[ad_1]

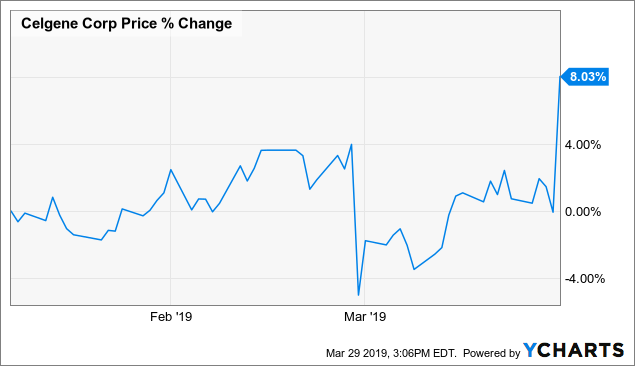

On March 29, ISS said it was in favor of the Celgene (CELG) Bristol-Myers (BMY) merger. The Starboard Value activist, on the side of Bristol-Myers, opposes the merger and concedes more or less the situation. We first wrote about Celgene on January 9 and followed up with about 24 articles. After the news on Friday, we finally have the impression that everything is fine:

Data by YCharts

However, there is still some air in the spread. Perhaps it is more attractive (much less risky) than ever before. Here are the basics:

- Celgene is trading at $ 93.27 currently.

- Bristol-Myers is currently trading at $ 47.22.

- Bristol-Myers offers you $ 50 in cash, a Bristol-Myers share and a CVR * for every Celgene share.

- The transaction is expected to close in the third quarter of 2019 and is not subject to financing.

- Spread (without CVR): 4.2%.

- Annualized, it is always between 10% and 25.2% (provided it closes in the 3rd quarter).

The CVR is unlikely to bear fruit because it is structured to be a binary event – either $ 0 or $ 9 – but because we are launching it for free, the TRI is really good. If we consider a value of $ 2 (a figure that analysts have heard many times), a hypothetical annualized return is pretty ridiculous, somewhere in the 15 to 36% range.

The risk of decline

I would say that the downside risk has decreased since the beginning of the year. Celgene has published a number of press releases on his various medications. Some good and some bad, but overall, I think these have been largely positive.

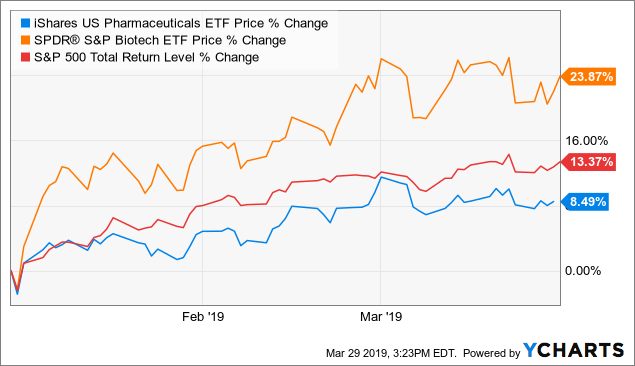

In addition, you will have noticed that the market has skyrocketed in recent months. The entire market is well behaved. The iShares U.S. Pharmaceuticals ETF (NYSEARCA: IHE) did not perform as well, but the SPDR S & P Biotech ETF (NYSEARCA: XBI) jumped. I think it's fair to assume that Celgene would be trading 15% more now compared to early January.

Data by YCharts

In addition, if shareholders approve the deal on April 12, there will be a cancellation fee of $ 2 billion. This adds value to Celgene's shares in a pro-forma transaction.

Add it all up and I put the inconvenience at $ 75-76 on the break-deal. This represents only 18% decrease from current levels.

Meanwhile, I think the odds of an agreement-break have dropped considerably and may already be less than 10%. Let's look at some of the remaining risks.

Risks remaining

BMY's shareholder vote appears to be the biggest individual risk. But there are others:

1) BMY shareholder vote

2) Make an offer for BMY (especially if you cover the game in shares)

3) regulatory approvals

4) All types of delays

BMY shareholders vote

This is probably the most important hurdle, although it only requires a majority, and ISS is behind the deal. In a previous article, I introduced shareholder basics, stating that most parties would vote FOR the agreement. You can find a public version here: Let's take a closer look at the make-up of Bristol-Myers Squibb shareholders. It seems unlikely that this vote will get the majority, but it is still possible. There are no safe things.

Make an offer for BMY

A bidder coming to Bristol-Myers on an individual basis is the second threat since day 1. It seems highly unlikely that a bidder for the BMY will show up now. There are only a few candidates and they know what's going on. I think Starboard would have already sniffed them and they would not be conceding them publicly. After the shareholder vote, the break-up fee is $ 2 billion. After this day, it becomes very, very unlikely.

Regulatory approvals

Note that the FTC reviews the contract:

On March 25, 2019, Bristol-Myers Squibb and Celgene both received a request for additional information and documents (the "Second Application") from the FTC as part of the merger review. the FTC. The parties understand that the FTC's review is focused on commercialized and developing products for the treatment of psoriasis.

This is most likely a new treatment for oral psoriasis. This is not a basic therapy for this link. Usually, even if there are objections, they can be corrected with the sale of assets or otherwise. But this can cause delays that are boring. However, this seems very unlikely, because the interest of a patent in biotechnology is to give a developer a little time to market its products without the burden of competition. But that's my stupid way of thinking about it. I do not understand what the specific objections of the FTC might be here. It seems to me very unlikely that it will upset the whole process.

delays

It's a mega-fusion, so there can always be delays. The Bristol-Myers management has shown unwavering dedication to close this deal. On the side of Celgene, the management also cooperated. Delays are possible and detrimental to annualized returns, but this appears to be an acceptable risk, as the spread is low enough to allow for disappointment at closing dates from time to time.

conclusions

I think it's now a very risky bet. There is still a lot of propagation given the limited time that you will probably have to wait. It has also become much easier to cover the BMY as the chances of a BMY bidder materializing are down. I increased my exposure to Celgene and hedged the bulk of the stock portion.

* CVR Details

The CVR gives the holder the right to a one-time, one-time cash payment of $ 9.00 following FDA approval of the following three elements:

- Ozanimod (as of December 31, 2020)

- Liso-cel (JCAR017) (as of December 31, 2020)

- bb2121 (no later than March 31, 2021)

See the investment report in a special situation if you want uncorrelated statements. We look at special situations such as spin-offs, share buybacks, rights offerings and M & A like Celgene. Ideas like this are particularly interesting in the last stages of the economic cycle.

Disclosure: I am / we have been CELG for a long time. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

Additional information: BMY short.

[ad_2]

Source link