[ad_1]

The American Petroleum Institute (API) has estimated the creation of a surprise crude oil stock at 401,000 barrels for the week ending August 29, while analysts expected a draw of $ 3.50 million barrels.

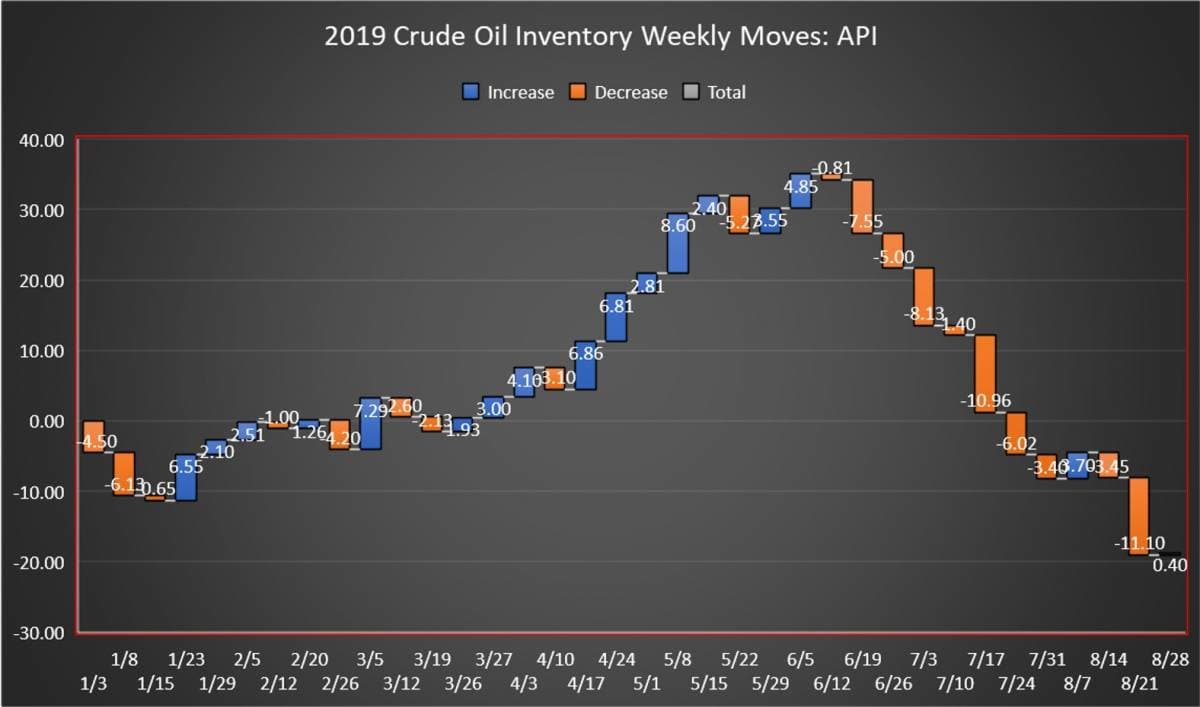

According to API data, the inventory built this week eliminates 11.1 million barrels of crude oil. The EIA has estimated this week that there had been a draw of 10.0 million barrels of stocks.

After today's inventory transfer, the net draw for the year is 18.68 million barrels for the 36-week reference period to date, using API data.

Oil prices were up sharply Wednesday before the release of data after the entry of favorable economic data from China, reinforcing what has been up to here a bad mood regarding the growth prospects of the request choked.

At 2:21 pm EDT, WTI was trading up $ 2.41 (+ 4.47%) to $ 56.35, about $ 1.50 more than last Tuesday. Brent traded up $ 2.46 (+ 4.22%) to $ 60.72 to $ 59.01, about $ 1.70 more than its level last week.

The API has announced this week a draw of 877,000 barrels in gasoline inventories for the week ending Aug. 29. Analysts have predicted a draw of gasoline stocks of 1.60 million barrels for the week.

Distillate stocks decreased by 1.2 million barrels for the week, while Cushing inventories decreased by 238,000 barrels.

United States crude oil production estimated by the Energy Information Administration showed production for the week ending August 23 reached 12.5 million bpd, a new production record.

At 16:42 EDT, WTI traded at $ 56.41, while Brent traded at $ 60.82.

The US Energy Information Administration's report on crude oil inventories is scheduled for Thursday at 11 am EDT, a day late because of Labor Day in the United States.

By Julianne Geiger for Oilprice.com

More from Reading Oilprice.com:

[ad_2]

Source link