[ad_1]

Our goal here at Credible Operations, Inc., NMLS number 1681276, referred to as “Credible” below, is to give you the tools and confidence you need to improve your finances. Although we promote the products of our partner lenders who pay us for our services, all opinions are ours.

View mortgage rates for October 8, 2021, which are largely unchanged from yesterday. (iStock)

Based on data compiled by Credible, mortgage rates have remained virtually unchanged since yesterday, with the exception of 10-year rates, which edged up.

- Fixed mortgage rates over 30 years: 2.990%, unchanged

- 20-year fixed mortgage rates: 2.750%, unchanged

- Fixed mortgage rates over 15 years: 2.250%, unchanged

- 10-year fixed mortgage rates: 2.250%, compared to 2.125%, +0.125

Rates last updated on October 8, 2021. These rates are based on the assumptions presented here. Actual rates may vary.

What does that mean: Mortgage rates closed the week virtually unchanged from yesterday, although 10-year rates rebounded to 2.250% after approaching lows in the past five days. Overall, mortgage rates remain at historically low levels, giving buyers time to secure a money-saving rate ahead of planned rate increases. Mike Schenk, chief economist for the Credit Union National Association, recently told Fox Business that 30-year mortgage refinance rates would end the fourth quarter “about a little north of 3%.”

To find the best mortgage rate, start by using Credible, which can show you current mortgage and refinance rates:

Browse the rates of several lenders to make an informed decision about your home loan.

Credible, a personal finance marketplace, has 4,500 Trustpilot reviews with an average rating of 4.7 stars (out of a possible 5.0).

Looking at Mortgage Refinance Rates Today

After hovering near the lows for five straight days, 10-year mortgage refinancing rates soared to 2.250% today. Meanwhile, the rates for the 30-year, 20-year and 15-year terms were unchanged from yesterday. These three terms are all lower than they were at the same time last year. It may still be a good time to lock in a lower rate ahead of planned rate hikes. If you are considering refinancing an existing home, find out what refinancing rates look like:

- Refinancing at a fixed rate over 30 years: 2.990%, unchanged

- Refinancing at a fixed rate over 20 years: 2.750%, unchanged

- Refinancing at a fixed rate over 15 years: 2.250%, unchanged

- Refinancing at a fixed rate over 10 years: 2.250%, compared to 2.125%, +0.125

Rates last updated on October 8, 2021. These rates are based on the assumptions presented here. Actual rates may vary.

A site like Credible can be of great help when you are ready to compare mortgage refinancing loans. Credible allows you to view prequalified rates for conventional mortgages from multiple lenders within minutes. Visit Credible today to get started.

Credible has received a 4.7-star rating (out of a possible 5.0) on Trustpilot and over 4,500 customer reviews who have safely compared prequalified rates.

How to get low mortgage rates

Mortgage and refinancing rates are affected by many economic factors, such as the unemployment rate and inflation. But your personal financial history will also determine the rates you are offered.

If you want to get the lowest possible monthly mortgage payment, the following can help you get a lower rate on your home loan:

It’s also a good idea to compare the rates of different lenders to find the best rate for your financial goals. According to research by Freddie Mac, borrowers can save an average of $ 1,500 over the life of their loan by purchasing one additional quote – and an average of $ 3,000 by comparing five quotes.

Credible can help you compare the current rates of multiple mortgage lenders at once in just a few minutes. Are you looking to refinance an existing home? Use Credible’s online tools to compare prices and pre-qualify today.

Current mortgage rates

Average mortgage interest rates have remained above 2.5% for three consecutive days. The average mortgage interest rate today is 2.560%.

Current 30-year mortgage rates

The current interest rate for a 30 year fixed rate mortgage is 2.990%. It’s the same as yesterday. Thirty years is the most common mortgage repayment term because 30-year mortgages typically give you a lower monthly payment. But they also usually come with higher interest rates, which means you’ll end up paying more interest over the life of the loan.

Current 20-year mortgage rates

The current interest rate for a 20 year fixed rate mortgage is 2.750%. It’s the same as yesterday. Shortening your repayment term by just 10 years can mean you’ll get a lower interest rate and pay less total interest over the life of the loan.

Current 15-year mortgage rates

The current interest rate for a 15 year fixed rate mortgage is 2.250%. It’s the same as yesterday. Fifteen-year mortgages are the second most common mortgage term. A 15-year mortgage can help you earn a lower rate than a 30-year term – and pay less interest over the life of the loan – while still keeping monthly payments manageable.

Current 10-year mortgage rates

The current interest rate for a 10 year fixed rate mortgage is 2.250%. It’s since yesterday. While less common than 30- and 15-year mortgages, a 10-year fixed-rate mortgage typically gives you lower lifetime interest rates and charges, but a higher monthly mortgage payment.

You can explore your mortgage options in minutes by visiting Credible to compare the current rates of various lenders who offer mortgage refinances as well as home loans. Check out Credible and get prequalified today, and take a look at today’s refinance rates via the link below.

