[ad_1]

The massive sale in the United Stateslisted shares of Chinese tech companies is unrelated to their fundamentals and is a greater buying opportunity, according to Citigroup Inc.

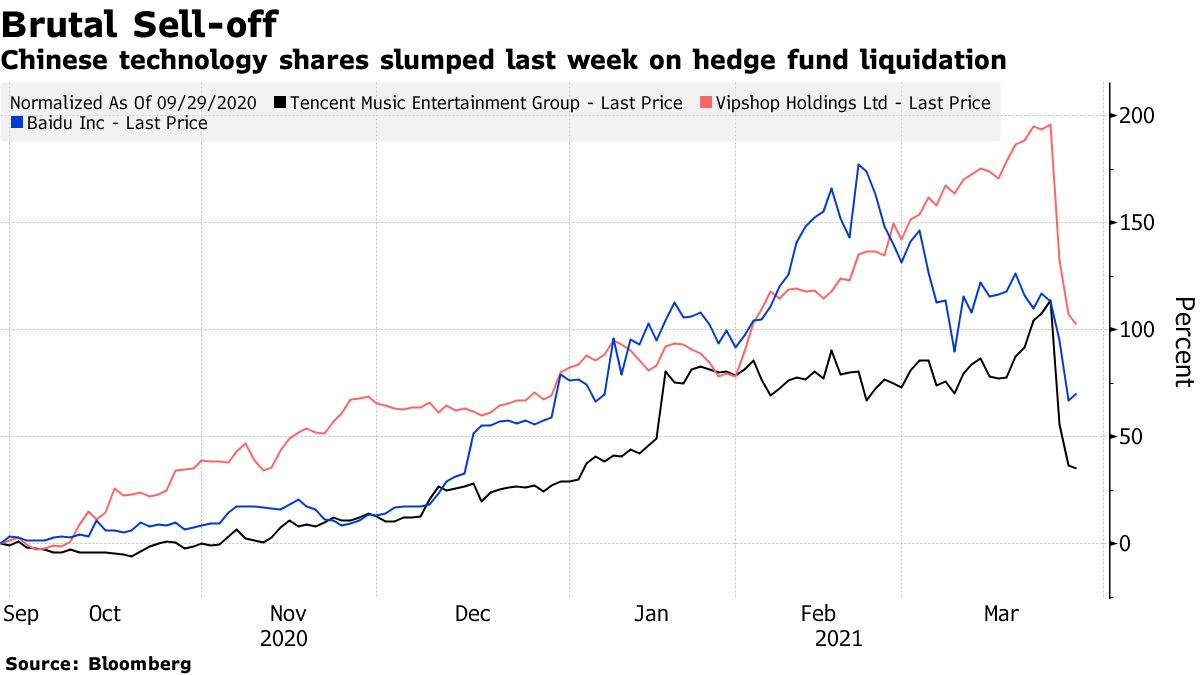

The brokerage reiterated the buy ratings of Baidu Inc., Tencent Music Entertainment Group and Vipshop Holdings Ltd. as a result of what she called an “unfortunate dislocation” in their share price. Gary Dugan, managing director of the IOC’s global office in Singapore, echoed Citi’s views.

“While we are uncertain whether the enormous volatility in the movement of the stock prices of many technology stocks over the past few days could trigger more forced selling pressure or reduce the risk of selling other funds in the coming days,” we are confident that none of the sales are fundamentally tied, ”Citi analysts, including Alicia Yap, wrote in a note.

Comments come after Friday unprecedented sell-off in some US stocks ranging from Chinese tech giants to US media conglomerates by the family office of former Tiger Management trader Bill Hwang. The company, Archegos Capital Management, was forced by its banks to sell more than $ 20 billion in shares after some positions were transferred against Hwang, according to two people directly familiar with the trades.

LILY: Tiger Cub Hwang’s Family Office behind the Friday shopping frenzy

Technical, exaggerated

“We would view the sale as technical and overkill and therefore as a long-term buying opportunity,” said Dugan of the Global CIO Office.

Tencent Music, whose ADRs have fallen 37% in the last three sessions, announced a share of $ 1 billion redemption on Monday. Baidu has about $ 2.78 billion in share buyback programs outstanding that it could use to repurchase the shares, Citi analysts wrote in a note.

“Baidu’s growth prospects remain promising,” they wrote.

Citi’s price target of $ 364 on Baidu’s ADRs implies a potential rise of around 75% from Friday’s close.

Baidu stock, which debuted in Hong Kong last week, slipped 4.5% at 11:15 a.m. local time, adding to its 5.6% loss on Friday. A measure of tech stocks was down 0.9% even as the benchmark Hang Seng traded higher.

LILY: Weak Baidu debuts, further proof of waning tech appeal: ECM Watch

“We bought shares of Baidu in Hong Kong last Friday,” said Paul Pong, managing director of Pegasus Fund Managers Ltd. in Hong Kong. “The valuation has become very attractive. Equities have hit a near-term low as the decline has nothing to do with fundamentals. He has profit growth and the momentum is not bad. It is the best tech title to hold if you want to get acquainted with the concept of automatic driving. “

(Update prices, add another comment in the last paragraph.)

[ad_2]

Source link