[ad_1]

Good things come in threes, we often say. But what happens when a once tight threesome is dominated by a powerful couple?

In the world of asset management, BlackRock BLK,

State Street Global Advisors STT,

and Vanguard have been known for several years as the “big three” behemoths, eclipsing everyone in a matter of degrees. Their scope was seen as so broad and stubborn that everything has been written about it, from academic studies to opinion editions.

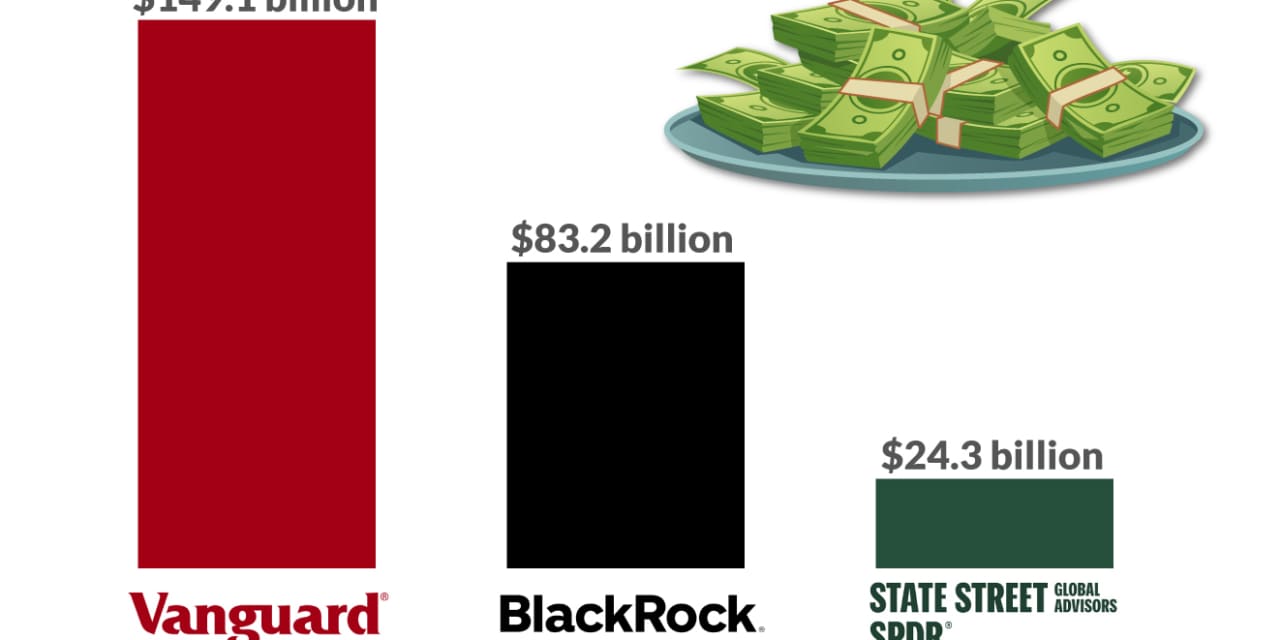

But more recently the Big Three have started to look a bit more like the Big Two.

As the ETF industry grew and evolved, flows to State Street, the home of the original ETF, began to lag behind those of its peers.

To be clear, the company is still a giant, with $ 5.8 trillion in ETF assets under management. But “the gap has widened” between the money they’re raising and what’s been going on in Vanguard and BlackRock “over the past few years,” said Todd Rosenbluth, who leads mutual fund research. and ETFs for CFRA.

This is mainly because ETFs are increasingly accepted by mom and pop investors and their advisers, Rosenbluth told MarketWatch. State Street has historically positioned itself for an audience of institutional / commercial investors willing to pay slightly higher fees for greater marketability, and not for buy and hold investors looking for a broad asset allocation. Among this growing class of investors, “fees matter most,” said Rosenbluth.

See: Are ETFs Safe… for Retail Investors?

Another trend that has played against State Street in recent years is the growing adoption of fixed income ETFs, an area that BlackRock and Vanguard’s iShares suite of products have dominated. State Street has a range of bond funds, but it’s much smaller, Rosenbluth noted.

As these trends manifest themselves, State Street has responded by launching lower-cost versions of its popular funds, including one to complement its flagship product, the world’s first ETF, the SPDR S&P 500 ETF Trust SPY,

and the very first gold ETF. These steps will likely shift the needle somewhat in terms of future flow, Rosenbluth thinks – but Vanguard and BlackRock may have a small advantage.

Related: This graphic shows how Vanguard’s explosive growth ‘took on a life of its own’

“Entries will continue to be concentrated in companies that offer relatively inexpensive and diverse products because there is a snowball effect to that,” he said. “Because they are designed to follow the market, they will give the investor a more comfortable experience.”

It is also difficult for a family of funds to shield investor assets from competitors in a market like this. “Money is less likely to be taken out of these products because they are not underperforming,” Rosenbluth said in an interview. “They are designed to track the performance of a commonly followed benchmark.”

[ad_2]

Source link