[ad_1]

Shares fell along with US and European futures on Tuesday amid concerns over the timing of President Joe Biden’s budget relief plan and amid warnings of potential asset bubbles. The dollar extended a lead.

An Asia-Pacific equity gauge slipped the most in about two months. Hong Kong underperformed, dragged down by a collapse of Tencent Holdings Ltd. after the internet giant’s market value reached the point of $ 1 trillion for the first time on Monday. In China, shares fell after the central bank withdrew liquidity from the banking system and an official cautioned against asset bubbles.

S&P 500 futures have slipped following comments from Senate Majority Leader Chuck Schumer that a an aid program is unlikely before mid-March. Nasdaq 100 contracts were trending lower ahead of earnings from some of the biggest tech companies. T-bills held up overnight and crude oil fluctuated below $ 53 a barrel.

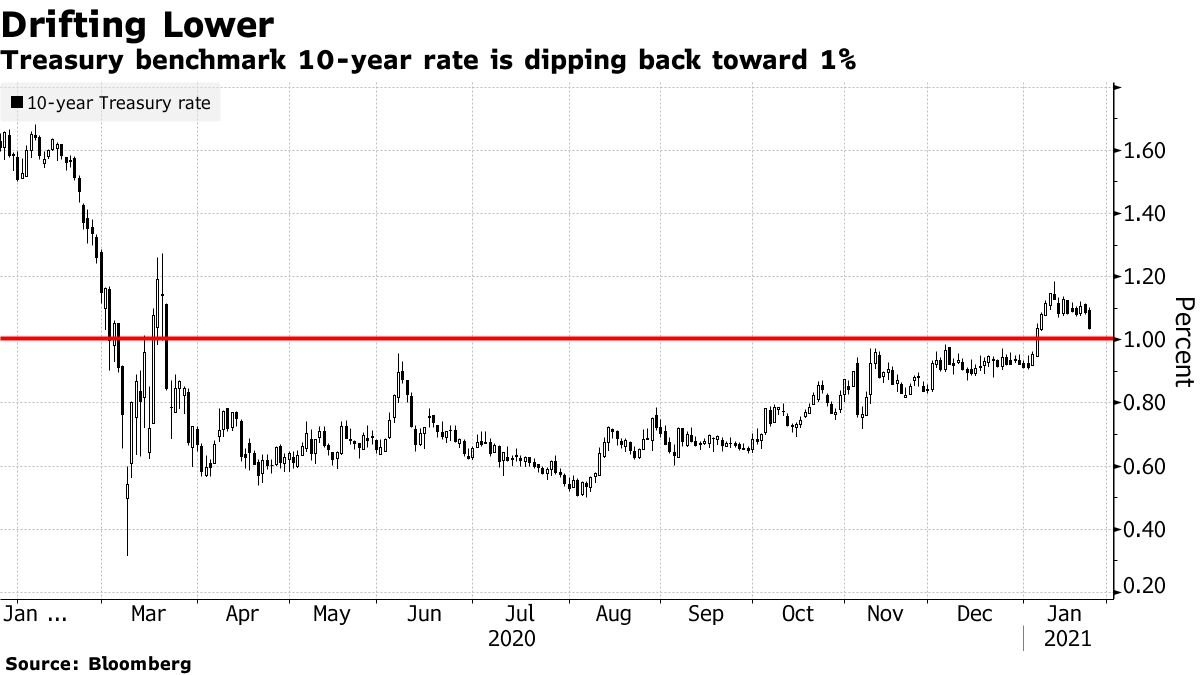

Global stocks have retreated from a record as investors look for new catalysts to push them higher or at least justify current valuations. This could be from a list of income reports due this week. At the same time, the possibility that a US budget relief program will be delayed undermines a major reason Treasury yields climbed earlier this year.

“If the financial markets needed further confirmation that the US fiscal stimulus was the only game in town, the herd of buy it all received it overnight,” wrote Jeffrey Halley, senior market analyst at Oanda Asia Pacific Pte. The concern of Senate Republicans over the size of the planned package “was enough to knock stocks off their intraday highs,” lowered bond yields and boosted demand for the dollar, he said.

President Joe Biden has said he is open to negotiation on his $ 1.9 trillion Covid-19 relief proposal and hopes to get Republicans behind it, but does not rule out pursuing a Democrats-only lane . Schumer said earlier on Monday that he aimed to secure the passage of the next round of relief by mid-March, just as jobless benefits from the last package run out.

On the pandemic front, vaccine coverage will not reach a point that stops transmission of the virus for the foreseeable future, according to the World Health Organization. U.S. infectious disease chief Anthony Fauci said he was concerned about delays in second doses.

Here are some key events coming up in the coming week:

- Microsoft Corp., Apple Inc., Tesla Inc., Facebook Inc. and Samsung Electronics Co. is among the companies reporting results.

- Data on US home prices and consumer confidence are released on Tuesday.

- The Federal Open Market Committee’s monetary policy decision and President Jerome Powell’s briefing are scheduled for Wednesday.

- Fourth-quarter GDP, initial jobless claims and new home sales were among the US data releases on Thursday.

- U.S. personal income, spending, and pending home sales arrive Friday.

Here are the main movements in the markets:

Stocks

- S&P 500 futures fell 0.6% at 7:12 am in London. The S&P 500 Index rose 0.4%.

- Japan’s Topix index fell 0.8%.

- South Korea’s Kospi index lost 2.1%.

- Hong Kong’s Hang Seng Index fell 2.4%.

- The Shanghai Composite Index fell 1.5%.

- Euro Stoxx 50 futures fell 0.2%.

Currencies

- The Bloomberg Dollar Spot Index added 0.2%.

- The euro plunged 0.1% to $ 1.2127.

- The British pound fell 0.3% to $ 1.3641.

- The Japanese yen was little changed at 103.74 per dollar.

- The offshore yuan is stable at 6.4866 per dollar.

Obligations

- The yield on 10-year Treasury bills held steady at 1.03%.

Basic products

- West Texas Intermediate crude fell 0.5% to $ 52.50 a barrel.

- Gold was stable at $ 1,855 an ounce.

– With the help of Vivien Lou Chen, Katherine Greifeld and Joanna Ossinger

[ad_2]

Source link