[ad_1]

The cyclically-adjusted price-earnings ratio (CAPE) is a surprisingly controversial measure, but available data suggest that it can be used by long-term investors.

Rather than simply dividing the current share price by one year of earnings, like the normal P / E ratio, the CAPE ratio divides the current price by the adjusted earnings of inflation over the last 10 years. This gives you a better idea of the low price of a stock or stock market versus a full earnings cycle, rather than a year of record or maximum earnings.

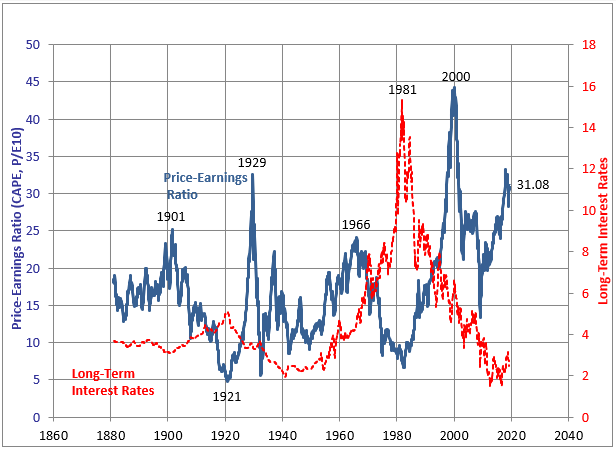

This measure was popularized by Robert Shiller, a professor at Yale, and more than a century of data suggests that periods of high CAPE are associated with low term returns for the S & P 500 (SPY) and that Low CAPE periods are associated with high forward returns.

This therefore does not give much information on how to synchronize the market in the short run, but on the probability distribution of long-term returns for a given market.

But as interest rates have fallen in the United States, CAPE ratios have risen sharply:

(Chart source: Robert Shiller online data)

Critics of the CAPE ratio argued that this makes the CAPE ratio irrelevant. Despite historically high CAPE ratios in recent years, S & P 500 equity returns have been quite good.

However, an excellent article by Meb Faber shows why it is important to think more globally. The United States is not your only pond in which to fish.

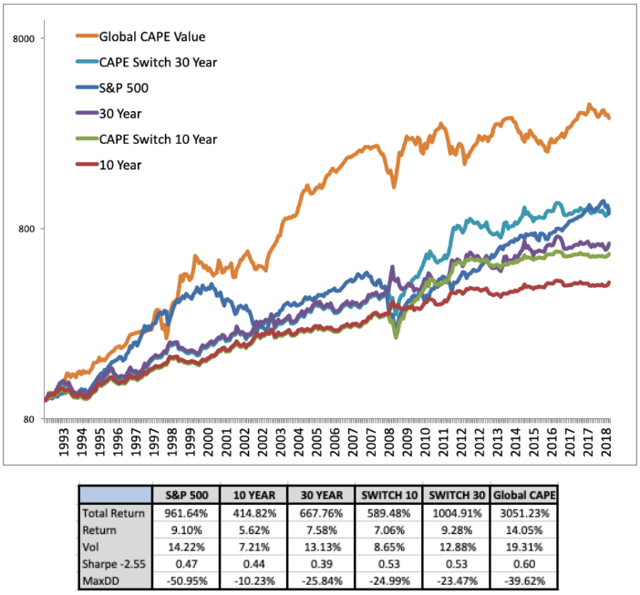

More specifically, his research shows that, from 1993 to 2018, investors who continuously built a portfolio around the cheapest 25%, based on the CAPE ratio (orange line below), would have generated 3051% total returns over 25 years, compared to 961% returns from the S & P 500 (dark blue line below):

(Graphical source: Meb Faber, Cambria Investment Management)

This graph is logarithmic rather than linear, so it minimizes the performance of this strategy. The table describes it more clearly. On an annualized basis, the overall low CAPE strategy generated annual returns of around 14% versus 9% for the S & P 500. The volatility of the overall CAPE strategy was greater than that of the S & P 500, but its maximum draw was actually less than geographical diversification.