Thousands of Trustpilot reviewers rate Credible “excellent”.

Rates last updated on October 8, 2021. These rates are based on the assumptions presented here. Actual rates may vary.

How credible mortgage rates are calculated

Changing economic conditions, central bank policy decisions, investor sentiment and other factors influence the development of mortgage rates. Credible’s average mortgage rates and mortgage refinance rates are calculated based on information provided by partner lenders who compensate Credible.

The rates assume that a borrower has a credit score of 740 and borrows a conventional loan for a single family home that will be their primary residence. Rates also assume zero (or very low) discount points and a 20% deposit.

Credible mortgage rates will only give you an idea of current average rates. The rate you receive may vary depending on a number of factors.

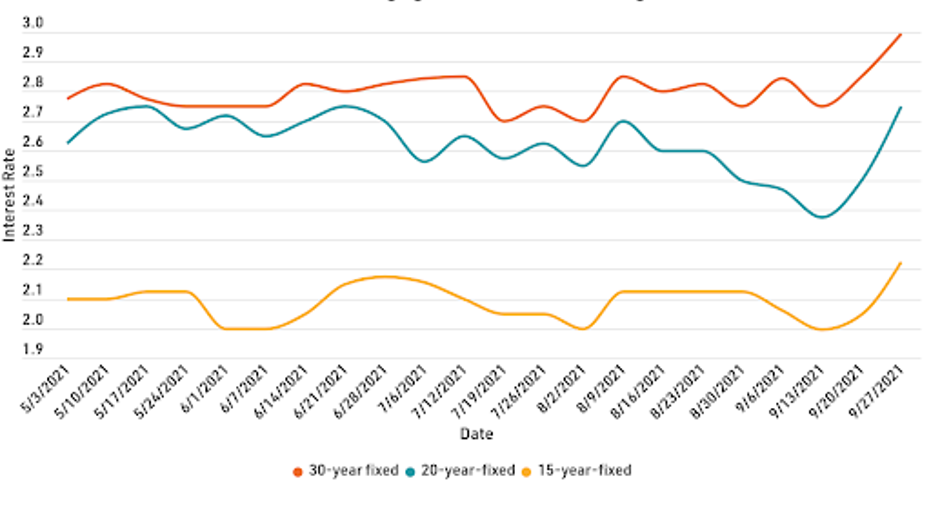

How mortgage rates have changed

Today, mortgage rates are largely unchanged from the same period last week.

- Fixed mortgage rates over 30 years: 2.990%, the same as last week

- 20-year fixed mortgage rates: 2.750%, the same as last week

- Fixed mortgage rates over 15 years: 2.250%, the same as last week

- 10-year fixed mortgage rates: 2.250%, compared to 2.125% last week, +0.125

Rates last updated on October 8, 2021. These rates are based on the assumptions presented here. Actual rates may vary.

These rates are based on the assumptions presented here. Actual rates may vary.

If you are trying to find the right rate for your mortgage or are looking to refinance an existing home, consider using Credible. You can use Credible’s free online tool to easily compare multiple lenders and see prequalified rates in just a few minutes.

With over 4,500 reviews, Credible maintains an “excellent” Trustpilot score.

Factors that influence mortgage rates (and are beyond your control)

There are many factors that influence the interest rate a lender can offer you. Some, like your credit score, are in your control. But others that you don’t have the capacity to affect, such as:

- The economy – During a financial downturn, the Fed may lower interest rates in an attempt to stimulate the economy. And when the economy is doing well, interest rates can rise.

- Inflation – Interest rates tend to move with inflation. When the overall cost of goods and services increases, interest rates are also likely to rise.

- The Federal Reserve – The Fed can choose to lower interest rates to stimulate a struggling economy, or to raise rates to try to curb inflation.

- Macroeconomic employment trends – When many people are unemployed, as they were during the months of pandemic lockdown, mortgage rates can drop. As employment increases, interest rates also rise.

Looking to lower your home insurance rate?

A home insurance policy can help you cover unforeseen costs you might incur during homeownership, such as structural damage and destruction or theft of personal property. Coverage can vary widely from insurer to insurer, so it’s wise to shop around and compare policy quotes.

Credible is a partner of a home insurance broker. If you are looking for a better home insurance rate and are considering switching providers, consider using an online broker. You can compare quotes from top rated insurance companies in your area – it’s quick, easy, and the whole process can be done entirely online.

Have a finance-related question, but don’t know who to ask? Email The Credible Money Expert at [email protected] and your question could be answered by Credible in our Money Expert column.

As a credible authority on mortgages and personal finance, Chris Jennings has covered topics such as mortgages, mortgage refinancing, and more. He was an editor and editorial assistant in the online personal finance field for four years. His work has been featured by MSN, AOL, Yahoo Finance, and more.

[ad_2]

Source link