[ad_1]

Do you want to "have your cake and eat it too"?

With the market in full swing in 2019, is it possible to find more efficient income supports that are still selling at a reduced price?

In fact, this is the case. Just look in the recesses of the market. In this case, we visited the world of closed-end funds – CEFs, which can be sold for a premium or a discount on their net asset value, or NAV.

Our trip took a few twists – we began by looking for public services that could be underestimated, inspired by the resurgence of this sector in 2019, thanks to the fact that the Fed was becoming more and more accommodating in its position of raising taxes. rate.

But instead of claiming only three utility actions, we checked with FECs if we could find undervalued approximations for this sector.

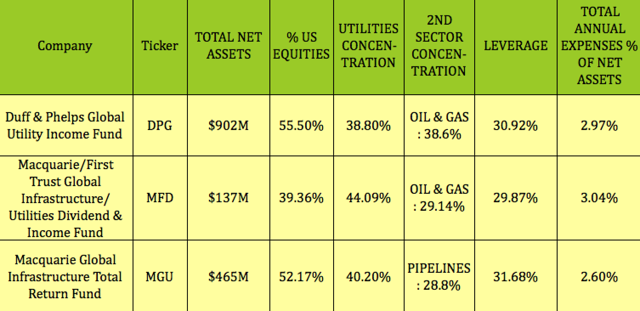

The three products that we have developed are the Duff & Phelps Utility Global Income Fund (DPG), the Macquarie / First Trust Global Infrastructure Utilities (MFD) Dividend and Income Fund, and the Global Yield Fund. Macquarie Global Infrastructure (MGU). .

