[ad_1]

introduction

In my previous article on my favorite investment strategies, I explained the selection process and why I focused like a laser on a few stocks that, in my opinion, are likely to generate catastrophic returns. Over the last few months and years, I've had a very good chance of analyzing dozens of companies, but because I was taking too many actions, I acquired undervalued stocks that did not necessarily respond to my high quality requirements. That's why I decided to turn my portfolio and focus on quality underpricing. Today, I think my optimized portfolio now reflects a good balance between growth, dividend and security.

Long-term performance

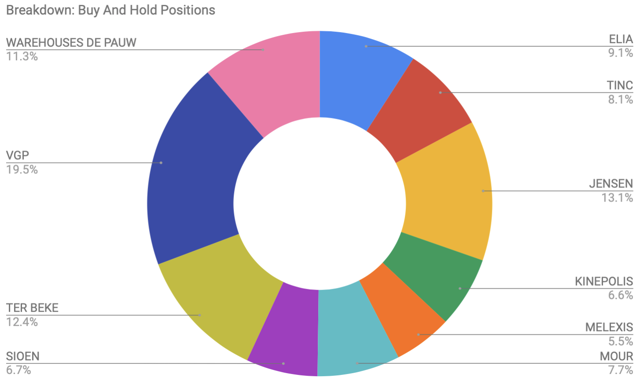

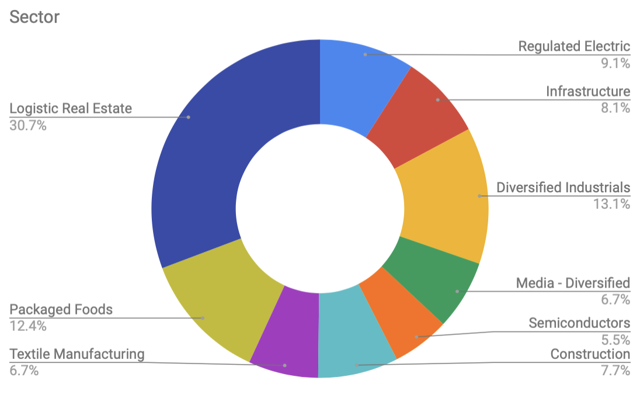

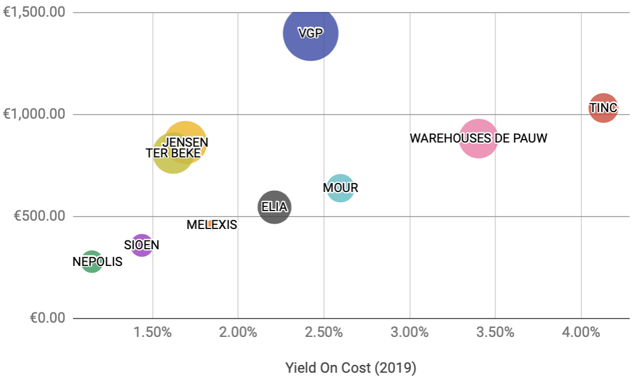

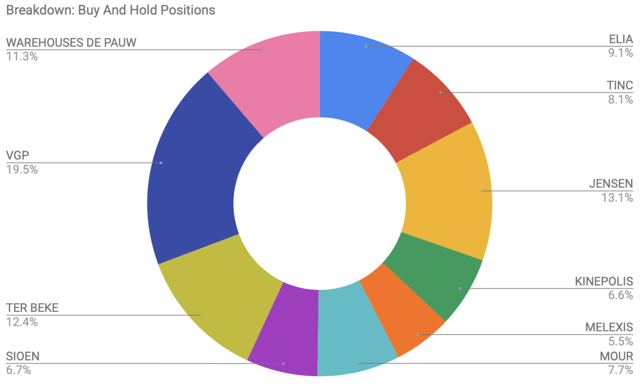

As you can see on the pie chart below, our core portfolio of purchases and investments is currently diversified into 10 stocks, all of which offer excellent long-term prospects, but their current valuation metrics are up to date. widely separate from each other. When I did my due diligence and balanced the overall risk by selecting the best stocks that proved to be conducive to exceptional value creation (and I expect them to maintain this favorable status in the future ), I am determined to keep them. shares for a very long time, even if the market sentiment is depressed. Today, the following 10 major positions form the basis of the most attractive dividend flow and stock appreciation due to the multiple expansion:

(Source: work of the author)

Over the past few years, this equity basket has easily outperformed the S & P 500 (SPY), Russell 2000 (IWM), Dow Jones (DIA) and Eurostoxx 600 indices, thanks to extraordinary cash flow growth. smart acquisitions and below-average gearing. In addition, they also outperformed yields generated by dividend aristocrats such as Coca-Cola (KO), Kimberly-Clark (KMB), Abbott Laboratories (ABT), and so on.

(Source: Tradingview)

I am pretty sure that most of you tend to invest in more than 10 names and may think that this portfolio will be more sensitive to strong market corrections. In theory, this should be true because it is composed mainly of small family-controlled companies and therefore of less liquid underlying securities.

Now, let's look in the rearview mirror to see if this statement is debatable. I've been testing this long-term portfolio and am happy to see that most of my positions have weathered the December storm well last year. The reason they stand in a recession could be the long-term property shared by many like-minded shareholders: simply keep your stock, ignore the noise and look only at fundamentals.

(Source: Tradingview)

More importantly, these stocks generally have a beta well below their benchmark, which makes them more attractive in market corrections.

| first name | Beta 3 years |

Performance over 5 years, (Dividends excluded) |

Month First purchase |

| Sioen Industries | 0.81 | 178.9% | April 2018 |

| Ter Beke | 0.25 | 134.8% | June 2018 |

| TINC | 0.15 | – | June 2018 |

| Jensen Group | 0.39 | 148.0% | May 2018 |

| Elia (OTC: ELIAF) | 0.31 | 74.3% | March 2018 |

| Melexis (OTC: MLXSF) | 1.10 | 109.5% | September 2018 |

| VGP | 0.20 | 290.2% | November 2017 |

| De Pauw Warehouses (OTC: WDPSF) | 0.50 | 155.5% | January 2018 |

| Kinepolis | 0.66 | 71.3% | March 2018 |

| Moury Construct | 0.13 | 41.0% | February 2018 |

| AVERAGE | 0.45 | 133.72% |

(Source: Infrontanalytics)

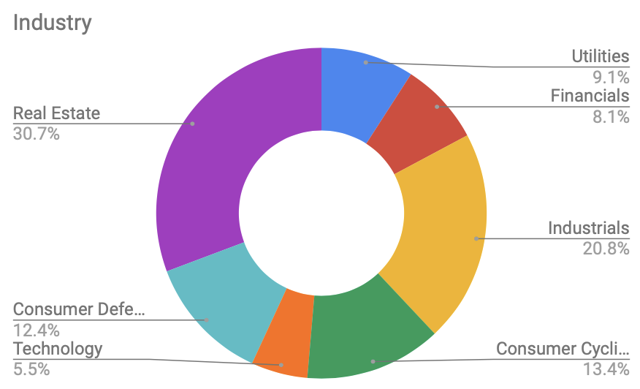

Distribution of the industry

Despite the fact that our buying and holding portfolio is highly concentrated in a few stocks, we have deliberately targeted sectors with economic resilience that can provide guaranteed dividends.

By deepening their business further, we spot the wide variety of end markets in which these companies operate. Let me introduce you to their business models.

Elia is a transmission system operator with a monopoly on the Belgian market and plays a key role in other European markets, such as Germany, where it retains a majority stake in 50Hertz. Elia remains a stable company that provides guaranteed dividends while keeping its distribution rate under control in order to free up capital for investment opportunities. Since its IPO, the company has never been forced to reduce its dividend.

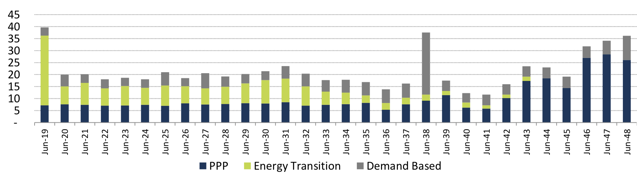

TINC focuses on investing in infrastructure that generates long-term sustainable cash flow. This company is considered a bond stock. Management has a very clear long-term view of future cash flows.

