[ad_1]

You want a mortgage? If this is the case, it is better to obtain a credit score higher than 650, otherwise 700.

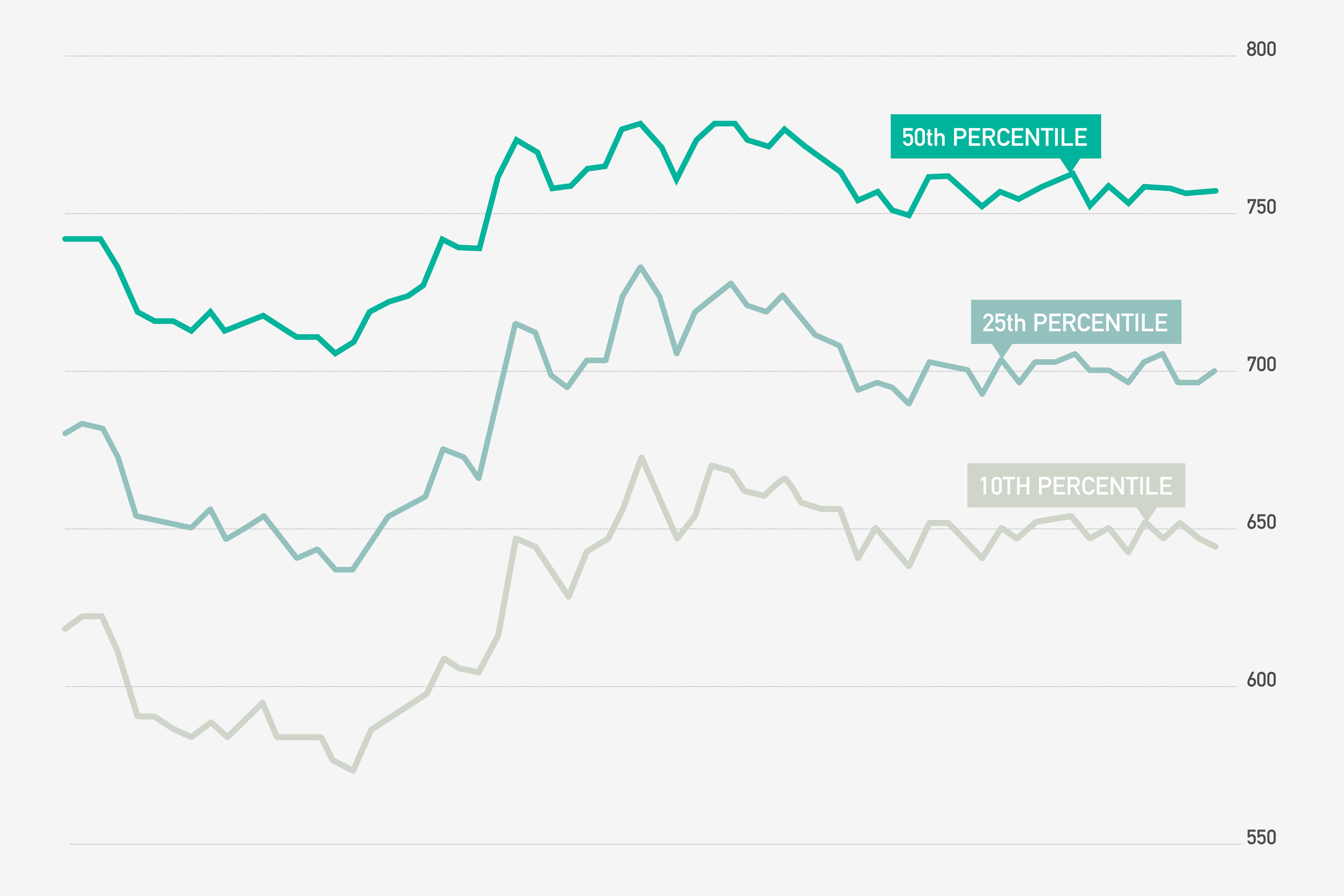

<p class = "canvas-atom canvas-text Mb (1.0em) Mb (0) – sm Mt (0.8em) – sm" type = "text" content = "Data from the Federal Reserve show that 9 out of 10 American mortgages go to borrowers with a score of 650 or more. Three-quarters go to borrowers with scores above 700. "data-reactid =" 12 "> The Federal Reserve's data shows that 9 out of 10 US mortgages go to borrowers with a score of 650 or more. go to borrowers with scores of better than 700.

