[ad_1]

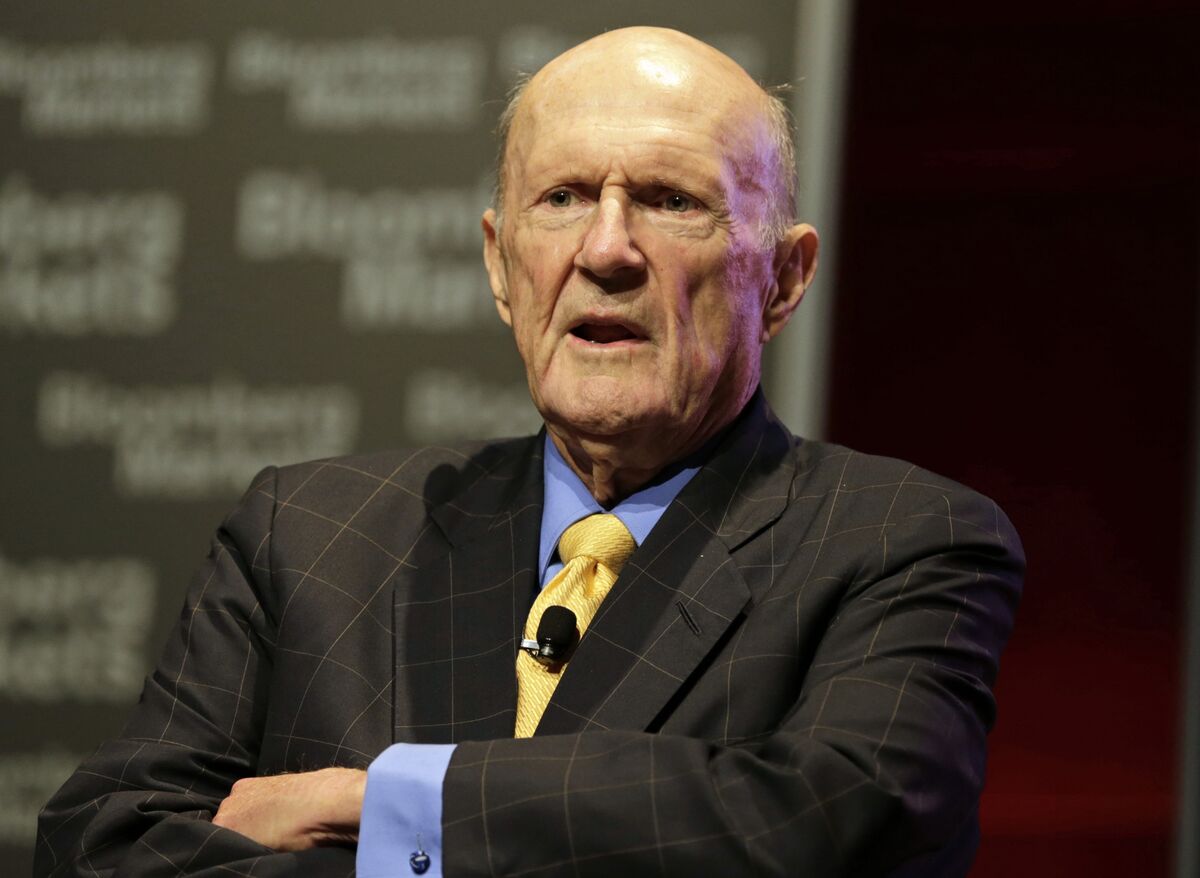

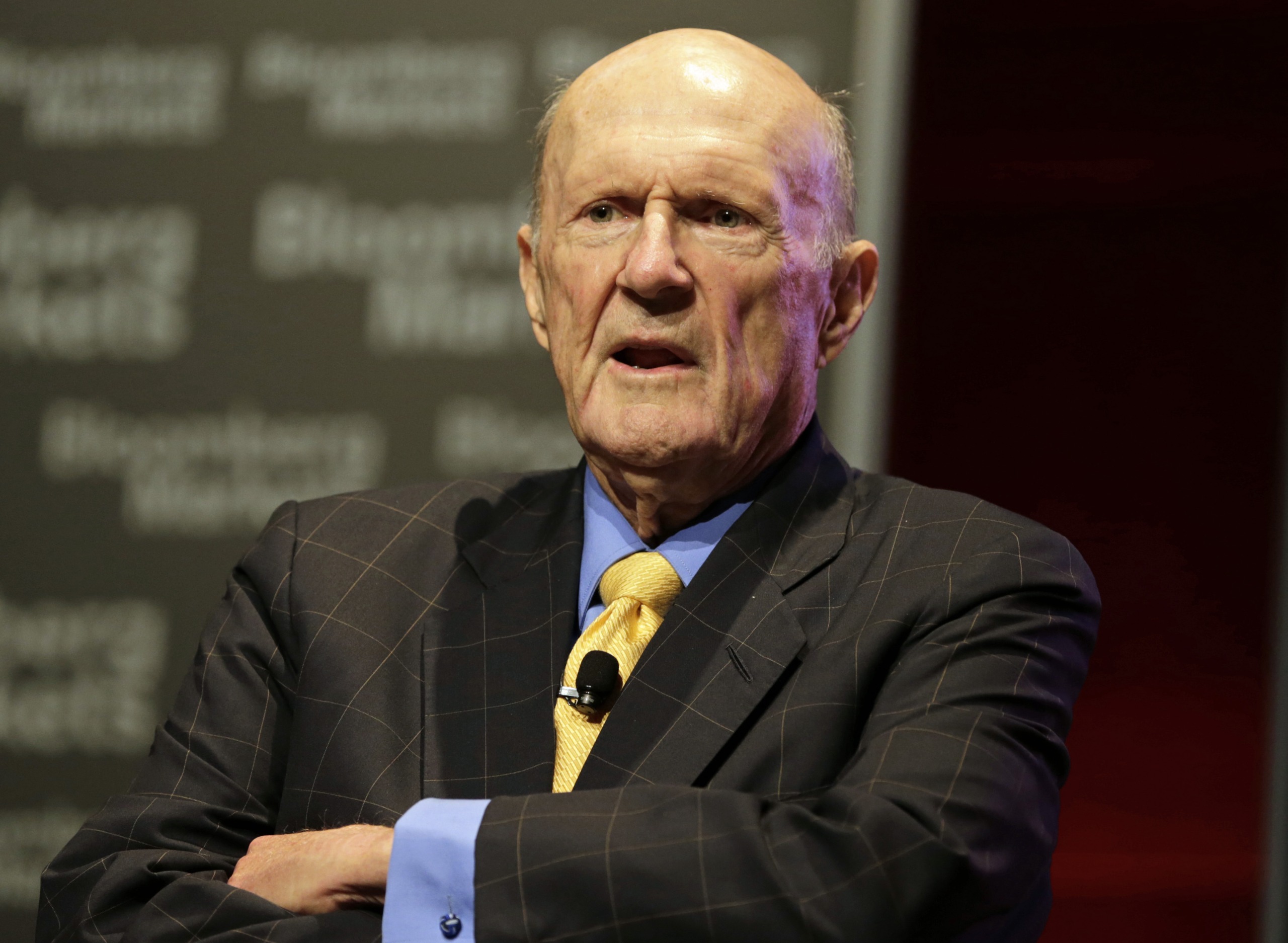

Julian Robertson in 2014.

Photographer: Peter Foley / Bloomberg

Photographer: Peter Foley / Bloomberg

There isn’t a single thing that makes the explosion inside Bill Hwang’s Archegos Capital Management so astounding. There is the scale, impact on world markets, the role of the big banks, those secret derivatives, all that leverage, and the investor’s own inequality regulatory history.

Then there is Hwang’s pedigree. He was a protégé of billionaire Julian Robertson, 88, a legend in the hedge fund world. Hwang was a so-called little tiger who left Robertson to build Tiger Asia Management, in part with Robertson’s money. After pleading guilty to insider trading in Chinese bank stocks in 2012, agreeing to criminal and civil settlements in excess of $ 60 million, he closed the fund and focused on managing the family’s money. office Archegos Capital Management. The company, forced by its banks to sell more than $ 20 billion in stock, was behind the stock sell-off on Friday, people familiar with the trades said.

Robertson said in a phone interview with Bloomberg News reporter Max Abelson on Monday that he would always invest with Hwang. The interview has been edited for clarity:

Max Abelson: What do you think watching this unfold?

Julian Robertson: I’m just very sad about it. I’m a huge fan of Bill, and it could probably happen to anyone. But I’m sorry that happened to Bill.

MA: But Bill has seen problems before. He had to pay $ 60 million. He went through difficult times.

JR: Well, we all have it. It’s not insider trading here.

MA: What’s wrong?

JR: Well, I don’t know what went wrong. I know Bill is a very decent guy. And I am so sorry that this has happened.