(Source: company presentation)

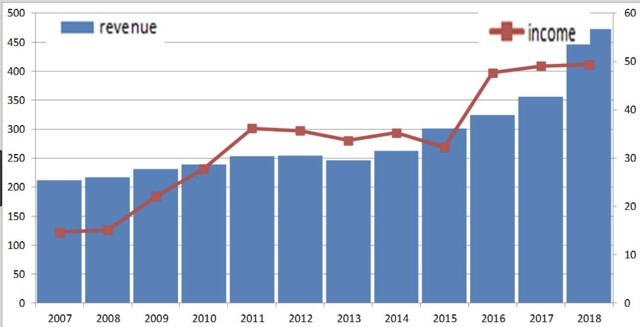

Kinepolis is a film group that wants to offer its audience the ultimate cinema experience. Through several acquisitions, Kinepolis has extended its traditional profile to a larger entertainment company. Two years ago, the company announced its intention to acquire Landmark Cinemas. Knowing that Landmark's profit margins remain one-third of Kinepolis' profit margins, this movement should be the driving force for many years to come.

(Source: Valuespectrum)

Automotive safety and automation are two areas that Melexis has been working for many years and this is ultimately the only reason why investors should turn to this interesting technology company. Until the end of September, Melexis shares were trading at costly multiples, but due to fears of a slowdown in the global economy, price levels have become more acceptable.

Building builder Moury Construct proves that it may be wrong to suggest that the construction sector does not offer opportunities for purchase and maintenance. If we take into account that at least 75% of the current market capitalization is made up of net cash, stocks are trading at falling multiples. In addition, Moury Construct will be able to bring its turnover to more than 100 million euros for the first time this year. This stock of bonds provides opportunities for patient investors looking for a boring and predictable dividend income.

The last are VGP and WDP, specializing in logistics real estate. While the law obligates WDP to distribute at least 80% of its annual net profits, VGP continues to recycle its capital invested in large projects, thanks to its joint venture with Allianz (OTCPK: ALIZF). Thanks to the bond issue at attractive rates, the two companies are focusing on the growth of their real estate portfolio in Eastern Europe, particularly in Romania, where real estate yields have reached the 8% mark. I expect VGP to increase its dividend very quickly by combining new projects (and rental income) and a constantly increasing distribution rate.

As you can see from the pie chart, I am heavily overweight REITs because of the tremendous returns this industry has been making for quite a long time. Most of them being up 20% since the beginning of the year, REITs are in vogue and there are significantly fewer opportunities to show up in a high quality space. Nevertheless, as long as its growth machine is running at full capacity and the multiples will remain very reasonable, I plan to add more to my current position in VGP.

(Source: work of the author)

Dividend income

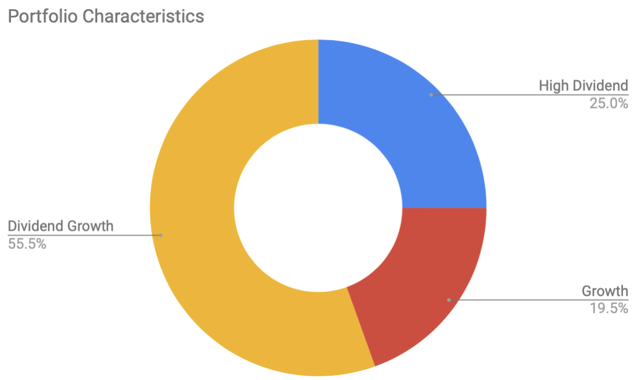

My parents and I are looking for strong and predictable dividend flows. In order to finally be able to live off our income streams, we have created several categories to classify our stocks and have explicitly chosen to select dividend growth companies.

(Source: work of the author)

Just to get my message across, these classifications have a personal interpretation. For me, if the annual growth rate of the dividend can not keep up with the inflation rate and the gross dividend yield is greater than 3%, I consider that it is about a "high dividend". In addition to choosing dividend cannons, we still have decades to go, so we aim to focus on growing companies where fast-growing dividends are not a priority because they prefer to use their cash surplus to opportunely pursue their prey of takeover.

