[ad_1]

I would say that I could think of more serious developments for a fragile market at a critical moment than in-depth antitrust investigations on some of the most important companies in America, but that would not be entirely true.

To be clear, it has been evident for at least 14 months (that is, since last March when concerns about privacy and certain presidential positions against Amazon shook the large cap technology) that an antitrust review was probably intended for all major technology enthusiasts. But it is not because something has been well telegraphed that the message will be digested with eagerness.

Short story (and I think the abridged version is all that is needed at the moment), the FTC and the Justice Department will launch a review of possible anticompetitive practices among large technology companies . This includes Facebook (NASDAQ: FB), Amazon (AMZN) and Google (GOOG). Apparently, Apple (AAPL) will also be examined, under the jurisdiction of the DoJ.

Unfortunately for these companies, some of the most influential politicians on both sides of the scene share the idea of looking for anticompetitive practices. Indeed, it is quite rare for Elizabeth Warren and President Trump to agree on anything, and although they may differ in terms of Why Some of the companies listed above should be "reviewed" (to quote the chair), they each called for a thorough review. For his part, Trump has repeatedly insisted that Goggle was biased against the conservative media and Warren explicitly called for Google, Facebook and Amazon to be dissociated in a high-profile March publication on Medium.

I'm not going to expand on the merits of these burgeoning probes nor address the political angle – believe it or not, it's a problem for which the politics of the situation interests me little.

What interests me, however, is the extent to which this news strikes at the worst possible moment. Markets are desperately trying to cope with climbing after each other, and the prospects for global growth are getting darker by the day. Large cap technology has been a pillar of market support for years and these names are so widely held that the massive liquidation of shares could actually be unpleasant. Remember that Q4 was characterized by broken roads in technology and that it was not well digested – at all.

