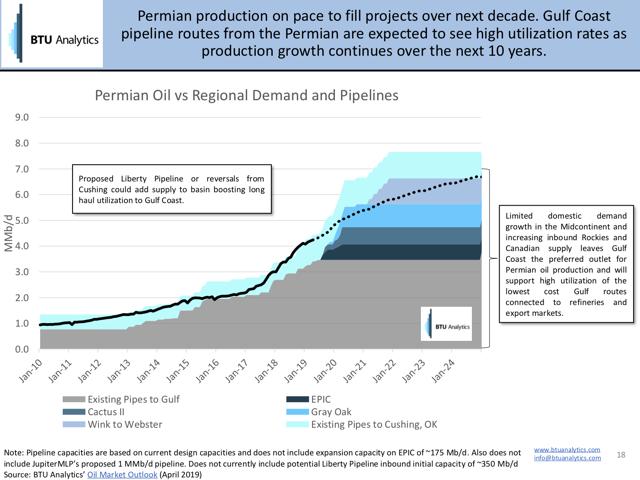

• The Permian Basin is expected to drive the growth of US oil production in the coming years. The Gulf Coast, as a center of demand for oil, liquids, natural gas and LNG, also bodes well for OXY's export potential.

Find meaning

The OXY-Anadarko agreement consolidates the Permian production, in progress for two years. Scott Sheffield, CEO of Pioneer Natural Resources (PXD), said that this would happen, eventually, after the collapse of prices in 2015-2016. Conditions are becoming more conducive to mergers and acquisitions, given the price outlook, global economic projections and their effects on oil demand growth, OPEC's willingness to balance the market and the market. American producers' attention to capital discipline in relation to growth. OXY suggested that the purchase of Anadarko facilitates a reasonable growth rate of 5%. The combination of the two companies creates a well-rounded oil and gas portfolio that can be streamlined and adapted to market conditions over time.

Disclosure: I am / we are long OXY. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link