[ad_1]

The oil rigs are in the Permian Basin region of Odessa, Texas.

Photographer: Sergio Flores / Bloomberg

Photographer: Sergio Flores / Bloomberg

OPEC oil ministers have a few challenges to consider at a crucial summit next week, but for the first time in years, the shale boom will not be at the top of the list.

A devastating global pandemic and an account with Wall Street appear to have shattered the solution to the savage shale problems that have made the United States the world’s largest oil producer. Years of dizzying growth, at the expense of crude oil hubs in the Middle East and Russia, have come to an end. If there was any doubt, it is now perfectly clear who has the upper hand in the global oil market.

“Going forward, we certainly think OPEC will be the alternative producer – really, totally in control of oil prices,” said Bill Thomas, CEO of EOG Resources Inc., the largest independent shale producer in terms of market value, at the beginning of the month. . “We don’t want to put OPEC in a situation where they feel threatened, like we are taking market share while they are supporting oil prices.”

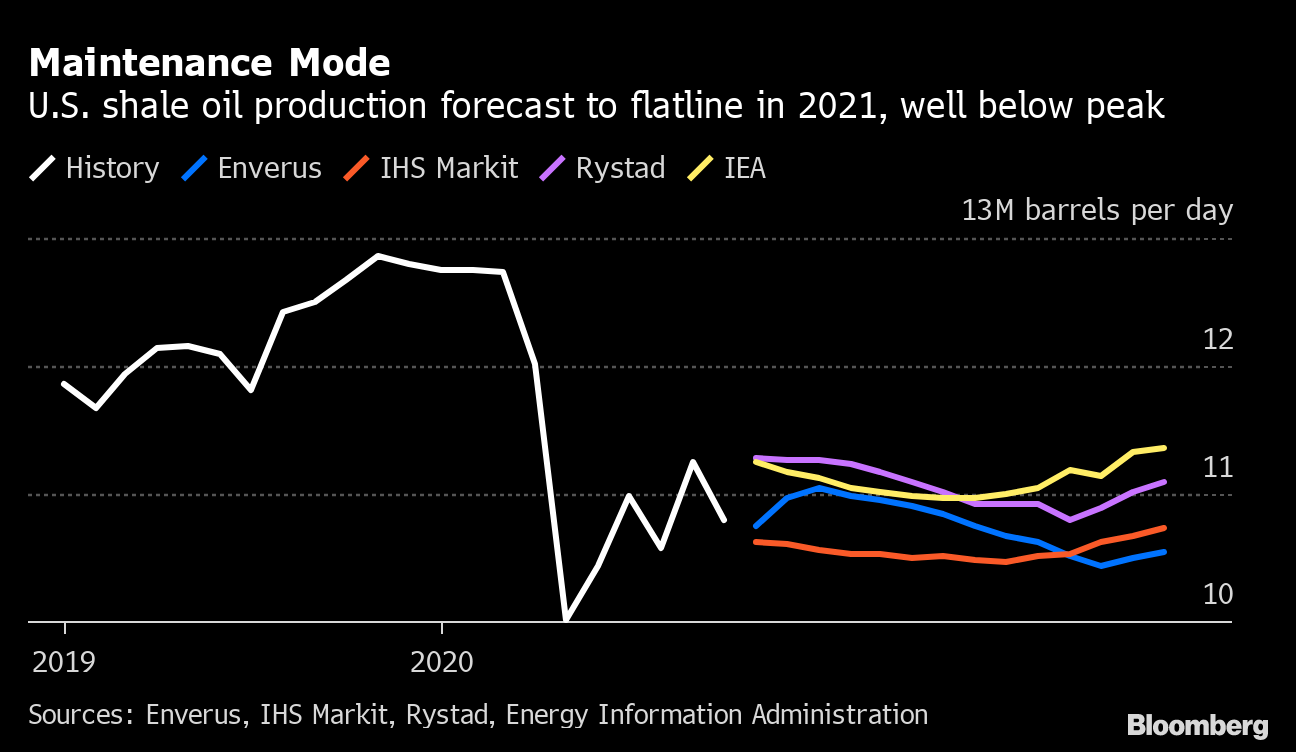

The cautiousness of the shale industry, also echoed by the CEOs of Pioneer Natural Resources Co. and Occidental Petroleum Corp., means production is likely to flatten after a sharp drop this year. U.S. oil production will end 2021 at nearly 11 million barrels per day, roughly the same as today, according to forecasters IHS Markit, Rystad Energy, Enverus and the US Energy Information Administration.

“I don’t see any more growth until 2022, 2023, and it will be very, very slight in terms of the growth of the US shale industry again,” Scott Sheffield, CEO of Pioneer, who will lead the fourth plus The country’s major shale operation after his company completes the buyout of Parsley Energy Inc., said in an interview.

Scott Sheffield at an OPEC seminar in Vienna, 2018.

Photographer: Stefan Wermuth / Bloomberg

This will surely be a relief for OPEC and its allies.