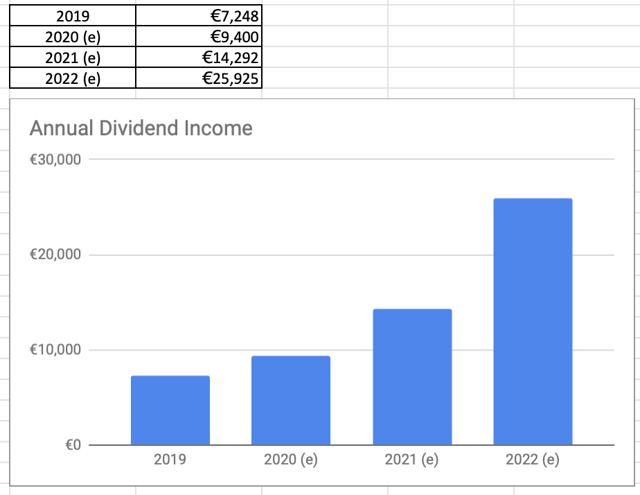

By picking up dividend growth stocks, I want to double our dividends over the next two years.

(Source: work of the author)

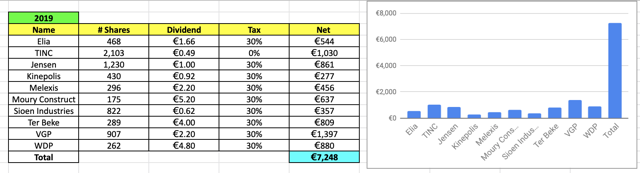

The distribution of dividends for 2019 is as follows:

(Source: work of the author)

At the dawn of this year's new dividend season, our dividend income is driven by three key players: VGP, TINC and Warehouses De Pauw. While TINC's dividend growth rate barely exceeds the Belgian inflation rate, VGP and WDP intended to increase their dividends by 15.6% and 7.0% respectively compared to 2018. Ter Beke and Jensen froze their dividend last year, but they are certainly able to recover their dividend. impressive series of dividend growth over the next two years.

(Source: work of the author)

The perfect American stock

Of course, the fundamental guidelines (such as dividend security, manageable leverage, attractive capital allocation, long-term visibility) that I have put in place in my own portfolio based in Belgium can also be used for US securities. If I had to put together a basket containing the top 10 blue-chip stocks for the next few years, I would have made the following selection.

| first name | FCF return | Leverage (net debt / EBITDA) (e) | Beta 3 years |

| Broadcom (AVGO) | 6.9% | 1.9x | 0.49 |

| Apple (AAPL) | 6.4% | Net position of cash | 1.09 |

| Altria (MO) | 7.8% | 1.9x | 0.61 |

| Comcast (CMCSA) | 6.8% | 3.4x | 0.72 |

| Cisco (CSCO) | 5.4% | Net position of cash | 0.90 |

| Johnson & Johnson (JNJ) | 4.9% | 1.5x | 0.73 |

| Simon Property (SPG) | P / FFO = 14.5 | 5.1x | 0.42 |

| 3M (MMM) | 4.0% | 1.7x | 1.19 |

| Equinix (EQIX) | P / FFO = 23.6 | 5.0x | 0.48 |

| Procter & Gamble (PG) | 4.3% | 2.0x | 0.54 |

(Source: information based on the results of the company and infrontanalytics)

To take away

Driven by a false sense of security, most investors tend to be too diversified in thinking about reducing the overall risk of the portfolio. Nevertheless, in doing so, they add unsystematic risk and unnecessary management work to their portfolios.

Contrary to this state of mind, I am a strong supporter of stock selection. That's why our wallet of purchase and retention consists of "only" 10 selected titles. Over the long term, instead of yielding to the volatility of stock markets, only operational performance matters to me and with the strict control of their founding families, it is highly likely that these companies will not squander their free cash flow but will preserve their dividend Payments. Over the next few years, the PCG will continue to play a key role in achieving our financial goals.

Disclosure: I am / we have been for a long time ALL BELGIAN STOCKS MENTIONED IN THIS ARTICLE. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link