[ad_1]

A building located in Newark, New Jersey, is located in April 2018 near a construction site in an "area of opportunity". The program to stimulate investment in low-income communities originated in the 2017 tax law.

Julio Cortez / AP

hide legend

activate the legend

Julio Cortez / AP

A building located in Newark, New Jersey, is located in April 2018 near a construction site in an "area of opportunity". The program to stimulate investment in low-income communities originated in the 2017 tax law.

Julio Cortez / AP

Hidden in the 2017 law to reduce Americans' taxes, it was a program to help communities with high unemployment and degraded housing.

What is not clear, is who gets the most.

The program allows investors to postpone and potentially reduce their capital gains taxes in exchange for an investment in designated low-income neighborhoods.

Critics of "opportunity areas" claim that residents of these communities could actually be harmed rather than helped, as wealthy investors with tax breaks could benefit more than local residents.

Supporters of these areas on both sides of the aisle say that they create jobs and make a difference in places that might otherwise be left behind.

President Trump often refers to the program when he talks about what his government has done for struggling rural and urban communities – and as part of its outreach to black Americans.

Lawmakers such as Senator Tim Scott of South Carolina – the only black Republican in the Senate – and Senator Cory Booker, a Black Democrat from New Jersey running for president, have also championed this policy.

White House officials said something was needed to help some parts of the United States that are not experiencing the same economic success.

"We spend billions of dollars a year on economic development programs, yet some communities have looked the same since the riots. [of 1968] or places that have been rusted 40 years ago, "said Ja. Ron Smith, deputy director of the White House Office for American Innovation.

Smith, who helps lead the White House's efforts on areas and other domestic policy issues, told NPR that the zones were helping cities and towns to take advantage of private sector investments in innovative ways. .

But the federal law does not specify how these funds should be used; investors can build affordable housing or high-end apartment buildings.

In other words, some fear that the government's attempt to stimulate development in poor neighborhoods will eventually force the poor into more expensive new developments.

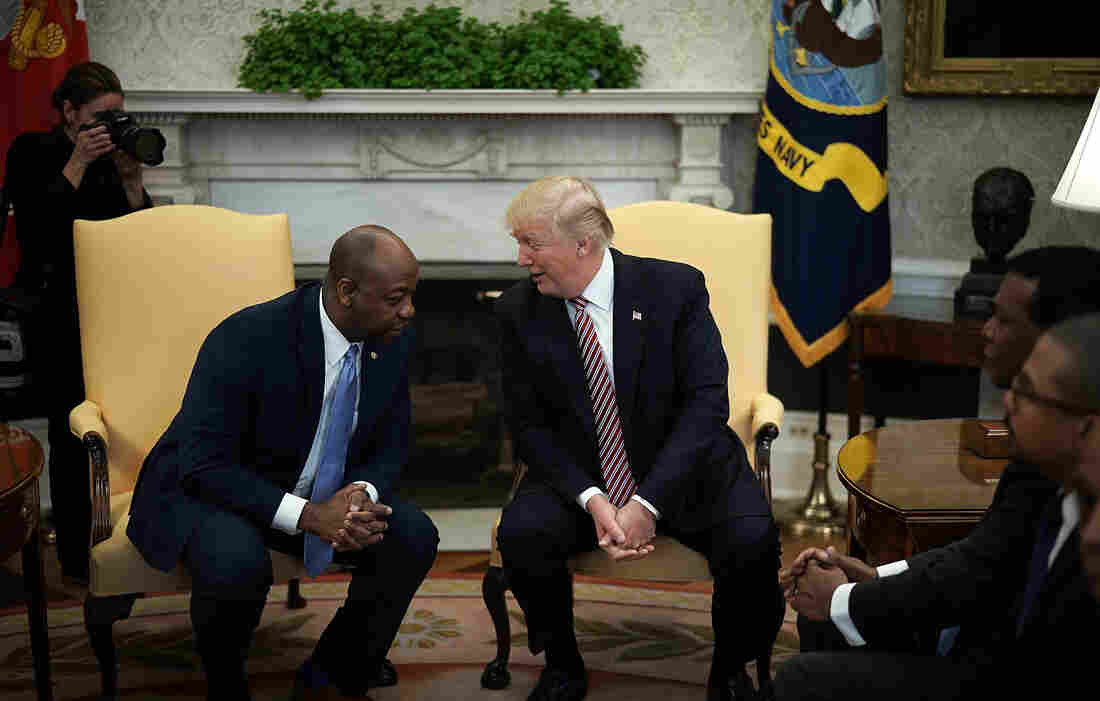

President Trump speaks to Senator Tim Scott, R-S.C., At a working session on Opportunity Zones in the Oval Office in February 2018.