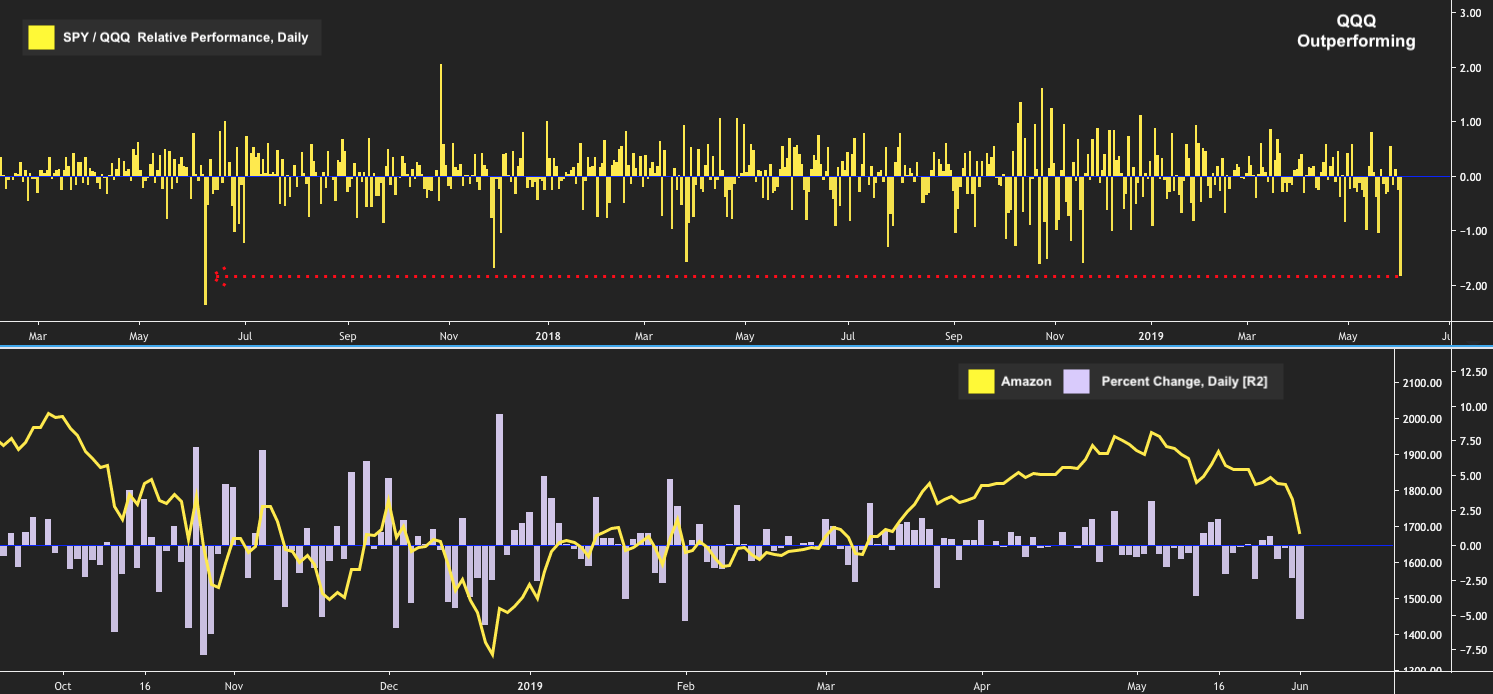

Notably, on Monday, the Invesco QQQ ETF (QQQ) underperformed the SPDR S & P 500 Trust ETF (SPY) by the largest margin since June 9, 2017 (top panel of the visual):

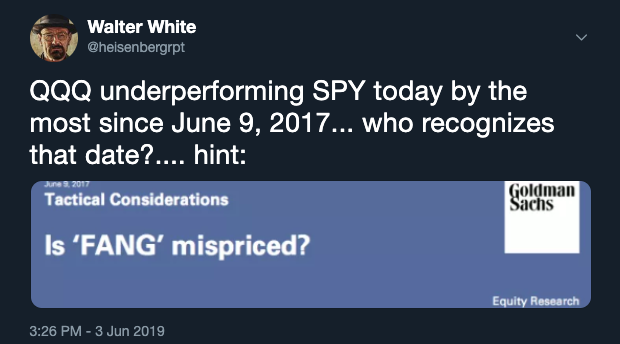

Do you recognize this date? If not, let me help you, via this practical tweet this afternoon:

On June 9, 2017, Goldman released its infamous "FANG FALSE" note, suggesting, among other things, that factor crowding was a risk to the markets. I had written about it for this platform at the time in Goldman's Big Fang Call: they are "misjudged", "Factormageddon" is taking shape ".

By the way, Goldman's analysis still applies, but I do not want to go too far into the bunny burrow. Instead, I just want to make a few simple observations and then talk a little about macro.

First, these companies are too important to suffer a sort of existential crisis on the eve of a possible economic slowdown in the United States (and by "existential crisis", I simply want to say that everyone is forced to sort through future, as in different regulatory regimes).

Even if you assume a positive result in the trade war, this cycle is long in the tooth. If you do not consider the yield curve, we are about a year away from the recession (it's debatable, but I'm talking about generalities here). At the same time, the profitability of US companies has probably peaked, at least for this cycle, and margins due to rising labor costs and tariffs are likely to materialize in the near future. ;to come up.

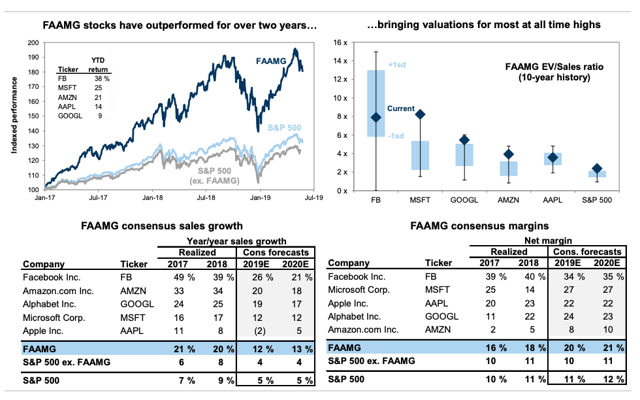

The snapshot below, taken from a recent Goldman presentation (in progress through May 24), is a prime example of the critical nature of these companies (note, for example, the growth figures of FAAMG's business turnover compared to S & P's as a whole, and the same comparison of margins):

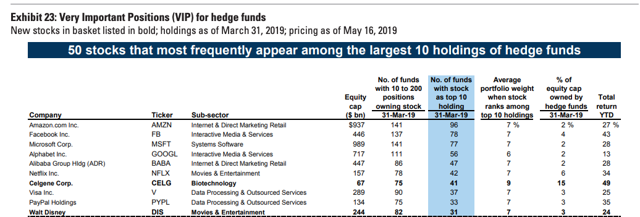

Now take a look at the top 10 stocks in Goldman's VIP hedge fund list, which reads, quote: "the 50 stocks whose performance will have a decisive influence on the long side of many hedge funds focused on fundamentals ":

Let me just repeat, again, that we are trying to write something on this topic that is both succinct and comprehensive in terms of capture. I) the multitude of issues related to how the government could respond to critics' concerns about Amazon, Google and Facebook, and ii) The potential impact on the market of an in-depth review of how these mammoths are treated in Washington is impossible. My goal here is simply to remind everyone that the importance of these names to the market goes well beyond the sensible assessment that because these companies are ubiquitous they are important.

