[ad_1]

Photographer: Kiyoshi Ota / Bloomberg

Photographer: Kiyoshi Ota / Bloomberg

US equity futures and Asian stocks advanced earlier in the week amid positive trading sentiment in the region and after a national US lockout was ruled out. The dollar has fallen.

Stocks opened higher in Japan and South Korea. Australian stocks advanced before trading was suspended due to a market data issue. Asia-Pacific countries including China, Japan and South Korea on Sunday signed the largest regional free trade agreement in the world. Meanwhile, advisers to President-elect Joe Biden have spoken out against a nationwide U.S. lockdown despite the accelerating pandemic, preferring targeted local measures. Oil rose and Treasuries were stable.

On Friday, the S&P 500 and the Russell 2000 Small Cap Index hit historic highs. The highly technological Nasdaq 100 underperformed on the rotation to economically sensitive industries. The pound fluctuated as obstacles remain to reaching a trade deal in Brexit negotiations.

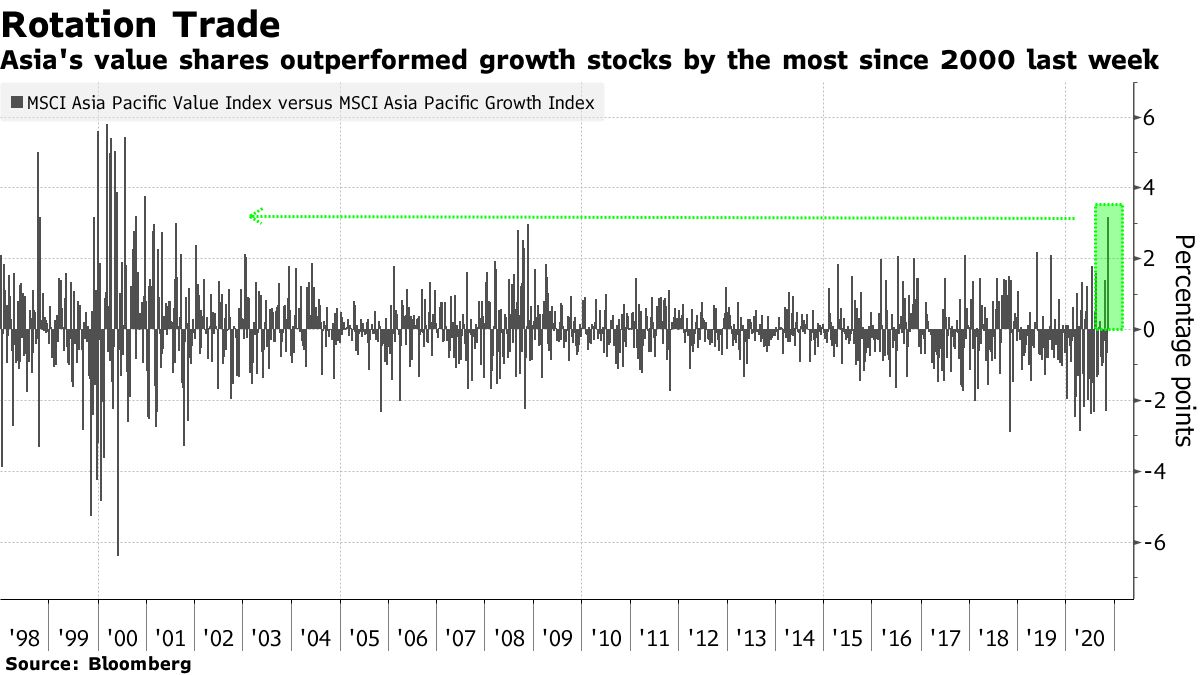

Global stocks returned to pre-pandemic highs after optimism over a vaccine last week led to a rotation in value and cyclical sectors, and more defensive industries underperformed. Yet concerns about a sustainable economic recovery persist amid a cases in the world.

Coronavirus cases in the United States hit a record high on Friday and approached 11 million infections after new cases exceeded 100,000 for 10 consecutive days. Germany has to live with “considerable restrictions” against the spread of Covid-19 for at least four to five months, the country’s economy minister said.

“There is certainly a loud rumor that potential closures in the United States will weigh more in the near term and maybe so, but investor sentiment is the highest since 2017,” said Chris Weston, head of research. at Pepperstone Group Ltd. Note.

The Asia-Pacific trade agreement encompasses one-third of the world’s population and gross domestic product. It includes Australia, New Zealand and the 10 members of the Association of Southeast Asian Nations who have signed the Regional Comprehensive Economic Partnership, or RCEP.

Meanwhile, US President Donald Trump is planning several sweeping new measures against China in the remaining weeks of his tenure, according to Axios. They may include sanctions or trade restrictions against more Chinese companies, government entities or officials, citing human rights violations, Axios reported, citing senior administration officials that they did not. have not identified.

Trump has shown little sign of conceding the presidential election to Joe Biden, while barely acting as though he is preparing for a second term.

Asia-Pacific countries on Sunday signed the world’s largest regional free trade agreement, encompassing nearly a third of the world’s population and gross domestic product.

Here are some events to watch out for this week:

- China Industrial production for October, retail sales expected on Monday.

- Brexit negotiations are expected to continue as the UK and the EU approach their final deadline.

- The Bloomberg New Economy Forum virtually convenes world leaders to discuss trade, growing political populism, climate change and the pandemic. Former Federal Reserve Chairman Janet Yellen and Indian Prime Minister Narendra Modi are among the many speakers. Until November 19.

- The OPEC + Joint Ministerial Monitoring Committee meets on Tuesday.

- US retail sales expected Tuesday.

- Bank of Indonesia rate decision Thursday.

Here are some of the main movements in the markets:

Stocks

- Futures on the S&P 500 index rose 0.5% at 9:17 a.m. in Tokyo. The S&P 500 gained 1.4% on Friday.

- The Topix index rose 1%.

- The S & P / ASX 200 index rose 1.2%.

- The Kospi index gained 1.1%.

- The Hang Seng Index futures gained 0.4% earlier.

Currencies

- The yen was little changed at 104.68 to the dollar.

- The offshore yuan rose 0.2% to 6.5893 per dollar.

- The Bloomberg Dollar Spot Index fell 0.1%.

- The euro rose 0.1% to $ 1.1841.

- The pound jumped 0.2% to $ 1.3212.

Obligations

- The yield on 10-year Treasury bills is 0.90%.

- The yield on Australian 10-year bonds fell to 0.90%.

Basic products

- West Texas Intermediate crude rose 0.9% to $ 40.49 a barrel on Friday.

- Gold was at $ 1,890.09 an ounce.

– With the help of Joanna Ossinger and Ishika Mookerjee

[ad_2]

Source link