[ad_1]

Photographer: Kiyoshi Ota / Bloomberg

Photographer: Kiyoshi Ota / Bloomberg

Like a slot machine that pays with every draw, the stock market’s most reliable bets in recent times have often been the riskiest.

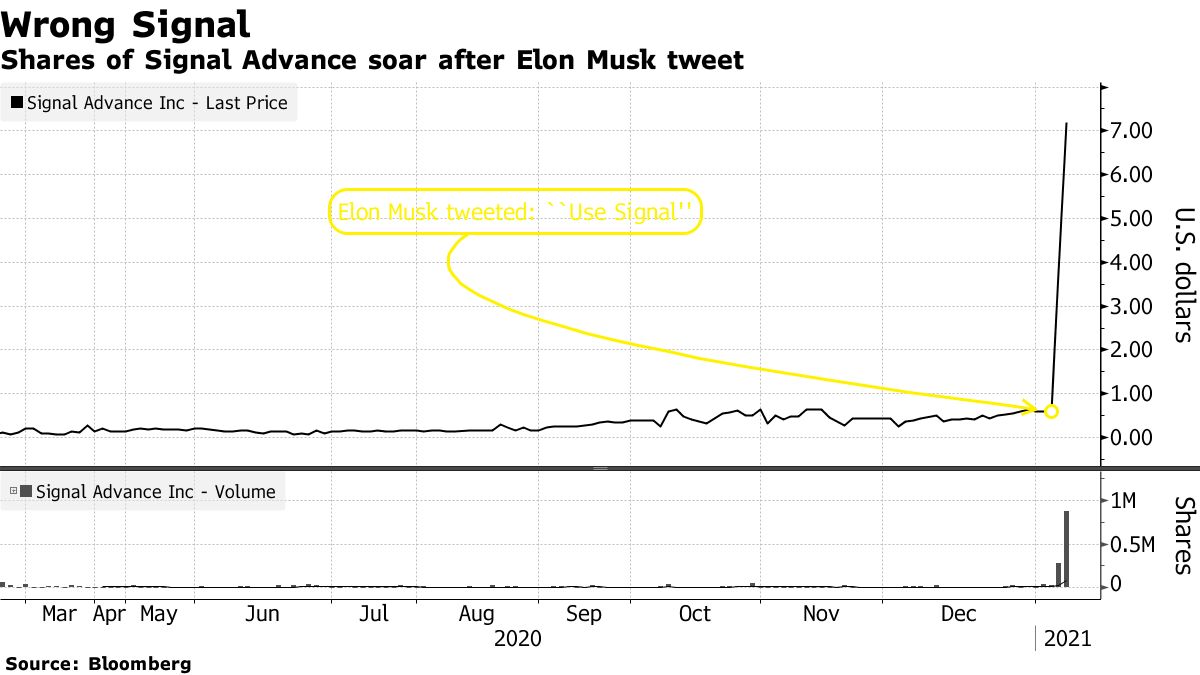

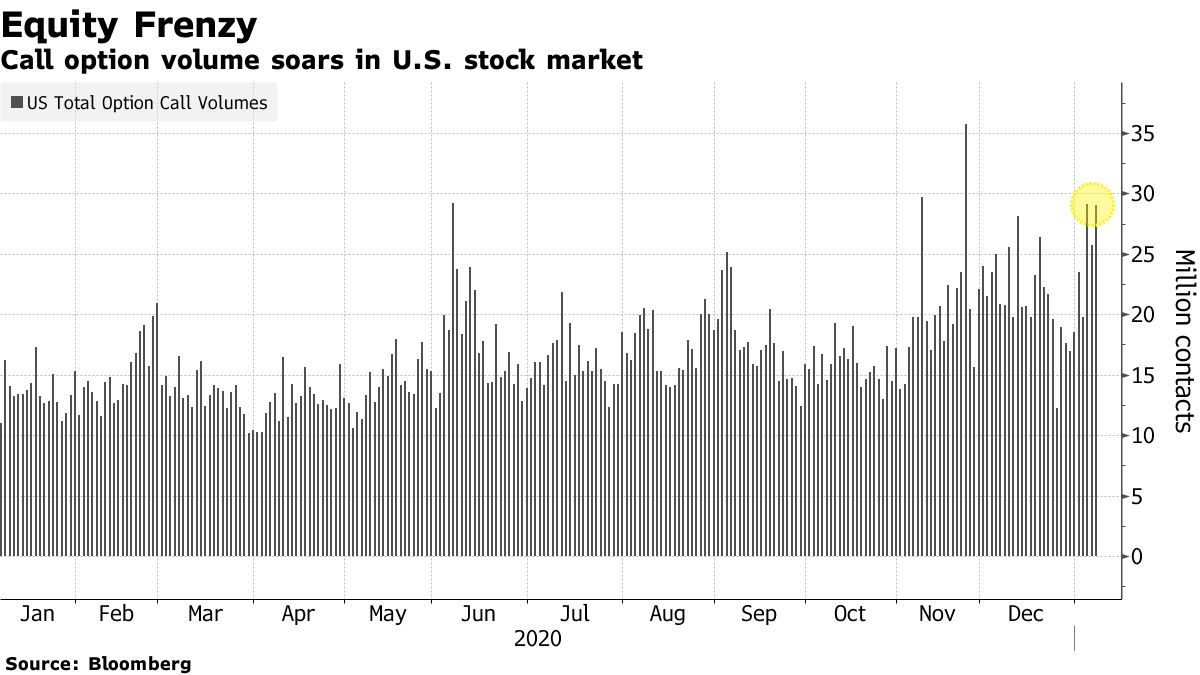

Go for a long time at a company that looks like something Elon Musk mentioned in a tweet (but not)? Signal Advance Inc. has just multiplied by 12. Lending money to a software maker to buy Bitcoin? A Microstrategy Inc. the convertible bond is up 50% in four weeks (its option is in the money). Saving the truck on bullish options after the Nasdaq 100 doubled in 24 months? Wednesday was the fourth busiest day for call trading in the US (the other three were last year).

Throw a dart, hit a winner, that’s what it seemed like lately. Emboldened by the Federal Reserve stimulus, vaccines and the psychological conditioning that comes when no bad patch lasts, everyone from retail newbies to institutional managers are rushing to cash in on the age-old merger of 10 months. Of course, it’s possible that this will all go on for weeks or even months without even a small reversal. Predicting exactly when these fevers will break down is almost an impossible task. But bubble warnings are starting to sound from all over.