<p class = "canvas-atom canvas-text Mb (1.0em) Mb (0) – sm Mt (0.8em) – sm" type = "text" content = "Any credit score between 670 and 739 is considered as " well," according to the credit rating agency Experian. The national average score last December was 704, which means that the vast majority of mortgages go to Americans with above-average credit. The credit ratings of Americans also vary a lot according to their age. The average age of 18-29 is only 659, suggesting that many consumers in their twenties may find it more difficult to find a mortgage lender than older Americans. "Data-reactid =" 13 "> Any credit score between 670 and 739 is considered" good ", according to the Experian rating agency.The average national score was 704 last December, which means that the vast majority of mortgages go to Americans with above-average credit ratings.The credit scores of the United States also vary a lot according to their age – the average of 18- to 29-year-olds is only of 659, suggesting that many consumers in their twenties may find it more difficult to find a mortgage lender than older Americans.

New York Fed / Equifax Consumer Credit Panel

<p class = "web-atom canvas-text Mb (1.0em) Mb (0) – sm Mt (0.8em) – sm" type = "text" content = "The target credit target lenders, according to the Fed data , are higher than the official minimum of 620 for loans guaranteed by government agencies Fannie Mae and Freddie Mac, the cheapest option for many homeowners. Mortgage loans backed by the Federal Housing Administration are a popular option for first time homebuyers. You can claim it with a score as low as 500 if you can also make a down payment of at least 10%. "Data-reactid =" 25 "> According to Fed data, the interest rates of targeted lenders are above the official minimum of 620 loans guaranteed by Fannie Mae and Freddie Mac government agencies, the option the cheapest for many homeowners, supported by the Federal Housing Administration, which you can claim with a score as low as 500 if you can also make a down payment of at least 10%.

<p class = "canvas-atom canvas-text Mb (1.0em) Mb (0) – sm Mt (0.8em) – sm" type = "text" content = "Keith Gumbinger, vice president of HSH.com mortgage websiteindicates that the best choice for most potential homeowners is 700 to 720. Borrowers with a credit rating below this level may face problems, such as high interest rates and low ceilings. the amount that the lenders will allow them to borrow. "You can get a mortgage with a low credit score," he says. "But that may not be beneficial for your [home buying] "Data-reactid =" 26 "> Keith Gumbinger, Vice President of the HSH.com Mortgage Site, says the best choice for most potential homeowners is 700 to 720. Borrowers whose credit level is below that They may be facing problems like high interest rates and low ceilings on the amount lenders will allow them to borrow. "" You can get a mortgage with a low credit rating, "he says. it may not be beneficial for your business. [home buying] transaction."

Lenders are also much stricter today than in the years leading up to the real estate bankruptcy in 2008, when the median loan had been granted to borrowers with credit ratings of around $ 50,000. 700 and about 10% of borrowers well below 600.

You fear not to qualify?

<p class = "canvas-canvas-text canvas Mb (1.0em) Mb (0) – sm Mt (0.8em) – sm" type = "text" content = "There are several ways to increase your credit. It is obvious that paying your bills on time counts. But factors such as the length of your credit history and the amount of unused credit available to you. "data-reactid =" 29 "> There are many ways to increase your credit score, it is obvious that paying bills on time counts, but so are factors like the length of your credit history. credit and the amount of unused credit available.

[ad_2]

Source link