[ad_1]

Keep an eye on the bond market today

ForexLive

While most of the markets are still moving towards the US-China trade front, they are hinting that there are bigger fish in the world today.

The ECB decision is the main event to watch and the price action in bonds is telling us that. It may be a bit of a "nothing but dip" but I think it's about the market is currently focused on the end of the week.

If you're wondering why it's so bad, it's because it's so much more focused on feeling stronger than it is.

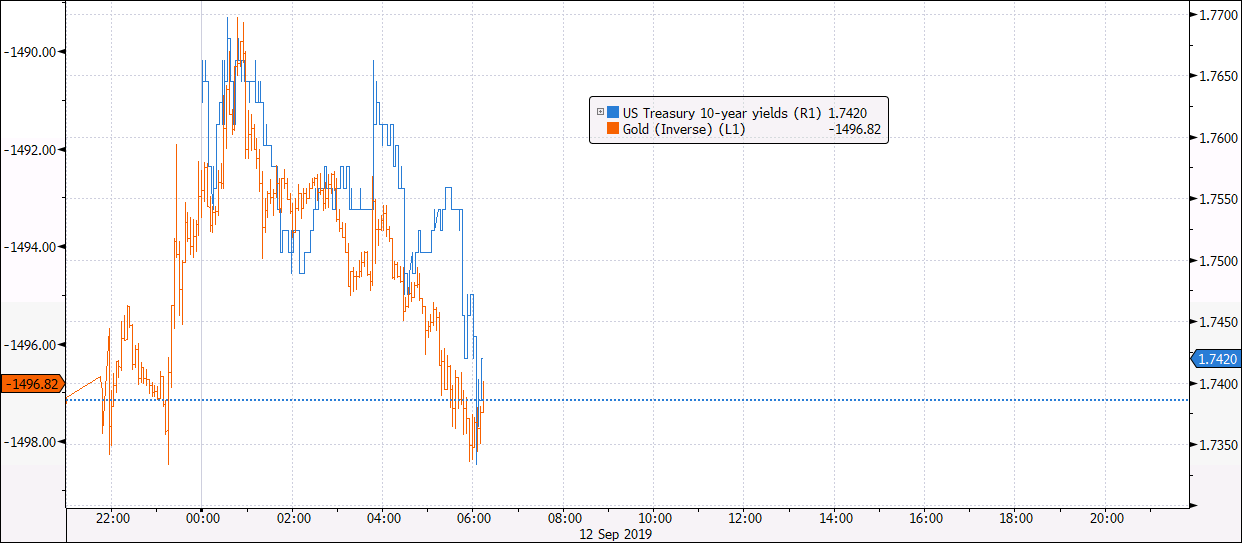

Just look at the correlation in price action between Treasuries and gold today:

Over the past week or so, the upside move in yields can be widely seen as a "retracement" to the sharp rise in August. I reckon that may still extend to the Fed again and again.

As such, the reaction to the ECB meeting will only tell the story. The other half – and arguably more important one – depends on the Fed next week.

[ad_2]

Source link