[ad_1]

A war is brewing between states to attract bitcoin miners, and new data shows many of them are heading to New York, Kentucky, Georgia and Texas.

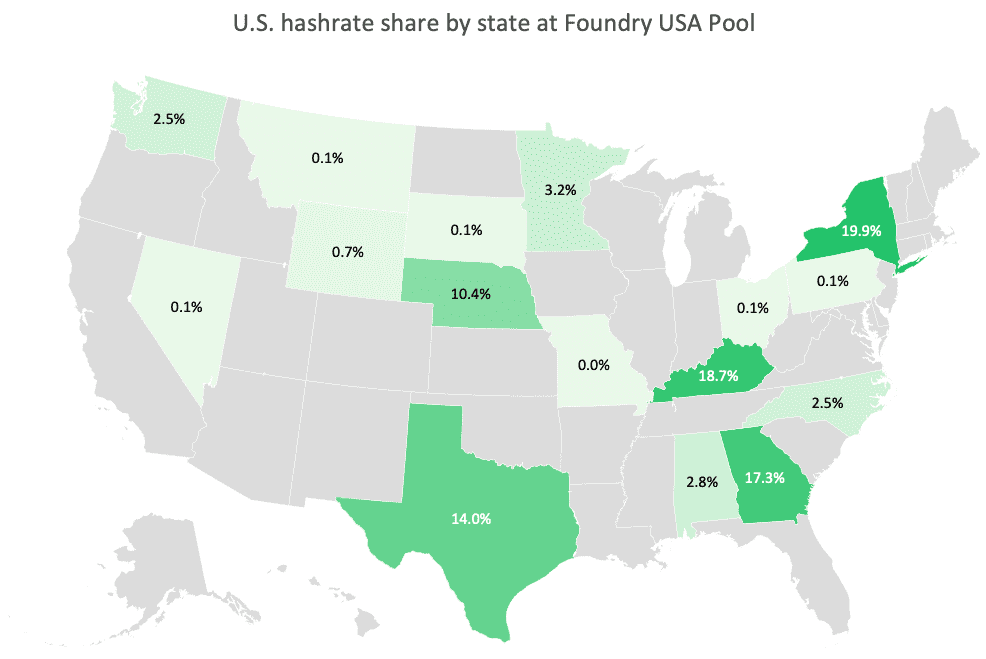

In the United States, 19.9% of bitcoin’s hashrate – that is, the collective computing power of miners – is in New York City, 18.7% in Kentucky, 17.3% in Georgia and 14 % in Texas, according to Foundry USA, which is the largest mining pool in North America and the fifth in the world.

A mining pool allows a single miner to combine their hash power with thousands of other miners around the world, and there are dozens to choose from.

“This is the first time that we have had any state level information on the whereabouts of the minors, unless you want to go through all the public documents and try to understand it that way,” he said. said Nic Carter, co-founder of Castle. Island Ventures, which presented data from Foundry at the Texas Blockchain Summit in Austin on Friday. “It’s a much more efficient way to determine where mining is taking place in America.”

But as Carter points out, the Foundry dataset doesn’t take into account all of the US mining hashrate, because not all US-based mining farms use the services of this pool. Riot Blockchain, for example, is one of the largest publicly traded mining companies in America, with a strong presence in Texas. They don’t use Foundry, so their hashrate isn’t factored into this dataset – which is part of why Texas’s mining presence is underestimated.

While the dataset captures only a portion of the country’s national mining market, it indicates trends nationwide that are reshaping the carbon footprint debate.

Many of the top-ranked states are epicenters of renewable energy, a fact that has already started to redefine the narrative among skeptics that bitcoin is bad for the environment.

While Carter acknowledges that mining in the United States is not fully renewable, he says miners here are much better at selecting renewables and buying offsets.

“Migration is definitely a net positive overall,” he said. “Moving the hashrate to the United States will result in a much lower carbon intensity.”

Where have all the miners gone

When Beijing decided to kick out all of its crypto miners this spring, about half of the bitcoin network went extinct virtually overnight. While the network itself hasn’t skipped a beat, the incident sparked the biggest bitcoin miner migration ever.

