[ad_1]

Apple is expected to announce three new iPhones Tuesday at an event at the Steve Jobs Theater in Cupertino, California.

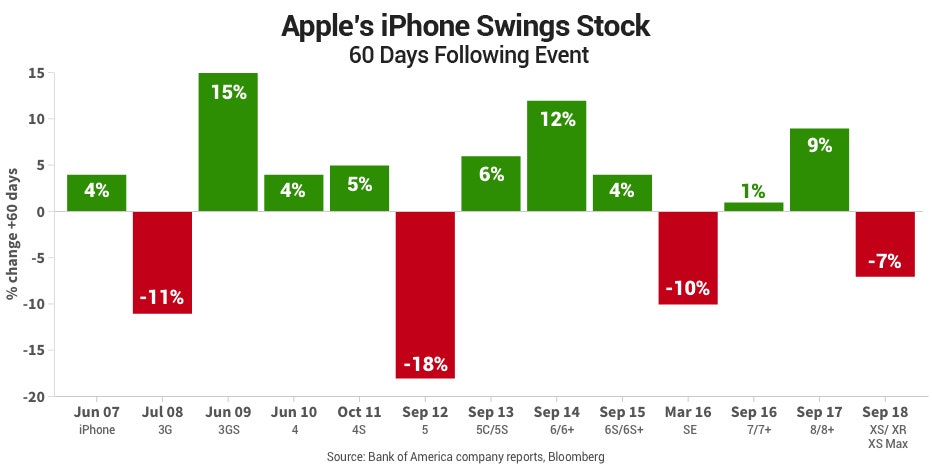

IPhone launches have generally been a positive catalyst for Apple stocks, which have gained nine out of 13 in the 60 days that followed such an event.

"Apple stocks generally took part in such launch events, declined slightly after the event, and then recovered 60 days after the event," said a team of Bank analysts. of America Merrill Lynch, based in New York, in a note addressed to customers.

Tuesday's event will be closely followed by Wall Street analysts, who will refine their models as soon as the details of the new products are revealed.

| Teleprinter | security | Latest | Change | % Chg |

|---|---|---|---|---|

| AAPL | APPLE INC. | 216.70 | 2.53 | + 1.18% |

Bank of America Merrill Lynch analysts have noted that the 2018 launch may have been influenced by a number of factors likely to hit again this year, including a higher price for new iPhones, the US-led trade war United and China and the slowdown in the global economy. . Apple's shares fell 7% in the 60 days following last year's event.

Many analysts expect Apple to keep its prices at the same level as last year, even though tariffs on products made in China will come into effect on December 15th.

"We suspect that Apple will likely maintain current iPhone prices on its 3 new models ($ 749 / $ 999 / $ 1099) and will keep the content in memory and storage identical to that of the iPhone." last year – despite sharp decreases in costs – offering a margin of safety to compensate for any tariffs. or a promotional activity required, "wrote Bernstein analyst Toni Sacconaghi of New York.

READ MORE ON FOXBUSINESS.COM

The trade war between the United States and China is an issue that has been central to Apple's concerns. In July, Trump rejected a request from Cook to have the tech giant protected from tariffs. The president asked the company to manufacture its products in the United States to avoid tariffs.

In August, Cook had dinner with Trump to discuss in more detail the negative impact of tariffs on his company, particularly on the question of how his South Korean rival Samsung should not pay these rates. Trump thought Cook had made a good point and said he would reconsider his decision.

Despite the potential pricing risk, Wall Street is primarily postive on Apple. According to an IBES survey, they have an average price target of $ 223 per share.

CLICK HERE TO READ MORE ABOUT FOX BUSINESS

"We believe that this week's launch aims to put gasoline in Apple's growth pipeline, an indispensable solution for Cupertino, while Cupertino overcomes the age-old headwinds of smartphones, which are exacerbated by the high-stakes poker game between the United States and China, "said Dan Ives, chief executive of Wedbush Securities. a price target of 245 USD – more than 14% higher than the closed shares on Monday.

[ad_2]

Source link