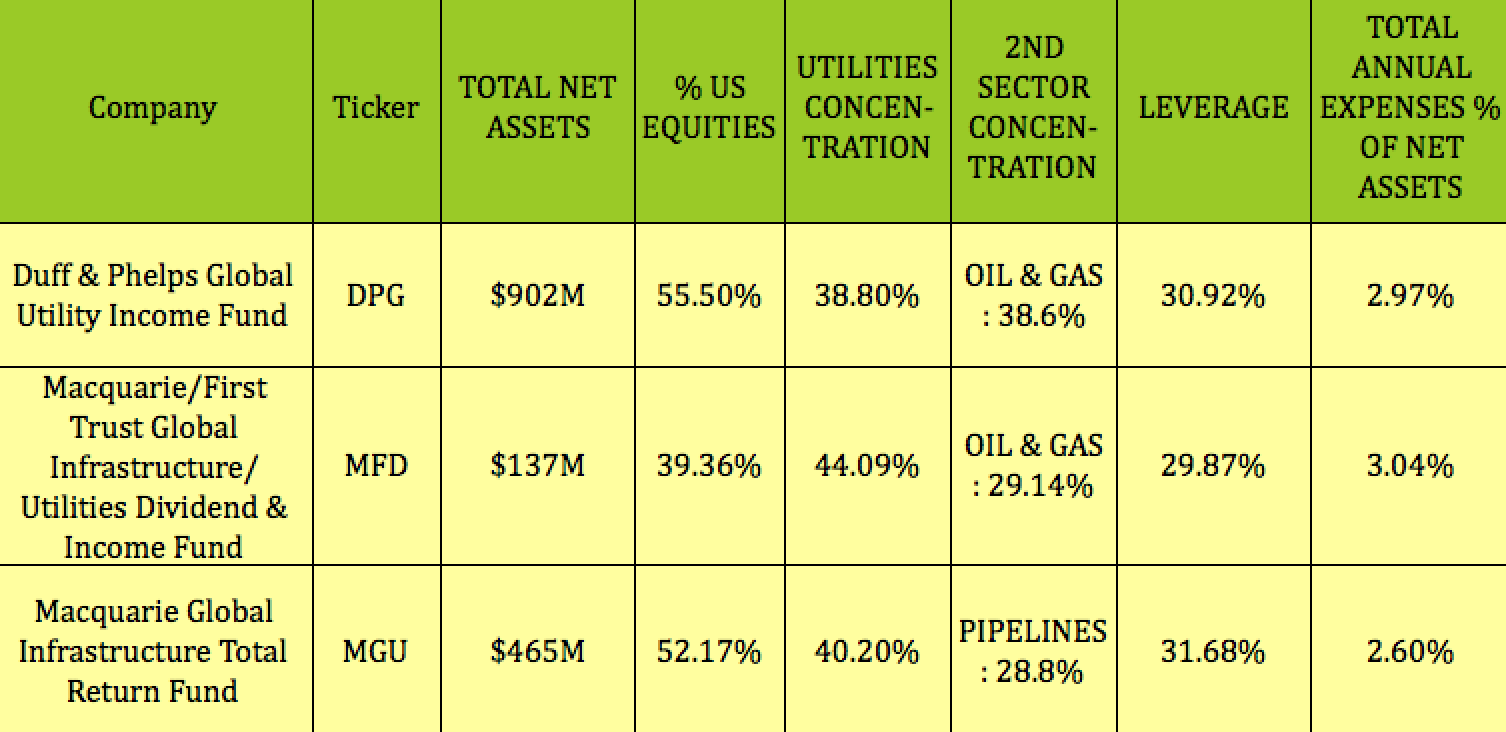

DPG is the largest of the three funds, with net assets of approximately $ 900 million. It also displays the highest concentration of US stocks, at 55.5%, but the lowest concentration of utilities, at 38.8%. Like the other funds, the second highest sectoral concentration of DPG is related to energy.

DPG also uses a 30.92% leverage to optimize its returns. The percentage of its expenditure is 2.97%, very close to the 3.04% ratio of MFD.

MFD is the smallest group in the group, with net assets of $ 137 million, but its utility concentration is the highest, at 44.09%, with oil and gas being its second largest sector, at 29%. 14%.

MGU has net assets of $ 465 million, with a 40% concentration in utilities, followed by a concentration of ~ 29% for pipelines. It has a concentration of 52% in US equities and the lowest operating expense ratio, 2.6% of the group:

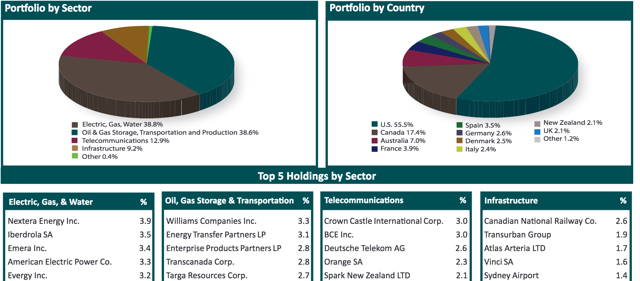

DPG's core assets are spread across four sectors: utilities, oil / gas storage / transportation, telecommunications and infrastructure. Next Era Energy (NEE) is the largest utility, followed by Spanish multinational Iberdrola Canadian Emera (OTCPK: EMRAF) and American company AEP (AEP). Evergy (EVRG).

Canada accounts for 17% of the allocation of non-US DPG countries, followed by Europe (around 15%) and Australia (7%):

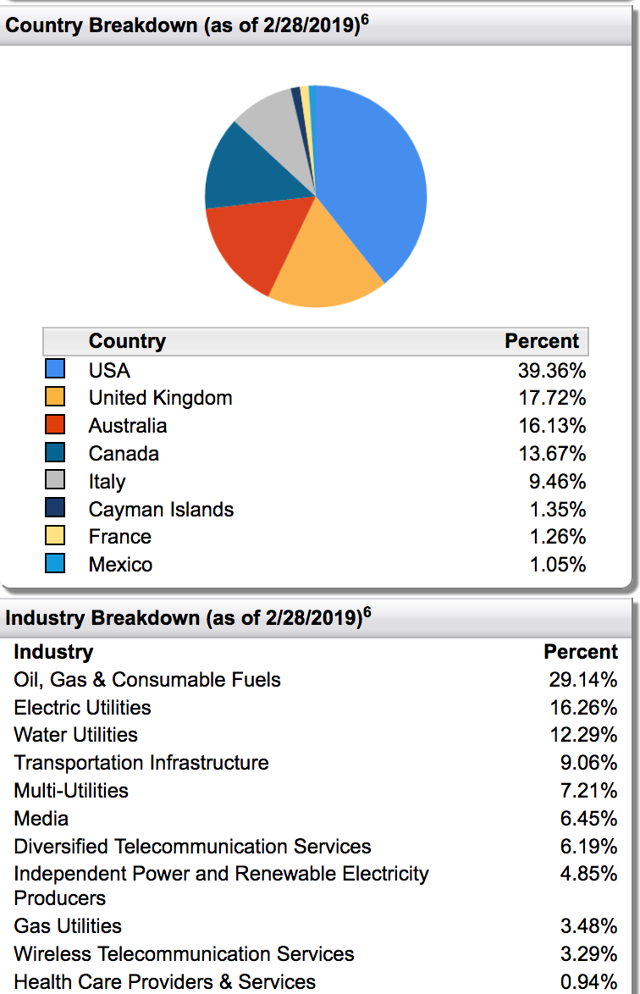

MFD has more British shares in its portfolio, 17.72%, with Australia, 16.13% and Canada, 13.67%, which make up the bulk of its non-US holdings.

