[ad_1]

President Trump has thrown all possible chances of grenades at the Federal Reserve, calling on the central bank to be "too tense" and harming the economy.

The president has repeatedly criticized the Fed for slowing US economic growth by raising interest rates too quickly and putting in place quantitative tightening, among other things. Given that central banks around the world are cutting rates, it is more difficult for the US to compete in the face of falling global currencies.

"The economy is doing very well, with huge upside potential!" Trump tweeted on Thursday. "If the Fed does what it should, we're a rocket!"

The president's attacks on the central bank come as the candidates prepare for the 2020 elections. Historically, a healthy economy can pave the way for a victory for the White House.

"The economy, stupid."

Remember the words of Clinton campaign strategist James Carville in 1992: "The economy, stupid".

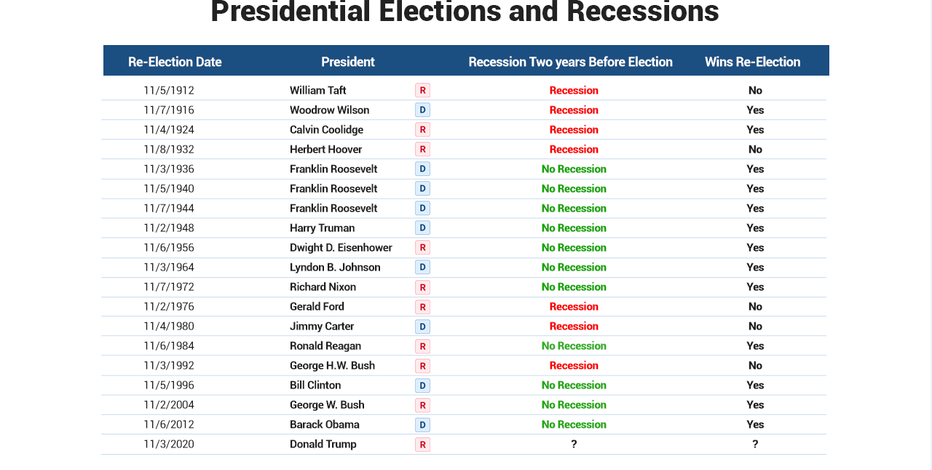

President Bill Clinton's victory in the 1992 election against George H.W. Bush was the last time an American president had lost a bid for reelection. This is also the last time an election took place in the 24 months following a recession in the United States.

Ryan Detrick from LPL Financial crossed the numbers and found that since the First World War, the president of the United States sitting was a perfect 11 for 11 if the economy was not in recession less than 24 months before the elections.

The presidents who watched the recession before the elections lost five of their seven campaigns, he said.

About FOXBUSINESS.COM

While the US economy is growing, with a revised estimate of the second quarter's gross domestic product, up 2%, as reported Thursday by the Commerce Department, it is lower than the 3.1% recorded in the second quarter. first trimester.

Slower growth, combined with a reversal of the yield curve for the first time since 2008, raises fears of a recession that is reaching record highs. The reversal took place before the last seven recessions, extending over more than 50 years.

While some on Wall Street think the timing is different in terms of the outcome of the yield curve reversal, a team of Bank of America economists Merrill Lynch has warned three of the five The main economic indicators of the business cycle (auto sales, industrial production and total hours) are "flashing yellow" and are close to constant levels at the beginning of previous recessions. However, they claim that "the most reliable early indicator", the first declarations of unemployment, remains very weak. In addition, the unemployment rate in the United States stood at 3.7%, a multi-year low in July.

The bank's official model points to a 20% chance of a US recession over the next 12 months, but economists say data and events suggest it's more of a chance. three.

[ad_2]

Source link