[ad_1]

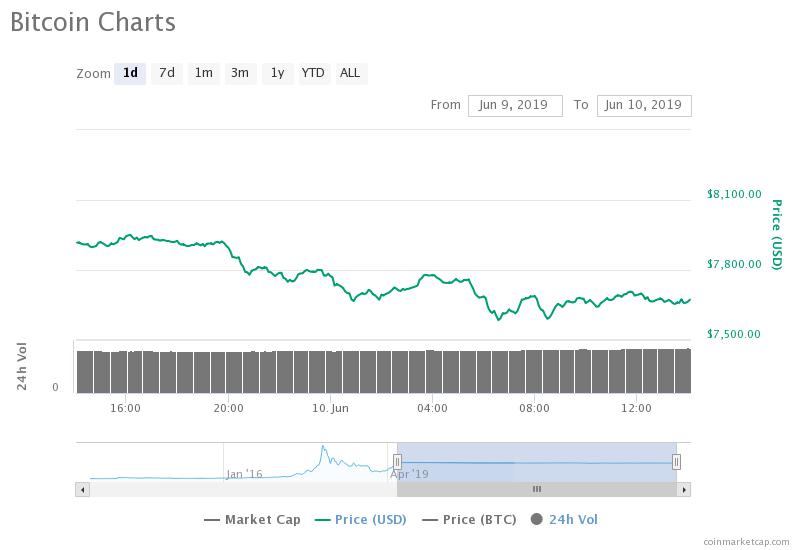

By CCN Markets: Over the past 24 hours, the price of bitcoin has risen from $ 7,900 to about $ 7,500 over 5% against the US dollar, which is a slight decline in the cryptography market.

The price of bitcoin has decreased by about 5% in the last 24 hours (source: coinmarketcap.com)

Over the last seven days, the price of bitcoin has dropped by more than 10%, which has led technical analysts in the cryptography market to think about the possibility of a prolonged withdrawal despite favorable market macroeconomic conditions. .

30% withdrawal for Bitcoin a possibility?

According to a technical analyst known as Crypto Thies, the Bitcoin Relative Strength Index (RSI) hit 92-95%, which historically resulted in a 30% drop in asset prices.

Over the last four years, Bitcoin has tended to fall by 30% on average after an extended rally.

"Whenever BTC has hit 92-95 RSI on the 3D map since 2015, prices have dropped more than 30% in the following months, before continuing. We have hit the same range of RSI recently. Will this time be different? This would involve a touch of at least $ 6.5 K if that 's the case, "said the analyst.

The performance or past trend of an asset is not a guarantee of future asset performance, especially in the case of major cryptographic assets, since the market structure has evolved considerably since 2016.

However, considering that the price of bitcoin is still up more than 100% since the beginning of the year compared to the US dollar, it has almost tripled to its annual peak, with strategists generally agreeing to to say that a decline would be beneficial for the market.

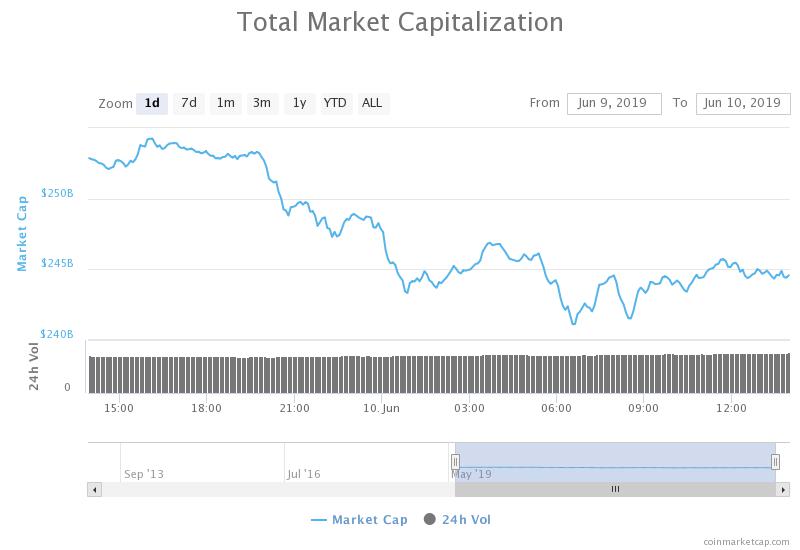

The valuation of the cryptography market is down $ 7 billion in the past 24 hours (source: coinmarketcap.com)

Merchants have begun to view the low-value region of USD 7,000 as a potential re-entry target in the context of an ongoing short-term correction in the cryptography market.

"Once again, I would feel much more optimistic after more than one reset, looking for a big rebound near the 50% retracement of this move," said a trader. m said.

Positive macro factors

The recent downturn in the cryptography market is generally seen as a technical change following a major upward movement in the short term.

On the macroeconomic and medium-term horizon, there are positive factors on the horizon that could improve confidence in the market.

Bitcoin developer activity over the last four years has steadily increased, the total number of peer-reviewed and merged codes having almost tripled.

The activity of developers in the open source bitcoin community is on the rise (source: Pierre Rochard)

Christine Lagarde, Managing Director of the International Monetary Fund (IMF), said in a speech at the G20 high-level seminar entitled "Our Digital Future" that governments are encouraged to integrate different approaches to Cryptography Regulation and Development Promotion. , calling for the stability and development of fintech.

"The integration of different national approaches to crypto-assets, non-bank fintech intermediaries and data governance is crucial if we are to leverage the potential of fintech to promote greater financial inclusion and development. At the same time, however, we must find a way to preserve financial stability and integrity, protect consumers and increase financial literacy, "said Ms. Lagarde.

In Japan, South Korea and the United States, with large economies pointing to the imposition of practical regulatory frameworks, public perception of the cryptography sector could pass from one to another. experimental market to an established market.

Technical analysts expect a short-term pullback due to the rapid movement of Bitcoin prices in recent months, but in the longer run, they remain optimistic about the evolution of the asset class.

[ad_2]

Source link