[ad_1]

The stock market has a fairly reliable track record: since World War II, when the S&P 500 fell in the three months before the November vote in a presidential election year, the incumbent president or the incumbent president’s party has lost. the election 88% of the time.

Likewise, when the S&P 500 rises during this period, the incumbent or the incumbent president’s party wins 82% of the time.

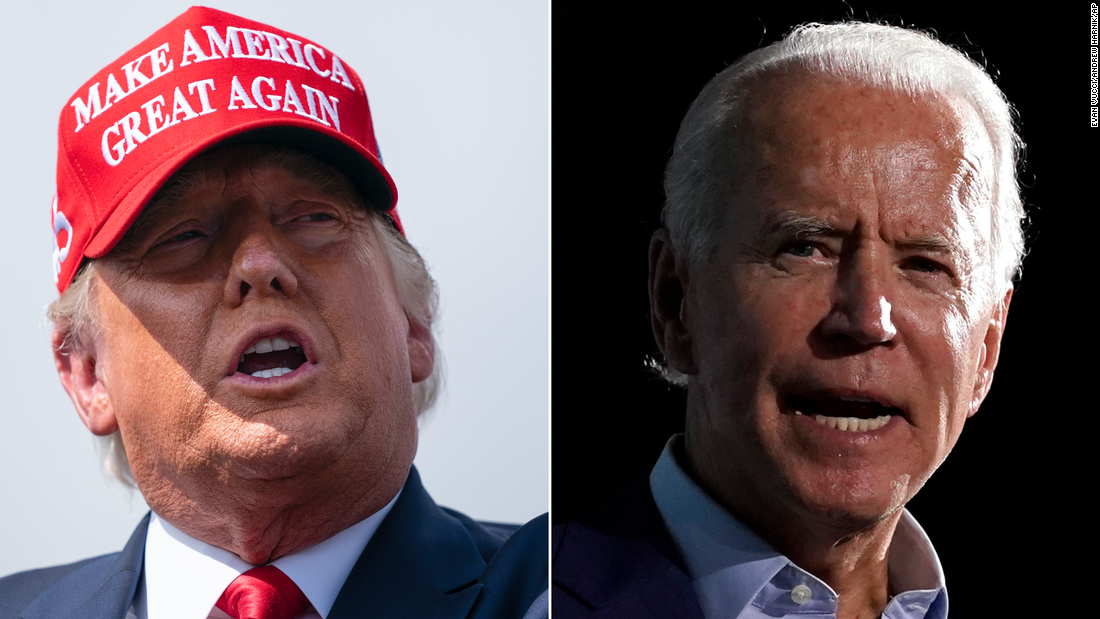

The stock market had predicted a Trump victory until Friday, when the S&P 500 fell 1.2%. It was just enough to send negative actions over the past three months, which gave Biden the edge.

“This year the Predictor has closed very slightly in the red during that three-month period, which implies, but does not guarantee, that Biden will emerge victorious,” said Sam Stoval, chief investment strategist at CFRA.

Bet on a blue wave

“Such a blue wave would likely cause us to upgrade our forecast,” Goldman Sachs chief economist Jan Hatzius wrote in a report last month.

Taken together, these expenses “would at least correspond to the longer-term likely tax increases on corporations and top earners,” Goldman Sachs wrote.

Likewise, JPMorgan strategists led by Dubravko Lakos-Bujas noted in July: “The consensus is that a Democratic victory in November will be a negative for stocks. However, we view this result as neutral to slightly positive.”

But Moody’s Analytics found that Biden’s economic proposals, if passed, would create 7.4 million more jobs than Trump’s. The economy would return to full employment in the second half of 2022, almost two years earlier than under Trump’s plan, Moody’s said.

Predict the outcome

No incumbent has ever won a second term in a recession in the two years leading up to the election, according to data from RiverFront Investment Group.

The only incorrect prediction from the CFRA’s presidential predictor when the market fell in the three months leading up to the election was in 1956, when incumbent President Dwight Eisenhower defeated Adlai Stevenson despite a 7.7% drop in the stock market during the crisis. de Suez and the Hungarian uprising.

[ad_2]

Source link