The Foundry dataset shows that the largest bitcoin mining operations are in some of the most renewable states – a game changer for the debate over bitcoin’s environmental impact.

As large-scale miners compete in a low-margin industry, where their only variable cost is usually energy, there is an incentive to migrate to the cheapest energy sources in the world, which also tend to be renewable.

Take New York, which tops the Foundry chart. One-third of its production in the state comes from renewable energy, according to the latest data available from the US Energy Information Administration.

New York is counting its nuclear plants toward its 100% carbon-free electricity target, and most importantly, New York produces more hydroelectric power than any other state east of the Rocky Mountains. It was also the third largest producer of hydroelectricity in the country.

New York’s cold climate – along with its previously abandoned industrial infrastructure ready for reuse – has also made it an ideal location for bitcoin mining.

Mining company Crypto Coinmint, for example, operates facilities in New York City, including one at a former Alcoa smelter in Massena, which harnesses the region’s abundant wind power, as well as cheap electricity produced from the dams along the St. Lawrence River. The Massena site, with a transformer capacity of 435 megawatts, is touted as one of the largest bitcoin mining facilities in the United States.

New York this year was reviewing legislation to ban bitcoin mining for three years so it could conduct an environmental assessment to assess its greenhouse gas emissions. Since then, lawmakers have largely caught up with him.

“Bitcoin mining in New York is actually very low carbon, given its hydroelectric power, and therefore if New York were to ban bitcoin in the state, it would likely increase the carbon intensity of the network. bitcoin as a whole, ”Carter says. “It would be the complete opposite of what they wanted.”

Kentucky and Georgia are other states that capture much of the US bitcoin mining industry.

Beyond the fact that the governor of Kentucky is friendly with the industry, having just passed a law this year that grants certain tax exemptions to crypto mining operations, the state is also known for its hydroelectric and wind power. .

Another source of energy is connecting rigs to otherwise stranded energy, such as natural gas wells. Although coal is also an important player in the energy mix, many mining operations revolve around renewable energies.

And then there is Texas

Texas may rank fourth according to the Foundry data set, but many experts believe there is no doubt that it is currently the leading jurisdiction for minors.

Some of the biggest names in bitcoin mining have moved to Texas, including Riot Blockchain, which has a 100-acre site in Rockdale, and Chinese miner Bitdeer, which is just down the road.

Orders for new ASICs – the specialized equipment used to mint new bitcoin – show that tens of thousands of additional machines are expected to be delivered to Texas, according to The Block Crypto.

The allure of Texas comes down to a few big fundamentals: pro-crypto lawmakers, a deregulated power grid with real-time spot prices, and perhaps more importantly, access to significant excess energy that is renewable, as well as stranded or flared natural gas. .

The regulatory red carpet being rolled out for miners also makes the industry very predictable, according to Alex Brammer of Luxor Mining, a cryptocurrency pool designed for advanced miners.

“It’s a very attractive environment for miners in which to deploy large amounts of capital,” he said. “The number of land deals and power purchase agreements that are in various stages of negotiation is huge.

Some miners plug directly into the network to supply their platforms. ERCOT, the organization that operates the Texas grid, has the cheapest large-scale solar power in the country at 2.8 cents per kilowatt hour. The grid is also quickly adding wind and solar power.

“You just can’t beat the cost of electricity in West Texas, and when you pair that with a qualified energy management company that can handle your demand response programs, it’s almost unbeatable anywhere else in the world, ”continued Brammer.

Deregulated grids tend to be the most economical for miners, as they can buy power on the spot.

“They can participate in economic allocation, which means they stop buying electricity when prices go up, so you have a lot more flexibility if you’re active in the spot markets,” Carter explained.

Another major energy trend in the Texas bitcoin mining industry is the use of “stranded” natural gas to power the platforms, which both reduces greenhouse gas emissions and brings back profits. money to gas suppliers, as well as to miners.

Carter says if this is fully harnessed, gas flaring in Texas alone could power 34% of the bitcoin network today – which would make Texas not only the clear leader in bitcoin mining in the United States, but in the world.

[ad_2]

Source link