So yes, the S & P 500 has performed well despite a historically high CAPE ratio in recent decades. However, a basket of markets with lower CAPE ratios beat these returns. All is relative.

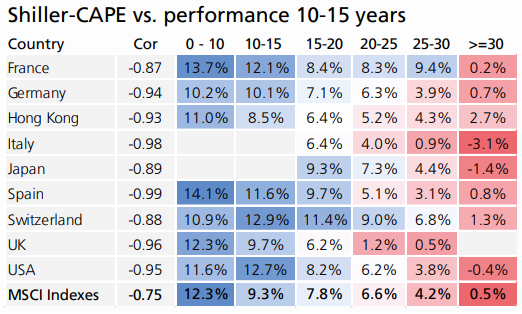

The Star Capital research group showed similar results. For 17 developed markets over a 36-year period between 1979 and 2015, the markets of the purchasing countries with low CAPE ratios significantly outperformed the markets of the buying countries when the CAPE ratio was high:

(Source of chart: Star Capital Research in Charts)

Sometimes, many markets are highly valued or inexpensive at the same time, and sometimes you can find pockets of value while others remain expensive.

Of course, this does not guarantee future returns. It is plausible that this strategy may stop working, although I have never seen a convincing justification for its effectiveness.

The warning is that it would be a terrible, scary and heartbreaking strategy to follow. Not necessarily because of volatility, but because of the headlines. Anything you read about your wallet would be bad because you would be invested in countries like Russia, Turkey and Italy all the time. It is the quintessential strategy to buy when there is blood on the streets, on a global scale. Most people can not handle this, especially during multi-year periods when the strategy is underperforming.

The advantage, however, is that this type of strategy is diverse. As a result, one or two value traps (situations in which a low CAPE country in any case generates mediocre long-term returns) will probably not defeat the strategy.

I have a long-term bullish outlook on a large subset of emerging markets (EEMs) from the relatively low valuation point and weak currencies against the US dollar. Naturally, many people are not fans of them. They talk about corruption and other undesirable aspects of the markets and often overlook the positive aspects. Investing too heavily in an emerging market is very risky, but diversifying into a basket, only placing a portion of a fully diversified portfolio in this basket, and rebalancing consistently in times of weakness is traditionally a good thing to do. if you want high risk-adjusted returns.

I would be interested to see more research on the subject of evaluations in general. Is the selection of the 25% of the cheapest countries the important part, or simply by avoiding the most expensive 25%? Perhaps this type of revised strategy would yield fairly high returns but would be easier to track. It can also reduce turnover and minimize the capital gains tax.

As I will show below, I like to go beyond pure valuation to take other steps to reduce my exposure to value traps. For example, I'm underweight Europe and much of the EAFE (EFA) right now, even though CAPE ratios are pretty low for the most part. I like cheap markets on an absolute basis, but more importantly, I like cheap markets relative to their fundamentals, such as growth, debt, stability and the strength of the currency. .

The cheapest markets today

In the United States, there is a lot of capital that pushes asset values to high levels. Investors, pension accounts, pension plans and foreign investors play a large part in the stock market.

In many foreign markets, particularly emerging markets, equity is much smaller. Local investors often buy real estate instead, which results in low participation in the stock market. So you can get a lot of profits and dividends for every dollar invested.