“It’s a fad in its own right, and the bull’s relative youth doesn’t make it ‘safer’ to get on board,” wrote Doug Ramsey, chief investment officer of Leuthold Group, in a report to clients Jan. 8. . note that his company is also one of the buyers. “We are just as guilty as the others for having continued this momentum”

Chasing it works. Four days after ending the year at nearly 40 times earnings, the Nasdaq 100 Index recorded its biggest rally in two months. Hedging against equities, on the other hand, has been expensive. A basket of preferred managers’ short positions hurt them 10% last week, having gained the most in seven months. It is futile to hope that the mania will go away too. The frenzy over special purpose acquisition companies continued, with a dozen new IPOs on Friday, including one with the symbol “LMAO. “

“Too much foam, too much complacency,” said Matt Maley, chief market strategist at Miller Tabak + Co., who believed last week’s show in Washington would have at least slowed down the frenzy. “After a rally of 16% in just two months and a rally of 70% since March, this news should have brought down the market. A 10% to 15% correction would be normal and healthy. “

Tesla Inc.’s ability to add 25% to a market value of nearly $ 700 billion over five days grabbed the headlines last week, but for a real froth, the options market was the place to look. Calls expiring Jan. 15 with a strike price of $ 1,000, the most traded Tesla option on Friday, quintupled on Friday, ending the week at $ 9.15 after starting at 53 cents each.