At the start of 2020, the group’s efforts to control prices are encountering increasing difficulties. The breakthroughs in horizontal drilling and hydraulic fracturing that ushered in the shale revolution have given the impression that U.S. production growth may never stop. Production exceeded 13 million barrels per day for the first time in February.

Then the Covid-19 hit, people around the world stopped driving and flying, and the oil market collapsed. President Donald Trump negotiated a landmark deal with OPEC in April to take nearly a tenth of global production from the market. He said the US contribution would take the form of market-driven cuts.

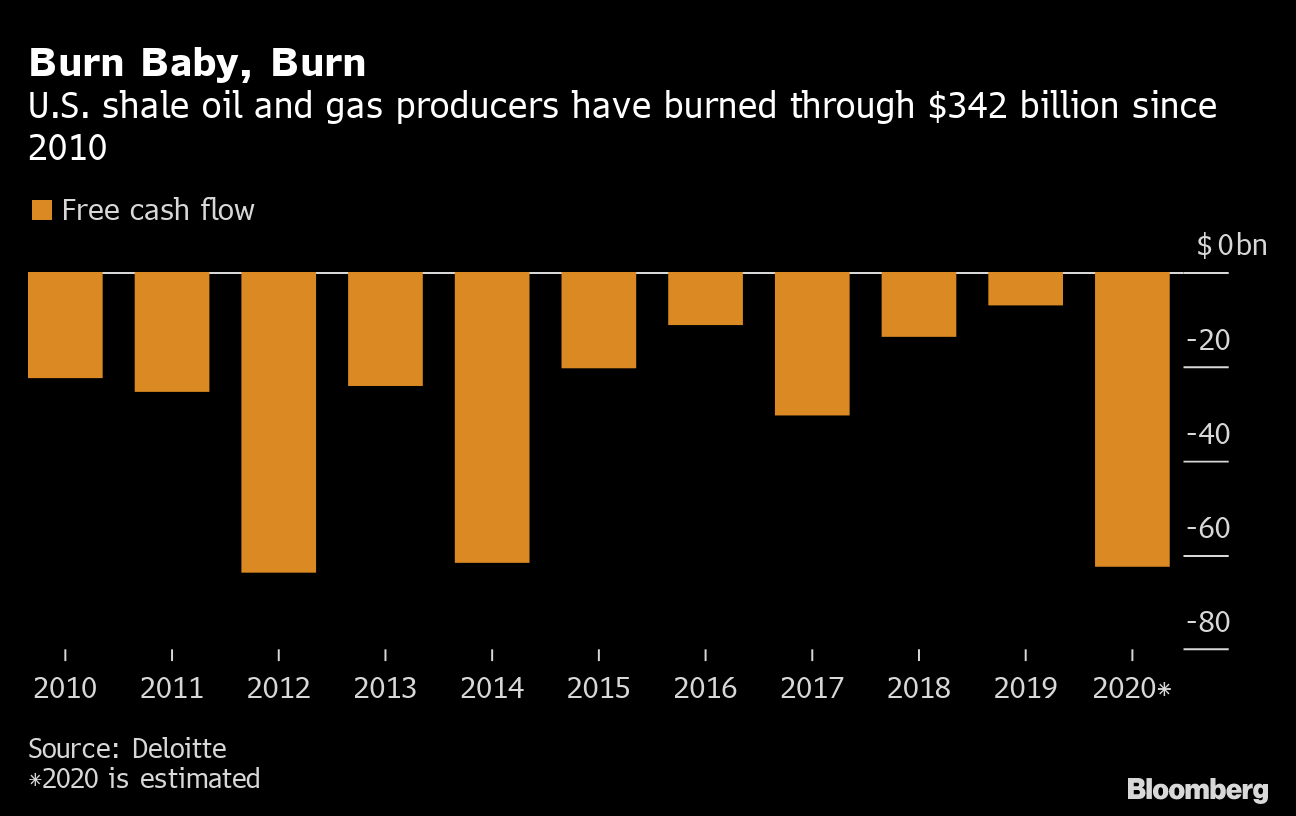

This commitment was delivered faster than expected and it made a huge difference. Investors who were already tired of the shale industry’s money frenzy withdrew from the sector and several producers went bankrupt. By the end of the summer, US production had collapsed by 3.4 million barrels per day, almost as when the UAE pulled out at peak production.