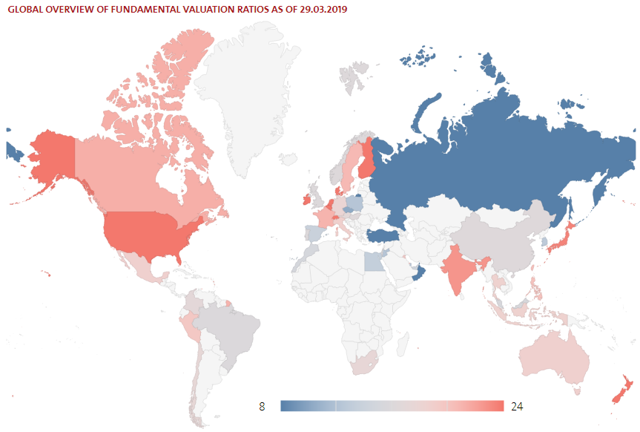

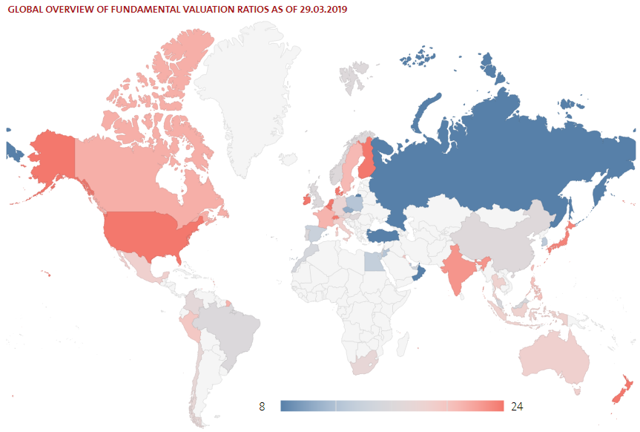

Star Capital maintains an excellent interactive map that shows the cheapest markets based on various parameters, including CAPE:

(Source of the chart: Star Capital Evaluation Card)

Currently, Russia (RSX), Turkey (TUR), Poland (EPOL), South Korea (EWY), Singapore (EWS), Spain (EWP), Malaysia (EWM), Israel (EIS) and Brazil (EWZ) have some of the lowest CAPE ratios. The United Kingdom (EWU) and China (MCHI) are not far behind.

But talk about portfolio securities; All you read about your investments would consist of sanctions, Brexit, debt bubbles, corruption, trade wars and currency crises!

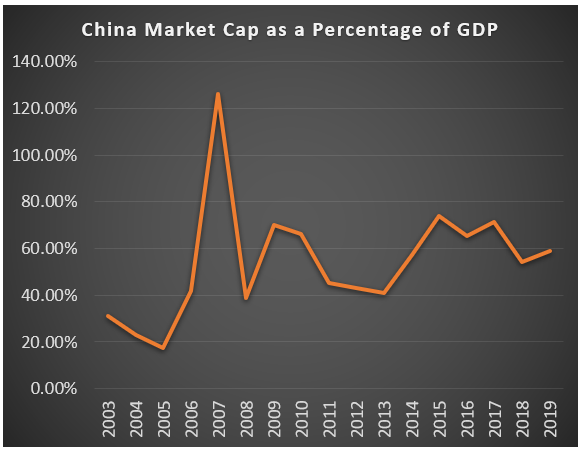

In addition to CAPE, I also like to follow the market capitalization / GDP ratio of the markets. This indicator can not be compared across countries because some countries derive much more from their income from foreign companies than others, but it is useful for comparing a country to its own recent historical identity.

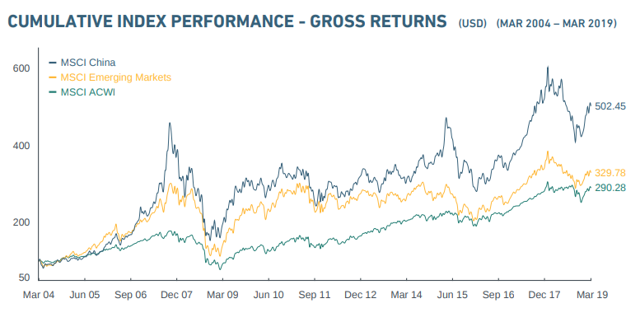

By this measure, China had a clear bubble in 2007:

(Data sources: World Bank and MSCI)

China's CAPE ratio was also north of the 60th parallel, which is higher than the valuation of the US market during the dot-com bubble. In fact, most of the BRIC countries were overvalued in 2007 due to euphoria regarding their growth prospects.