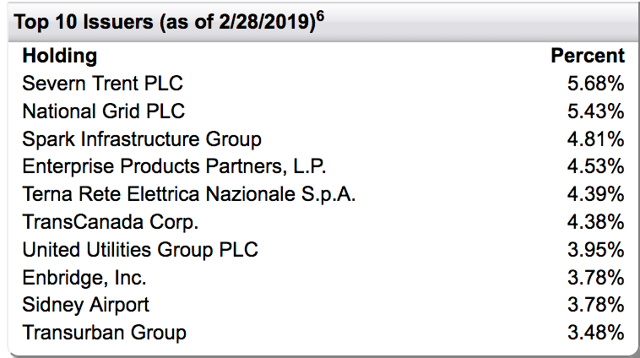

The top 10 of MFD includes British water services Severn Trent and United UtilBusiness Group and National Network (NGG), wHe also owns US assets. There are also Australian infrastructure companies, such as SPark, Sidney Airport and Transurban Group, as well as the US mid-market giant Enterprise Products Partners LP (EPD):

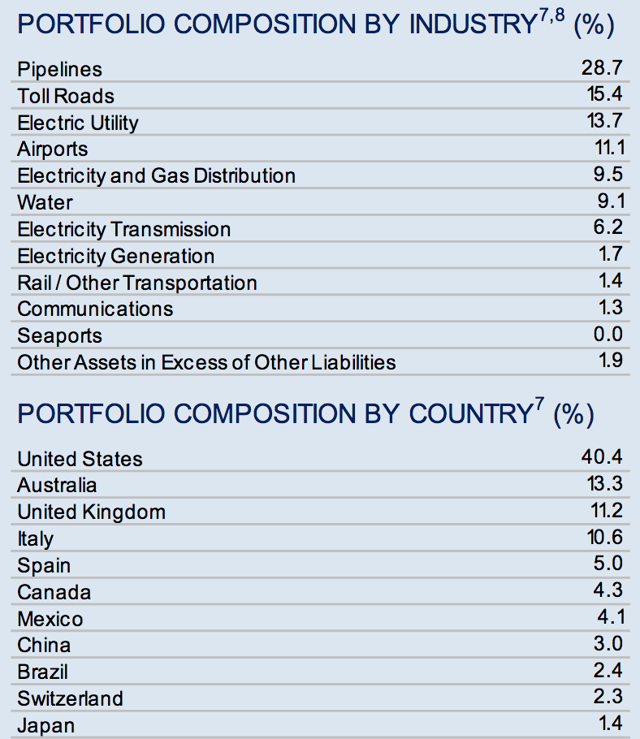

MGU has a significant share of infrastructure assets in its layout, with toll roads, 15.4%, and airports, 11.1%, accounting for 25.5%. Like DPG, MGU is highly exposed to Europe, representing 17.9% of its geographic composition:

Among MGU's top ten holdings are some of the same British and Australian companies as MFD, such as Transurban, National Grid, Sydney Airport and Severn Trent, but with different percentages – Transurban topping the list, followed by US stocks, Cheniere Energy (CQP). ) and Sempra Energy (SRE):

distributions:

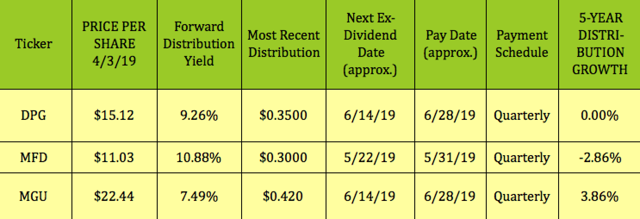

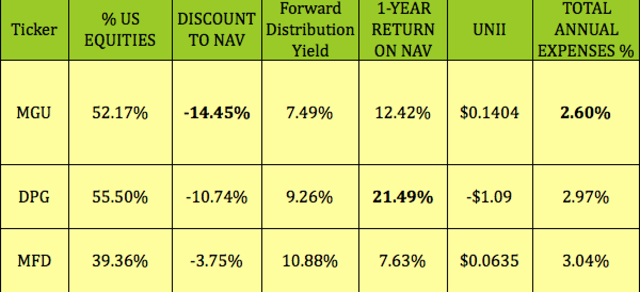

MFD has the highest yield of the group (10.88%), followed by DPG (9.26%) and MGU (7.49%). These are certainly not big dividend gains – the five-year dividend growth ranges from -2.86% for the MFD to only 3.86% for the MGU. The three funds pay quarterly.