Alex Wong / Getty Images

hide legend

activate the legend

Alex Wong / Getty Images

President Trump speaks to Senator Tim Scott, R-S.C., At a working session on Opportunity Zones in the Oval Office in February 2018.

Alex Wong / Getty Images

New take on the old idea

Opportunity areas are a new version of an old concept.

"Enterprise zones", which started in the United Kingdom and were established in the United States in the 1980s, had to take a different approach in less-favored areas.

"Before the 1980s, [the approach] was to consider bulldozers in the village, to eradicate old buildings and, in many cases, to change the population and try to straighten out the regions in this way, "said Stuart Butler, a conservative scholar at which is attributed the concept of "business zones" in the United States

In enterprise zones, however, the objective was to facilitate the creation of businesses by the people who live there and to provide tax incentives for those who take the risk of investing.

States began adopting their own versions of business zones and, in 1993, Congress authorized the creation of "empowerment zones". As part of the empowerment program, local governments competed for grants and tax incentives.

Proponents of the opportunity areas argue that the new areas created by the 2017 legislation are very different from their predecessors.

Butler, who now works for the Brookings Institution, shares this view, but fears that the new program may have gone too far with his incentives.

"This attracts the wrong kind of investment – a large-scale investment that could lead to much larger gentrification and population withdrawal than the original intent of the zone idea." business, "Butler said.

Become big on the areas of opportunity

Under the tax legislation, governors are allowed to designate up to 25% of low-income census tracts in their state as areas of opportunity.

Today, there are more than 8,700 opportunity areas covering nearly 35 million Americans.

Investors can defer their capital gains taxes until 2026 by putting their profits in funds of opportunity zones who invest in these communities.

Depending on how long investors keep their money in the funds, they can reduce their tax burden and possibly not pay capital gains tax on money generated by the funds.

Some critics worry that these rules will make the rich more likely to focus on their own profits than on the needs of those in the zone of opportunity.

"People who were going to invest anyway now benefit from tax relief and you may be able to transfer their investments from outside areas to inland areas," said Timothy Weaver, professor of political science at the State University of New York in Albany who studied this type of programs. "In either case, you will probably see an increase in rents for everyone."

Smith of the White House said that these criticisms are unfounded.

Smith said the program was intentionally designed to give local governments the opportunity to tailor their policies to the needs of their specific communities.

Although some cities – such as Washington DC – have seen new investments in poor neighborhoods that displace the people who live there, this is not happening everywhere, he said.

"Gentrification is not something that happens in every city – it does not happen in the Mississippi Delta, is it?" Housing is very affordable there. So it's paramount to create an economic development tool that tries to solve a problem that only affects certain urban areas – not smart, "Smith said.

The White House has also set up a council to help target federal housing grants and other funds specifically for areas.

Shay Hawkins, a former assistant to Senator Scott of South Carolina, helped create the area measure included in the tax law. He is now the head of the trade group representing the funds of the area of opportunity.

"We did not want to do one-size-fits-all, we really wanted to provide the outlines to get the capital out there and to make sure the capital is productive in the area," Hawkins said.

Hawkins argued that tax incentives could make economically feasible infrastructure projects expensive, such as increasing rural access to broadband.

However, skeptics like Weaver said that it was not clear whether the areas would actually spark new investment, especially in areas that were already booming.

"The overall problem with this whole approach is that by cutting taxes for the very rich, there is no mechanism to help the poor," Weaver said. "It's basically an application of the economy in its crudest form to poor regions."

Critics and supporters of the policy agree that it is necessary to have additional information on the impact of the areas.

The reporting requirements were included in the original measure, but were removed from the final tax bill.

The Hawkins Trade Group plans to eventually publish data from its members and the Trump Administration examines the type of information that it can collect on areas.

In addition, bipartisan bills were introduced in Congress that would impose reporting requirements and force the government to determine whether the benefits are actually being paid to the communities that need them.

The next question is when and where they will pass – and in what time frame investors and officials could find out more about the results of this money.

[ad_2]

Source link