[ad_1]

First, the good news. When the S&P 500 SPX,

jumped more than 8% over a six-day period, market returns 12 months later were up 18%, with gains 88% of the time since WWII. As well – when more than 60% of stocks hit monthlong highs, stocks rose an average of 13% over the next 12 months, with gains 92% of the time.

Both of those milestones were hit on Monday, and now for the bad news – market returns over the next month were only 1% when the S&P 500 jumped over 8% over a six-day period, and stagnant when more than 60% of the S&P 500 voters peak in a month, according to Keith Lerner, chief market strategist at SunTrust Advisory Services, a unit of Truist Financial.

An uptrend has broken out which means markets will be more vulnerable to bad news. The Hulbert Sentiment Index, which reflects the average equity allocation recommended by the newsletter editors, has fallen from 22% in early November to 64% currently. The latest survey from the American Association of Individual Investors shows that the percentage of investors who consider themselves optimistic has reached its highest level of optimism since January 2018.

“After largely focusing on what could go wrong, the markets were set up for a positive surprise in the run-up to the election or in regards to optimistic vaccine news. Today, alongside the sharp rise in the market, investor expectations have also risen. It just means the markets are more vulnerable to unexpected bad news and we anticipate a period of digestion of recent gains. It would be normal and somewhat expected, ”Lerner says.

There is still a lot of news to destabilize the markets – increasing cases of COVID-19, lingering deadlock over additional fiscal stimulus, and unresolved status regarding oversight of the US Senate. “However, we seem to be moving closer to the other side of this pandemic, we are probably at the very beginning of a multi-year economic expansion, monetary policy remains very supportive and relative valuations continue to favor stocks,” he said.

“Therefore, on a net basis, we expect the market to trade volatile in the near term and strong gains to shift. But we do not want to lose sight of the trend in the primary market, which, according to our work, is higher. For investors investing excess liquidity in the market, we would continue to average, but appear more aggressive in a downturn.