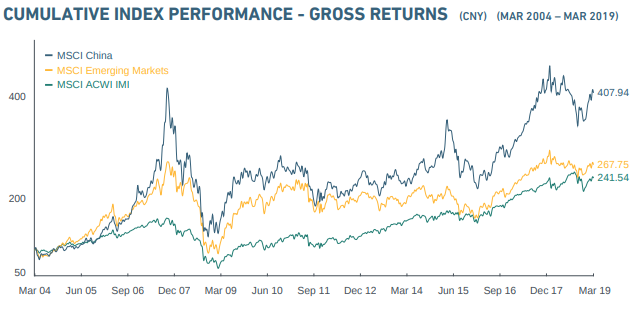

The MSCI index for China has taken a decade to fully recover from this bubble in USD and CNY:

(Graphic source: MSCI)

(Graphic source: MSCI)

What makes a good market?

Rather than focusing strictly on the cheapest markets, I prefer to invest in markets with an attractive balance between valuation, growth, debt, stability and monetary fundamentals. There are always tradeoffs to be made, but some countries offer better global packages than others, and I review several metrics for each of these five categories.

This process helps to filter bubbles, while allowing investment in high value-added and growth-at-a-reasonable-price (GARP) markets.

Evaluation

Rather than focusing only on the CAPE ratio, I also take into account the current ratio of market capitalization to GDP relative to recent levels for this country, as well as the price-to-book ratio and the average dividend yield. .

It is important to also take into account the sectoral distribution in this country. The cheapest countries may not be very exposed to technology or health care, for example, but instead have many banks and commodity producers, who usually trade for lower valuations around the world.

Growth

Valuation does not say much without taking into account growth. Some countries deserve higher valuations because they have better growth and better demographics.

Peter Lynch popularized the PEG ratio for companies, which is the P / E ratio divided by the growth rate. Applying this to countries means dividing their current P / E ratio or CAPE ratio by their expected long-term GDP growth rate, as judged by the IMF or other research. This gives you a kind of PEG ratio for different country stock markets, which is a rough but interesting indicator when it is applied on a large scale rather than individual stocks.

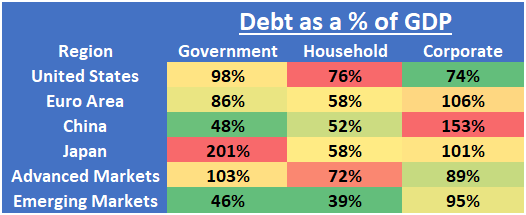

Debt

Some countries have experienced growth mainly due to indebtedness, which is unsustainable when it reaches high levels. The Bank for International Settlements has a good database that allows you to search the debt of households, businesses and governments as a percentage of GDP for dozens of countries. It also has measures for advanced markets and emerging markets combined:

(Data source: BIS Statistics Warehouse)

Stability

Some countries are bastions of stability without much drama. They lack major political instability, have low levels of terrorism, do not have many international conflicts and have a strong legal system and a good history of respect for the capital. Other countries have gaps in one or more areas.

All other things being equal for risk-adjusted returns, it is rational to pay to a certain extent for more stable countries and to discount less stable countries.

Motto

A significant risk to international investment, particularly in emerging markets, is that their local currency will weaken considerably compared to yours, or more particularly to the dollar, as many of their governments and businesses have debts denominated in dollars.

For this reason, it is useful to monitor multiple currency metrics. The indicators I focus on include a country's current account balance, real interest rates, dollar-denominated external debts, and size of foreign exchange reserves relative to GDP and money supply. at large.

In retrospect, most currency crises are evident and are developing in countries with large current account deficits, high dollar debt and no significant foreign exchange reserves.

The differences in purchasing power should also be noted, as countries whose currencies are undervalued have an advantage over exports and can at least partially return to their historical average.