MA: Will his career survive?

JR: I certainly have hope it bounces.

MA: Have you spoken to him?

JR: Yes. I didn’t speak to him directly, but left a message and he replied. I just said, you know, I was sorry, it could have happened to anyone, I’m so sorry. He responded and said, thank you, you are wonderful to come to my corner.

MA: But it was one of the biggest margin calls in history.

JR: How much was it?

MA: There were over $ 20 billion in bulk trades on Friday. What do you think when you hear this?

JR: I think it’s a lot of money.

MA: It’s something he played a role in, because of the magnitude of the leverage.

JR: He’s actually a wonderful person. And it’s tragic that this particular thing is probably having a bad effect on his life.

MA: It has bad effects on the market.

JR: He’s a devoted Christian. He works with a lot of young people and all that. You can say it all, but he’s a really good guy. If you ever make a story on Bill’s good side, call me, do you hear?

MA: When was the last time you saw him?

JR: I think three or four months ago. We had lunch together in Southampton. We were and are very good friends.

MA: Did he say anything that came to your mind?

JR: No… Here is a very good guy who made a terrible mistake.

MA: Being over-indebted?

JR: Yeah, but I think it’s a commercial mistake. And he was hurt by this mistake more than anyone. So it’s not like he’s taking money from a bank or something like that.

MA: Would you like to invest in it again?

JR: Yeah.

MA: Why?

JR: Because he’s a good investor. And he will learn from it. We are still learning.

MA: It was not until last April that its ban was lifted. And the magnitude of that is just amazing.

JR: He’s not the type to be small, that’s for sure.

[ad_2]

Source link