[ad_1]

Photographer: Al Drago / Bloomberg

Photographer: Al Drago / Bloomberg

Barriers to higher yields in the world’s largest debt market are slowly disappearing.

Bond bears appear to have more than just a moment here in early 2021, with Treasury yields finally breaking out of long-held ranges to levels last seen at the start of the pandemic. Most Wall Street analysts see yields slipping even higher, given the vaccine deployment, and the prospect of business reopening and fiscal stimulus.

The threat of rising borrowing costs is already threatening risky assets, from US equities to emerging market securities. So far, the pace of the increase does not seem to alarm Federal Reserve officials, but traders will be watching President Jerome Powell. testify to Congress next week for any signs he is troubled by higher long-term borrowing costs. Unless otherwise stated, the market needs to ask how much reflation trading will drive up returns.

“Before the pandemic, the 10-year yield was trading at around 1.6%, and if we’re going to go back to what the economy was like – give or take – back then, then there’s no reason for the yields to be lower. than that, ”said Stephen Stanley, chief economist at Amherst Pierpont Securities.

He predicts the 10-year yield will end the year at 2% – a level last seen in August 2019 – up from the nearly one-year high of 1.36% reached this week.

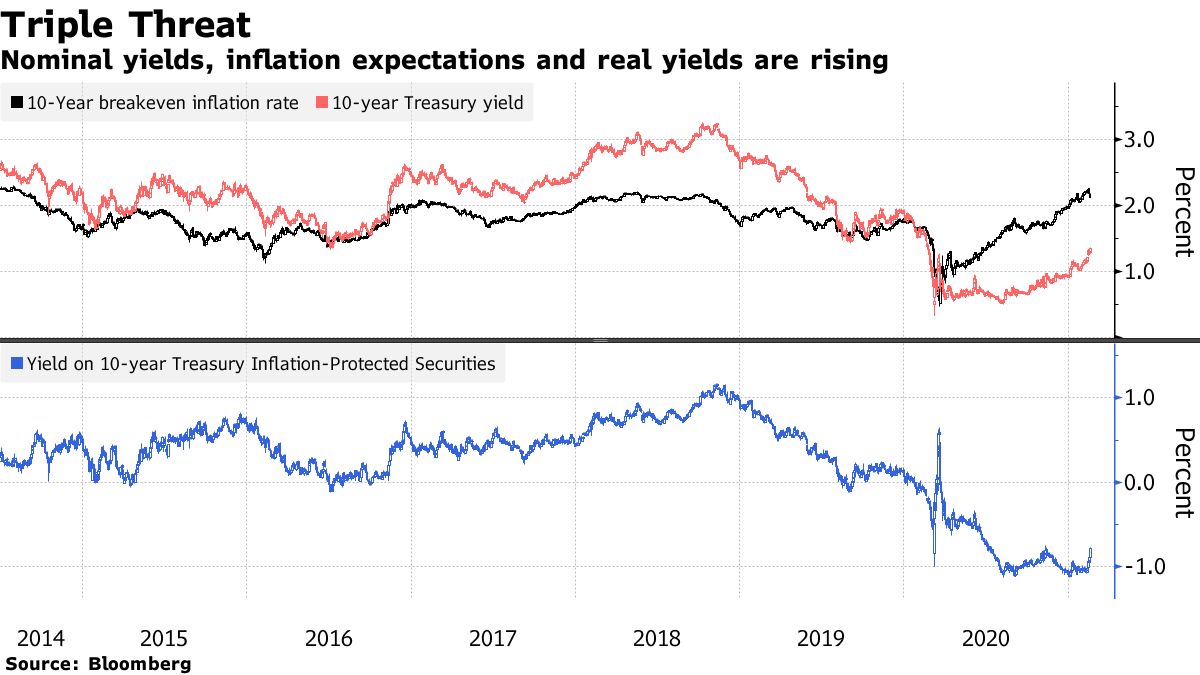

Soaring inflation expectations have been a major driver of 10-year yields, a trend the Fed helped fuel by promising to keep key rates extremely low until prices fell. consumption accelerate sustainably. Ten years break even The rates, a proxy for where investors see the annual inflation rate for the next decade, hit 2.26% this month, the highest since 2014.

Real headache

The pace of the rise in nominal yields has been surprising. But the markets are also watching real returns, which eliminate inflation and are seen as a purer reading of growth prospects. Real rates have reached a significant milestone, with long bonds surpassing zero for the first time since June. This is potentially a problem for risky assets because real rates are viewed as a measure of the capital costs of firms.

The median forecast from a Bloomberg survey is that 10-year Treasury yields will hit 1.45% in the fourth quarter. Zachary Griffiths of Wells Fargo sees the rate between 1.3% and 1.5% by the middle of the year, with the low end possible if vaccine distribution weakens or additional challenges from Covid-19 make area.

To be sure, there are big bond bulls. Robert Tipp, chief investment strategist at PGIM Fixed Income, which manages around $ 968 billion, warns the 10-year yield could drop back to around 1% by the end of the year.

Inflation expectations have risen too high and markets may also be unaware that the economic stimulus from the government’s stimulus measures will eventually wear off, he said.

See here to learn more about an options bet whose returns may not increase much more.

Against the forces

There are other forces to be wary of. International investors can step in to buy at any given time, especially returns hedged in currencies jumped. And with any unruly surge in long-term borrowing costs that tightens financial conditions or causes illiquidity, the Fed may decide to boost asset purchases.

So far, there are few signs of concern. New York Fed Chairman John Williams Friday said rising yields show optimism about the recovery.

“The reflation trade is going to stay,” said Chris McReynolds, head of US inflation trading at Barclays Plc. “We will of course continue to see volatility around inflation expectations and real inflation impressions themselves. But you have to take the Fed completely at its word, that it’s going to be behind the curve “in tightening policy even as the economy and inflation picks up.

There is a strong market signal that supports this view – the sharp rise in the price ratio of copper to gold, which has a strong history of predicting returns. The This relationship generally works because copper is a cyclical commodity and gold is a haven sensitive to inflation and rates.

The ratio rose, suggesting that the rise in yields is only just beginning.

What to watch

- The economic calendar:

- February 22: Chicago Fed National Activity Index; advanced index; Dallas Fed Manufacturing Activity

- February 23: FHFA data on house prices; S&P CoreLogic Housing Data; Conference Board Consumer Confidence; Richmond Fed Manufacturing Index

- February 24: MBA mortgage applications; new home sales

- February 25: orders for durable goods / equipment; unemployment benefit claims; GDP; The comfort of Bloomberg consumers; pending home sales; Kansas City Fed Manufacturing Activity

- February 26: advance of the goods trade balance; wholesale / retail stocks; personal income / expenses; PCE deflator; MNI Chicago PMI; University of Michigan sentiment

- The Fed’s schedule:

- February 22: Governor Michelle Bowman

- February 23: President Jerome Powell to present biannual report on monetary policy to the Senate Banking Committee

- February 24: Powell appears in virtual hearing before House Financial Services Committee; Governor Lael Brainard; Vice President Richard Clarida in two appearances

- February 25: Raphael Bostic from the Atlanta Fed; James Bullard of the St. Louis Fed; Vice-president in charge of supervision Randal Quarles; John Williams of the New York Fed

- The auction calendar:

- February 22: invoices for 13, 26 weeks

- February 23: invoices for 52 weeks; 42-day cash management invoices; 2 year notes

- February 24: 2-year variable rate notes; 5 Year Notes

- February 25: invoices from 4 to 8 weeks; 7 year tickets

– With the help of Eddie van der Walt

[ad_2]

Source link