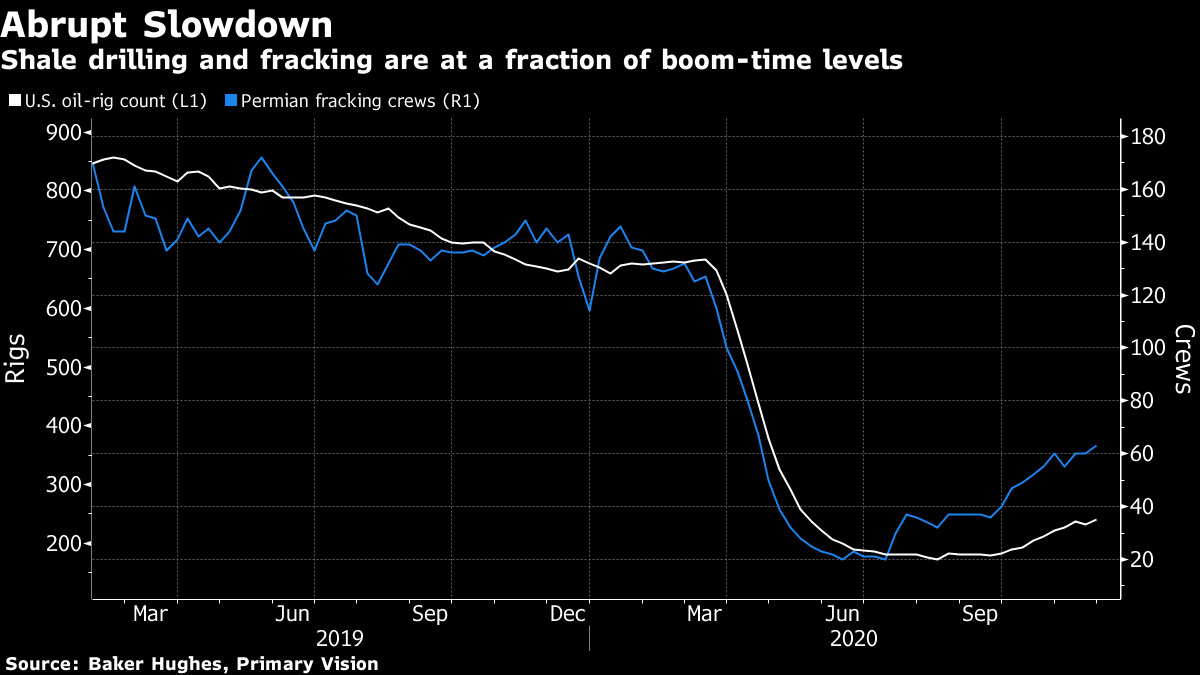

Production from shale wells typically declines within a few months, so new wells must be drilled and fractured just to keep production at current levels. A recent increase in drilling and hydraulic fracturing does not appear to be sufficient to support production growth.

Since bottoming out this summer, the number of rigs looking for crude in shale fields has increased from 69 to 241 this week, according to data from Baker Hughes Co., which is still under review. down from 683 in March.

Likewise, the number of hydraulic fracturing teams in the once dynamic Permian Basin straddling Texas and New Mexico has risen to 63, an improvement from the meager 20 in June, according to data from Primary Vision Inc. But c less than half of the 146 crews pumping mixtures of water, chemicals and sand into wells in January to release oil from the region’s shale rock.

It is as if the United States has suddenly gone from being a thorn alongside OPEC to an unofficial member of the cartel alliance with Russia and other producing countries. Since June, benchmark US oil prices have been remarkably stable, hovering around $ 40 a barrel, and that’s what OPEC appreciates.

Now, when the cartel meets in a virtual rally on November 30 and the broader OPEC + alliance on December 1, they will likely be more focused on the impact of the pandemic on fuel consumption. Most of the rough that the group pulled off the market has already been successfully brought back without any fuss.

While the shale pullback has made OPEC’s life easier, for the US oil industry it has been brutal. There have been 43 bankruptcies of exploration and production companies from this year to October, according to a report by law firm Haynes & Boone.

The shale may be on the decline, but it certainly isn’t. The United States is still an oil superpower and will remain so for years to come. And there is always the possibility that higher prices will prompt explorers to drill and fractionate relentlessly as before.

A sustained rise in prices to $ 50 a barrel “will trigger growth again,” said Bernadette Johnson, vice president of strategy and analysis at Enverus. At $ 60 a barrel, U.S. shale will come back sharply, she said.

The oil market received a boost this week as AstraZeneca Plc became the third pharmaceutical company to show promising results from a trial of its coronavirus vaccine. This helped push prices in New York City above $ 45 a barrel for the first time since March. If further bullish news takes prices to levels that encourage shale growth, even temporarily, producers could take the opportunity to lock in prices with hedging contracts. This is a risk that OPEC + will have to take into account.

Whether investors will be ready to fund shale again is another question. Before Covid-19, the sector was already in debt with high debts and shareholder dissatisfaction. Shale producers have spent about $ 342 billion in cash since 2010, Deloitte LLP said in June.

Another unknown is what titans Exxon Mobil Corp. and Chevron Corp. will choose to do next year. Both have cut capital budgets by about a third this year, with the biggest cuts coming from the U.S. shale.

“Basically, OPEC + has yet to fight for market share,” said Natasha Kaneva, commodities analyst at JPMorgan Chase & Co. “After six months of minimal capital spending, production of shale in the United States will remain limited. “

– With the help of Javier Blas

[ad_2]

Source link