[ad_1]

This is an archive photo showing Chevron Corp. Jack / St. The deepwater oil platform of Malo is located in the Gulf of Mexico on aerial photography off the coast of Louisiana, Friday, May 18, 2018.

Luke Sharrett | Bloomberg | Getty Images

The US energy sector has halted about a third of the Gulf of Mexico's oil production and is expecting further disruption as a result of the first hurricane of the year.

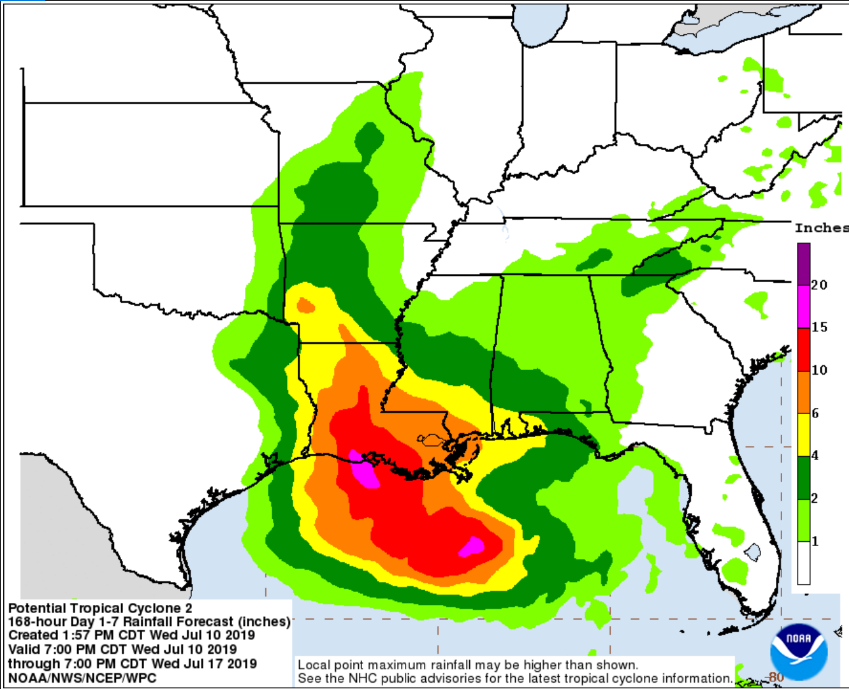

The raging storm, which was still forming on the Gulf on Wednesday, was expected to travel to the Louisiana coast by Saturday, spilling a large amount of rain.

Oil prices climbed 4.5% a barrel on Wednesday, fearing the storm would disrupt oil production and threaten flooding around refineries in the region. Gasoline futures also rose about 4% to $ 2 a gallon.

The US Energy Information Administration announced on Wednesday that US crude inventories fell by 9.5 million barrels last week, triple the market forecast. At the same time, the oil industry has ceased production and major producers have evacuated rigs in the Gulf of Mexico, in anticipation of the next storm.

The National Hurricane Center predicts that the storm will form on the Gulf of Mexico and reach the Louisiana coast on Saturday. The storm, which will be called Barry, would be the first hurricane of the season.

Reuters reported that production in the Gulf had been reduced by 602,715 barrels per day, or about a third of Gulf production, according to the Office of Safety and Environmental Protection. Natural gas production has been reduced by almost 18%.

The US Coast Guard plans to impose possible restrictions on the Mississippi waterways in the next two days. This could limit the movement of oil tankers to and from refinery areas.

A US Coast Guard official has stated so far that "we have not issued any restrictions on the waterways, we expect this in the next 24 to 48 hours." The spokesman said the wind and rain forecasts warned that coast guards could limit tanker traffic on the Mississippi River. The Coast Guard could also limit speed and direction in the shipping channel.

"The forecasts point to a significant amount of rain and the potential for flooding along the Mississippi River is a concern for the refining and oil sector," said Andrew Lipow, president of Lipow Oil Associates . "The market is dealing with all the storm issues, and a number of producers have evacuated their rigs in the Gulf of Mexico and reduced their production."

Chevron, Royal Dutch Shell, BP, Anadarko Petroleum and the BHP Group were evacuating personnel from 15 offshore platforms.

"From the runway, it looks like the landing is in the Lake Charles area." The concern is in the dirty side, where we get a lot of rain, can occur in the New Orleans areas and Baton Rouge, we could see a storm surge that is discharging water into Mississippi, which is already very high, "said Lipow. Lipow said there were three major refineries in Lake Charles and a dozen in the New Orleans and Baton Rouge area.

"I do not think it's a big threat," said Brian Lovern, Meteorologist at Bespoke Weather Services. "Most likely, if we get there, we'll talk about a Category 1 storm." "I do not want to mitigate the hurricanes." "It's still a hurricane." These hurricane force winds would be in a very small area, all around the center In the grand scheme of things, the big story is that it will be a rainmaker more than anything else. "

Lovern said it seemed that much of the state of Louisiana would receive rain between 6 and 12 inches. There are places that could reach 18 inches.

"It's not going to move fast, but it's not like Hurricane Harvey hit Houston and did not move for five days," he said.

The biggest consequences for the energy sector could be downtime.

"There is something else, as a precaution, they will shut everything down in the Gulf.This will have an impact on operations in this regard," Lovern said. "It should not cause a lot of damage that will cause disruption in the longer term."

Gene McGillian, of Tradition Energy, said other factors were contributing to rising oil prices, including tensions between the United States and Iran and the recent deal struck between the US and Iran. 39, OPEC and Russia to reduce production.

"All things together are starting to push the market higher again, and we have not seen an increase in trade problems either, which helps to alleviate some of the concerns of demand," McGillian said. reaction of the storm could be exaggerated.

Jacob Mesel, a senior natural gas analyst at Condor Alpha Asset Management, said he expects some effects on liquefied natural gas shipments. "The canals of the LNG vessels could be disrupted – basically, they might not be able to ship LNG vessels in Sabine Pass or Cameron for a few days."

However, Meisel said the bearish factors outweigh the bullish factors for the natural gas market. Natural gas futures prices rose about 0.5% on Wednesday.

"They are going to try to get global levels and continue their operations until the storm hits in. This storm is not so bad that I'm afraid the LNG facilities are really damaged," he said. he declares.

Mr Meisel said that one more important factor could be the disruption of demand following the storm, especially in case of flooding and power failure.

Reuters contributed to this story

[ad_2]

Source link