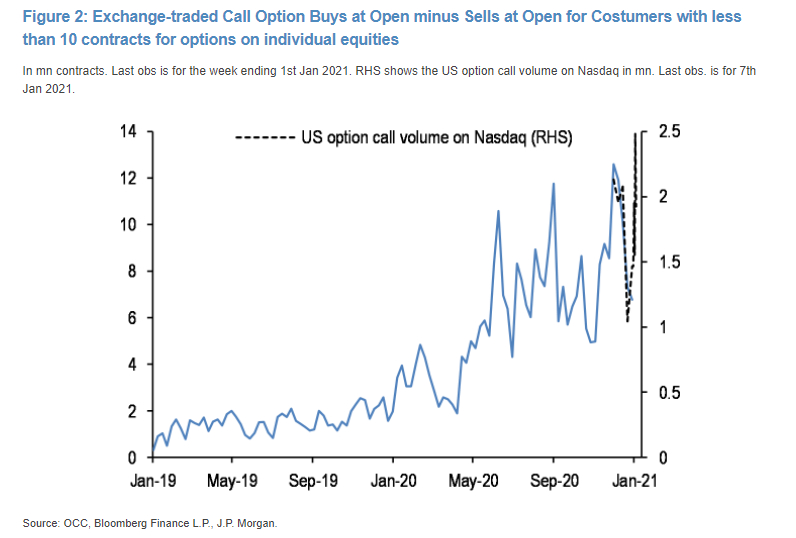

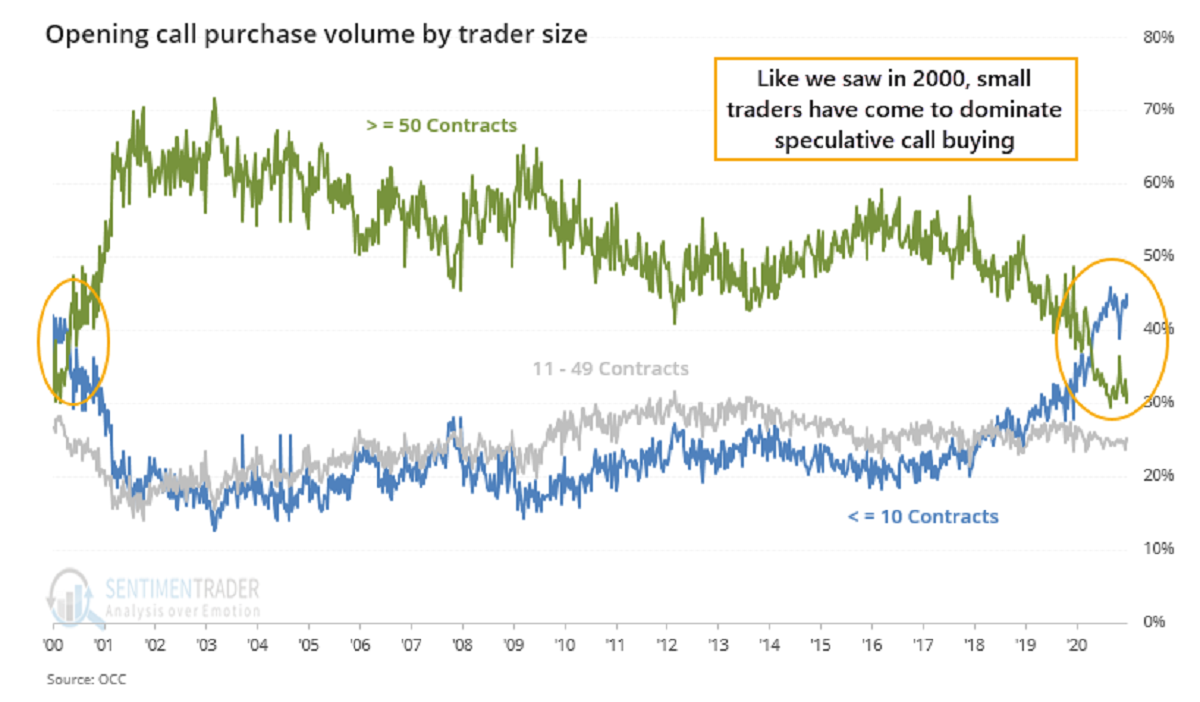

People appear to be driving the action, according to JPMorgan Chase & Co., which cited an approximation of NYSE margin account data indicating a potentially strong rally in December from previous months. The buying of call options by small traders picked up sharply after a seasonal decline last week in December, as did over-the-counter retail-oriented trading, according to the bank.

“The strength of liquidity appears to be echoing once again intensely through retail investors, in a repeat of the second quarter of last year,” the strategists led by Nikolaos Panigirtzoglou wrote in a note on Friday. “Given the anticipation of additional budget support, this strength should continue over the coming weeks.”

The industry has taken note. Cboe Global Markets Inc. tailors its products to small investors. He updated options for S&P mini indices to improve liquidity and provide better execution for retail clients, after announcing in June that he would be relaunching. a mini-VIX product intended at least partially for small traders.

The company has attempted to “make products that reflect these changes in investor demand, which we believe are here to stay,” said Arianne Criqui, head of derivatives and global customer services at Cboe, in an interview in November. She Noted that Robinhood Markets Inc. says that about a fifth of its clients trade options. “We are seeing great benefits” for more people to start, she said.

Jason Goepfert of Sundial Capital Research has been raising flags since the end of December over the strength of retail traders in the options market. He cited data on the number of purchases per call and the money spent on them – where the smallest participants had a share of 54% versus 28% for the largest.

“At first glance, things got worse,” Goepfert wrote in a note Tuesday. “The most reliable sentiment metrics are typically those that focus on real money and leveraged instruments. This is where emotion has the greatest impact. When we take a look at some of the most leveraged vehicles available to investors, there is plenty of evidence of extreme speculation. “

The market is poised for a rush for riskier securities, as many assets like cash and bonds offer historically depressed returns. Some investors have turned to stocks – and options – to generate the income that is lacking with almost everything else. Chris Murphy, Derivatives Strategist at Susquehanna, Noted in November, the crash “may be a great way to improve returns” given the combination of high volatility and high valuations.

Andy Nybo of Burton-Taylor International Consulting LLC also sees the hunt for yield contributing to the options frenzy.

“With bond yields at zero rates or at very low rates, there are a multitude of investors looking for improved yields,” he said in an interview in October. “Options are a powerful tool not only for gaining exposure, but also for earning returns for existing holders. Crush strategies, call writing strategies are therefore all useful tools for investors to earn returns and manage their risk exposure up or down. “

Saying there is moss on the fringes is not the same as saying everything is doomed. In a note last week, Bank of America strategists attempted to trace any signs of a bear market into broader measures of stocks, and found that 63% of them had been met. Among them are reduced liquidity in funds, a rise in the Cboe volatility index and good consumer mood. While the reading hit a three-month high, it is below the peak level of 79% seen in September 2018.

“Our checklist of bearish market signposts (signals typically triggered before a market spike in the S&P 500) has gradually increased,” wrote the strategists led by Savita Subramanian. “Our The forecast for 2021 calls for muted returns from the S&P 500.

– With the help of Sarah Ponczek

[ad_2]

Source link