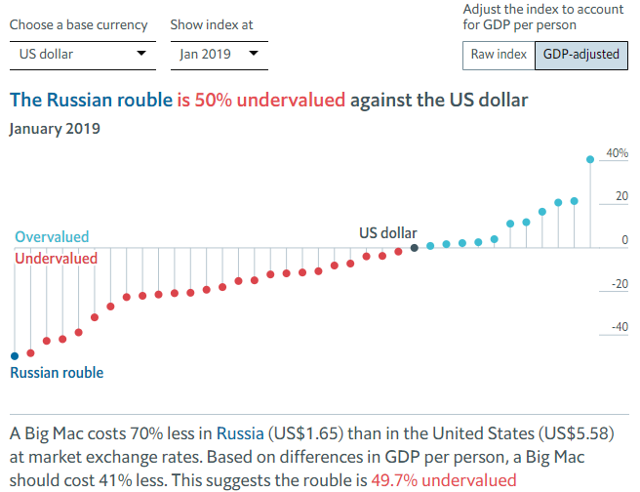

One of the most interesting and humorous indicators is the adjusted version of GDP for the Big Mac index, calculated twice a year by L & # 39; economist:

(Graphic source: L & # 39; economist)

The Russian ruble, for example, is underestimated at 70% on the basis of the gross calculation and remains at 50% when its GDP per capita is lower than that of the United States. This is despite the fact that Russia has one of the lowest debt levels in the world, a positive current account balance, positive real interest rates and very high foreign exchange reserves, both in terms of GDP and overall of their money supply. The sanctions are frightening investors, perhaps rightly so, but this potentially offers a strong upside potential if these tensions subside rather than intensify. In other words, it may be an asymmetric opportunity, although it is probably best to keep it as a small position.

US investors in Russian equities would likely benefit if the ruble strengthened against the dollar. On the other hand, as long as the currency remains as cheap, Russia enjoys a considerable price advantage for wheat exports and other commodity markets.

Put all together

The reason that the purchase of cheap markets has always worked well is the sum of the results obtained. Cheaper markets tend to have higher dividend yields, lower valuations are more likely to grow than shrink, and weak currencies are more likely to return at least partially to the average than to plunge further if they are considered in the long term. Contrary to popular belief that trees do not grow in the sky, the majority of markets do not fall into permanent abyss either.

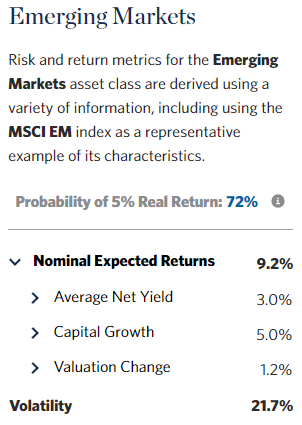

This chart, for example, presents an estimate of the long-term long-term performance of emerging markets of Research Affiliate, based on the sum of its parts estimated in its asset allocation tool:

(Source: Research Affiliates)

Given that investors tend to outperform in both directions, the prices of the best performing markets are often too optimistic, while those in distressed markets are too pessimistic.

Last thoughts

Many investors have little or no exposure abroad.

And for investors who have exposure abroad, they usually hold something wide, like the Vanguard Total International Stock ETF (VXUS), which is weighted by market capitalization and is therefore heavily invested in Japan – markets growing without any kind of evaluation filter mechanism.

If you invest a portion of your foreign equity allocation in iShares single-country ETFs or other providers representing some of the least expensive markets, or in ETFs with unique filtering mechanisms like Cambria Global Value ETF (GVAL) investors could get better returns if history offers any insight here.

Personally, I am optimistic about several long-term foreign markets. There is a lot of value in many parts of the world, with a good balance of high dividends, low debt, strong monetary fundamentals and substantial growth potential.

Disclosure: I am / we have been for a long time VWO, IEMG, RSX, TUR, INDA, EWY, EWZ, EWS. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link