MFD has the next ex-dividend date, 5/22/19, DPG and MGU paying a dividend on ~ 6/14/19:

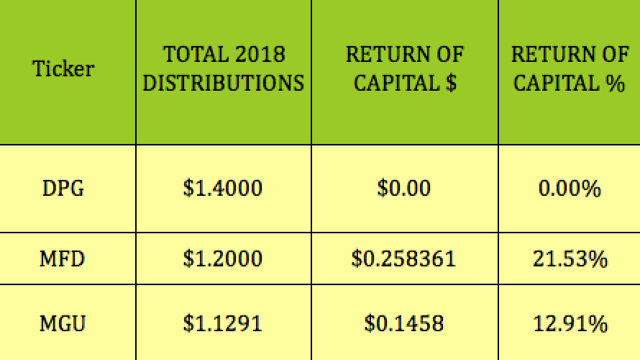

MFD posted the highest percentage of tax deferral in its payments in 2018, with a return of capital of 21.53%, followed by MGU, at 12.91%, while DPG had no repayment of capital. The three funds issue € 1099 to investors at the time of the tax.

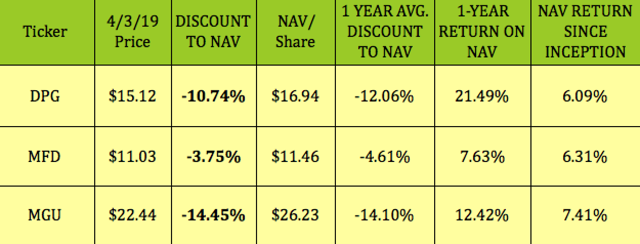

We have often found that CEFs have been trading below their net asset value in the past, but have also experienced negative returns on their net asset value since inception. This is not the case with these three funds, which have yielded 6.09% to 7.41% of the net asset value since their inception.

CPD has the highest NAV return of the past year, at 21.49%, compared to 12.42% for MGU and 7.63% for MFD.

However, the three funds are currently selling at a price below the net asset value of -3.75% for the MFD, at -10.74% for DPG, at -14.45% reduction for MGU, whose current discount on NAV is slightly higher than the average one-year discount of -14.10%:

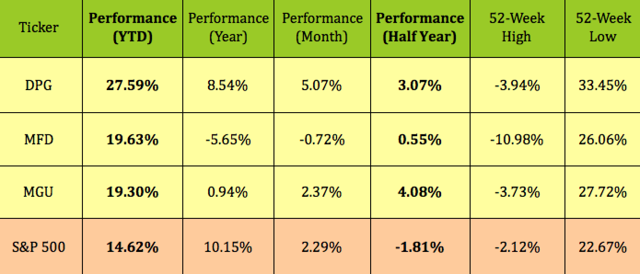

The three funds significantly outperformed the S & P 500 in 2019 and over the last six months, including the fourth quarter decline in 2018, with MGU and DPG posting the largest gains during the six-month period. Last month, DPG and MGU posted the best performances, while MFD fell behind the market.

We rate MGU as a purchase, based on its higher percentage of US equities, with a much higher NAV discount (the MGU discount is slightly higher than its one-year average). MGU also has a positive net unrated investment income – UNII – of $ 1404, the highest in the group, compared to a – $ 1.09 UNII for DPG, and the lowest overall expense ratio, 2.60%.

However, as you can see in the table below, it is not easy to choose MGU instead of MFD and DPG – they all have positive attributes. MFD has a much higher yield, at 10.88%, and UNII positive, but a reduction in NAV of less than 3.75%. DPG also has a higher yield, better return on NAV and better YTF performance, but negative UNII.

Our Marketplace service, Hidden dividend stocks more, focuses on undervalued and undervalued sources of income and high-yield special situations.

We travel the US and global markets to find strong revenue opportunities with dividend yields ranging from 5% to 10% and above supported by strong earnings.

We publish weekly exclusive articles containing investment ideas for the HDS + site that you will not see anywhere else.

Discover now how our portfolio beats the market in 2019.

Disclosure: I am / we are long MGU. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

Additional information: CLARIFICATION: Our investment website www.DoubleDividendStocks.com has increased subscriber returns through high dividend put options for over 10 years.

[ad_2]

Source link