The buzz

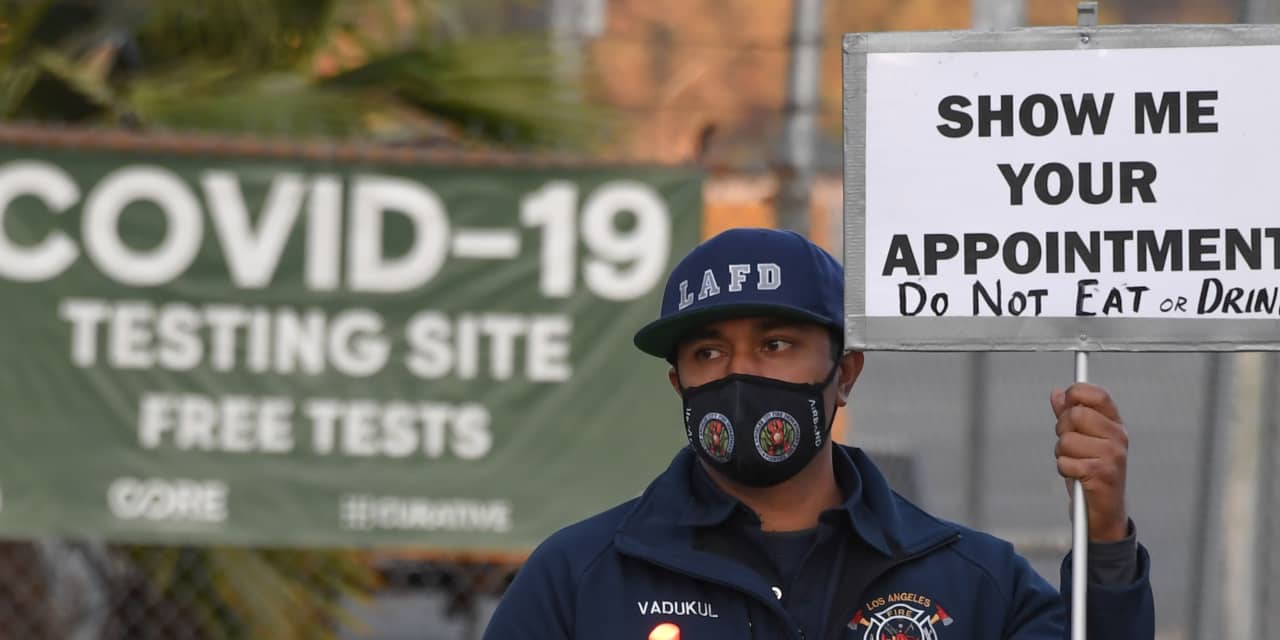

The United States recorded new highs Thursday in new confirmed coronavirus cases and hospitalizations, according to the COVID Tracking Project. Chicago issued a month-long stay-at-home notice that goes into effect Monday, the latest set of restrictions announced by state and regional leaders.

There were a host of benefits, most of them well received. Walt Disney Co. DIS,

grew 3% in pre-market trading as it reported a lower-than-expected loss and attracted more subscribers to its Disney + streaming service than expected, although the entertainment giant said it would ignore its half-yearly dividend payment scheduled for January. Cisco Systems CSCO,

jumped 7% as it reported stronger-than-expected profit, even as revenue fell for a fourth consecutive quarter as the network equipment maker forecast a better quarter underway than analysts expected.

Farfetch FTCH luxury fashion platform,

reported a lower than expected loss on higher than expected income. Palantir Technologies PLTR,

the data analytics company, has raised its revenue forecast for the full year. Manufacturer of Applied Materials AMAT chip equipment,

exceeded profit and revenue expectations and guided for a fiscal first quarter that was also better than expected.

DraftKings DKNG,

rose 6% as the loss-making sportsbook company raised its revenue forecast for 2020.

The latest data on producer prices and the University of Michigan Consumer Confidence Index are expected to be released, and New York Federal Reserve Chairman John Williams is due to speak.

President Donald Trump signed an executive order prohibiting Americans from investing in Chinese companies that support that country’s military, including two listed on the New York Stock Exchange, China Mobile CHL,

and China Telecommunications CHA,

In a radio interview, US Secretary of State Mike Pompeo said Taiwan is not part of China. Hours later, China finally congratulated President-elect Joe Biden on his election victory.

Cloud platform company Fastly FSLY,

increased in pre-market commerce after the Trump administration delayed enforcing its ban on TikTok, which is a Fastly customer.

The steps

US equity futures showed a strong Friday the 13th, with gains for the S&P 500 ES00,

and Nasdaq-100 NQ00,

contracts. The dollar DXY,

fallen, and GCZ20 gold,

Pink.

The 10-year Treasury yield TMUBMUSD10Y,

which lost 10 basis points on Thursday, was 0.88%.

Table

Although still higher than pre-pandemic levels, America’s economies are rapidly depleting. There are a number of provisions in the Cares Act (Coronavirus Aid, Relief, and Economic Security Act) that will expire at the end of the year, including providing 39 weeks instead of the 26 weeks of unemployment benefits that most states provide, extending unemployment to the self-employed and mortgage and student forbearance measures. “Everything is converging towards the end of the year, where momentum was already slowing down, and now you’re going to see benefits expire and programs expire,” said Rubeela Farooqi, chief US economist at High Frequency Economics. It prevents an increase in defaults and bankruptcies that could arise if there is no additional help.

Random readings

NASA’s Hubble Telescope discovered unexplained brightness in a colossal explosion.

Despite archaeologists’ objections, the British government authorizes a road tunnel under Stonehenge.

Need to Know starts early and is updated until the opening bell, but sign up here to receive it once in your inbox. The emailed version will be sent out at approximately 7:30 a.m. Eastern Time.

[ad_2]

Source link