This latest disconcerting news (at least from the point of view of those who only care about the short-term direction of equities) comes at a time when market participants have digested the predictable daily dose of commercial war damage claims. On Sunday night, The New York Times reported that the Trump government had considered slapping tariffs in Australia last week, and early Monday morning the Chinese Ministry of Education issued a warning to students and academics about their studies in the United States.

None of these two evolutions is trivial.

The Australian news is puzzling for obvious reasons (that means we almost got even more tariffs last week in addition to the situation in Mexico and in addition to the Trump administration's decision to remove the status India's SGP), while China's warning to students valid Analysts have long feared that the Sino-US dispute is now spreading in areas that have little (if anything) to see with the economy and trade.

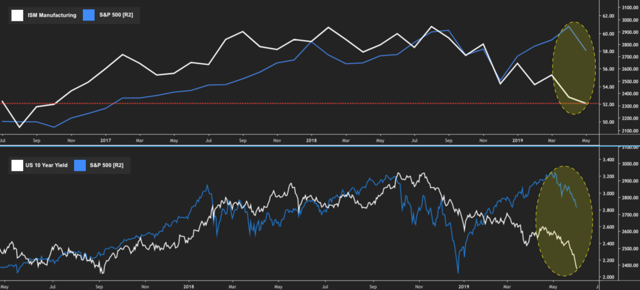

At the time when Hu Xijin, editor of the Global Times, first posted a tweet about student notification, the 10-year US rate of return fell to 2.07 %. It is incredible, given our situation in September, and it shows how global growth has become a source of acute concern. Later in the session, ISM Manufacturing printed the lowest of the Trump presidency. The gap between shares, on the one hand, and the ISM and bond yields, on the other, is not about to close, which, according to the pessimistic among you, suggests that equities have yet to fall.

Expectations for Fed cuts are now overworked. On Monday, discussions revolved around the extent to which Jerome Powell needs to reduce this monthif he wants to orchestrate a dovish surprise. This is a worrying setup, as it suggests that the Fed simply can not catch up to market expectations (ie, there is no way to be accommodating enough). This in turn means that any reduction below, say, a 25 basis point reduction this month or an indication that the July meeting will likely bring an insurance discount of 50 basis points, with insurance , risk of giving the impression of being a factual rate hike compared to market expectations. Nomura's Charlie McElligott said this in a note Monday morning.

For the Powell Fed, the dilemma is that lowering rates may create a scenario in which the White House is encouraged to go ahead with even higher rates, knowing that the central bank actually provides coverage . Higher tariffs pose an additional risk of inflation and growth, which means that, paradoxically, if the Fed were to make a reduction now in an attempt to counter a trade-related slowdown, the situation could worsen if the reduction from insurance came to an end be considered by the administration as a green light to intensify the trade war.

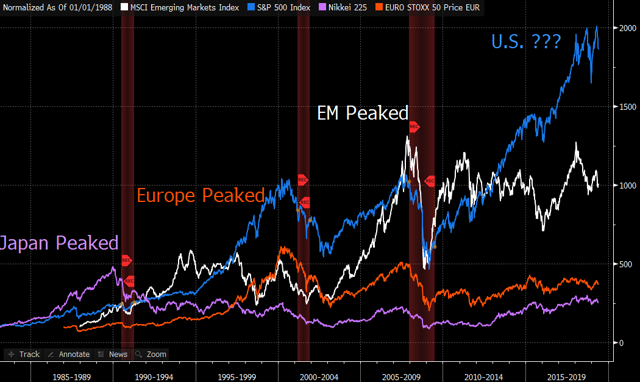

And with all the above in mind, I leave you with one last chart, that of Bloomberg Ye Xie, who kindly posted on Twitter:

Disclosure: I / we have / we have no position in the actions mentioned, and do not plan to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link