[ad_1]

There has never been a market rally like this.

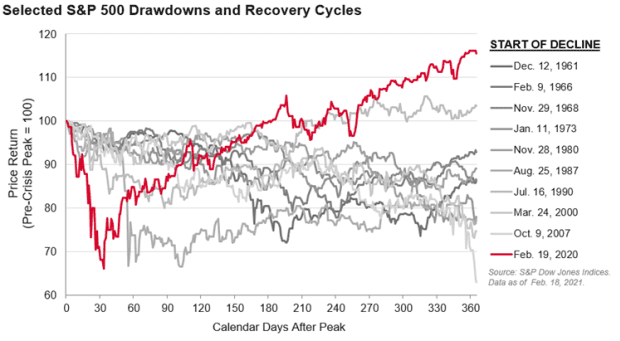

Standard & Poor’s analysts have plotted the last 10 times since 1957 that the S&P 500 has fallen 25% or more from a record high. The graph shows that this is the best reaction to a withdrawal since World War II.

It was exactly one year ago, February 19, 2020, that the S&P 500 SPX,

reached a record level, and the VIX VIX stock market volatility index,

was at a low of 14. This quickly backfired in the face of the COVID-19 pandemic that has spread out of China around the world.

“Since then, work clothes around the world have picked up dust, while on the positive side we have all gotten better at telecommuting. Today, 366 days later, there is good reason to hope that we are closer to the end than the beginning, ”said Tim Edwards, Managing Director of Index Investment Strategy for S&P Dow Jones Indices .

The S&P 500 jumped 75% from its March lows. The high-tech Nasdaq Composite COMP,

more than doubled.

[ad_2]

Source link