[ad_1]

"Just a notice – it is possible that BTC comes first, having reached its price target in case of key resistance. A correction could occur before another move to 6500, then a larger correction, "Brandt m said.

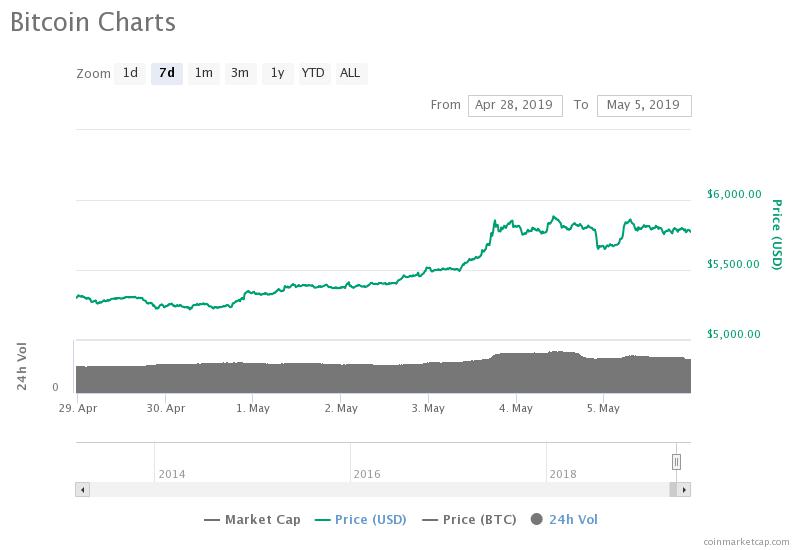

Brandt's forecasts come after the price of bitcoin jumped 10% over last week against the US dollar, reflecting strong momentum.

The price of bitcoin rose by more than 10% last week. (source: coinmarketcap.com)

However, in the medium and long term, technical analysts remain quite positive on the bitcoin price trend and expect only temporary short-term corrections.

Trade scandal in bitcoins encourages retailers to proceed with caution

Based on the data provided by OnChainFX, the actual daily volume of "true 10" bitcoins, which calculates the legitimate spot volume of the dominant cryptographic resource using the Bitwise Asset Management methodology, is & On bit,,,,,,,,,,,,,,. approximately $ 435 million.

In early March, Bitwise announced that the actual daily volume of bitcoins from exchanges of at least a million dollars in verifiable daily volumes, such as Kraken, Binance, and Bitfinex, was up. approximately $ 270 million.

5 / Only 10 exchanges have a daily volume of bitcoins exchanges greater than $ 1 million. @ binance, @bitfinex, @krakenfx, @ Bitstamp, @coinbase, @bitFlyerUSA, @Gemini, @itBit, @BittrexExchange, @Poloniex / @circlepay

You can see the daily volume of BTC exchanges on these exchanges at the following address: https://t.co/MQ4CD3K9hz. pic.twitter.com/yLFiL8kQNn

– Bitwise (@ BitwiseInvest) March 22, 2019

"When you remove the false volume, the actual volume of the BTC is quite healthy given its market capitalization. The market capitalization of gold is approximately $ 7 trillion, with a cash volume of approximately $ 37 billion, representing a daily turnover of 0.53%. The $ 70 billion market capitalization of Bitcoin would imply a daily business turnover of 0.39%, very much in line with that of gold, "said the Bitwise team.

The daily volume of bitcoin has nearly doubled in the past 30 days, indicating a significant increase in demand and interest in bitcoin.

However, as suggested by DonAlt, a crypto technical analyst, the Bitfinex scandal could become a threat to the short-term performance of Bitcoin, especially if the premium on Bitfinex increases.

On April 25, New York Attorney General Letitia James filed a lawsuit against iFinex, a company that oversees Tether and Bitfinex, alleging that Bitfinex had mismanaged $ 900 million of Tether's cash reserves to " to cover a loss of $ 850 million.

"Our investigation revealed that trading platform operators 'Bitfinex', who also control the virtual currency 'Tether', pledged to conceal the apparent loss of 850 million dollars of funds from clients and businesses combined. Said Attorney General James.

After the filing of the complaint, the bitcoin premium on Bitfinex increased from about $ 300 to $ 400, indicating that Tether holders are selling the stablecoin in the recent controversy that bitcoin is being bought at a higher rate than the cash price.

DonAlt said that this trend was not sustainable and that if the bitcoin premium on Bitfinex remained unreasonably high over the next few weeks, the market could collapse.

But, according to the analyst, Bitfinex will end its bid of a billion dollars, as proposed by its billionaire shareholder, Dong Zhao, to avoid a crash.

"This has the effect of reducing the risk of a quick compression of Bitfinex, which would have led to a huge drop in my opinion. That said, the premium must still disappear. As indicated in [my first tweet], the most likely way for this to happen, in my opinion, is still a slum, "said the analyst.

At 3000, everyone talked about shorting the 6000 test again with all its money instead of 3000.

Now we have revisited 6000 and nobody dared to do it.

It's funny how it works.6000 seems to be a good place to reduce risk.

I am always looking for long movements to 4700-4300. pic.twitter.com/hX85lHqsF6– DonAlt (@CryptoDonAlt) May 4, 2019

Major Cryptographic Assets Record Significant Gains – At the Moment

While bitcoins showed stability in the range of $ 5,700 to $ 5,800, the main cryptographic assets, such as cash bitcoins (BCHs), posted relatively strong gains against the US dollar, with BCH gaining 5, 3% that day.

[ad_2]

Source link